I published a two-part article earlier this month on a concept I call Growth Constellations (GC hereafter).

- Growth Constellations – A New Phrase For Strategy Part 1

- Growth Constellations – A New Phrase For Strategy Part 2

Two people asked how they could go about auditing their firms for how many and what kinds of GCs each currently has and what the performance of each. So here is an approach that I think can work. This will be a step-oriented article for your consideration.

Recall my definition of a GC is: a key valuable resource or a bundle of valuable resources and a unique capabilities set aimed at a particular opportunity or related set of opportunities in the marketplace. This approach is brand new so I have only initial experience in conducting GC audits. However, I think this audit framework works but I invite your suggestions from your experience on things I would need to edit or add.

Step 1: Identify and List All Current Key GCs in Your Firm and Categorize Appropriately

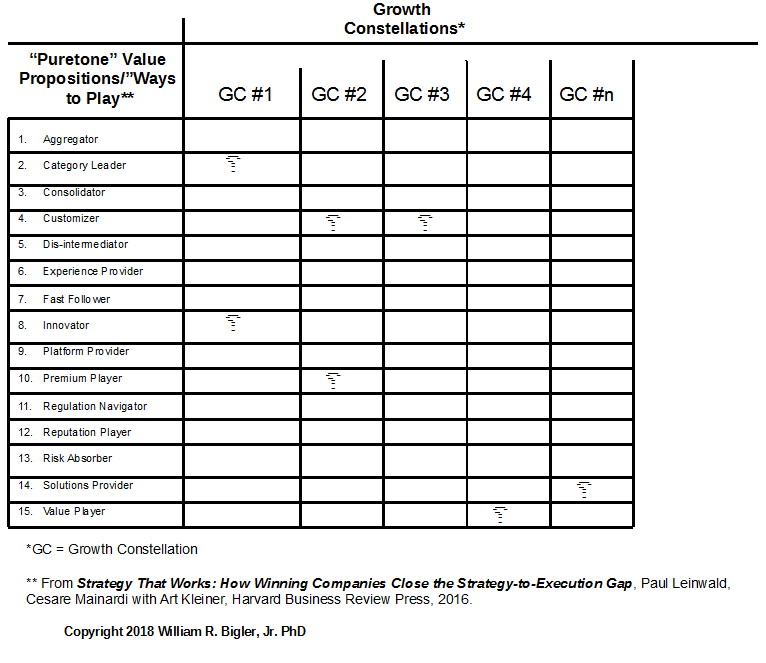

Figure 1 depicts this step:

Figure 1: A Growth Constellations Audit – Step 1

Notice the approach to categorize each GC. As I cite in the figure, I am borrowing from a recent good book titled Strategy That Works. For these authors, the fifteen elements are “puretone” dominant value propositions and alternatively they describe them as fifteen “ways to play”. The authors state, and I agree, most firms will mix two or more of the puretones. But describing the fifteen depict the distinct possibilities. I think this is a good way to label and categorize each GC. Another way is to use one of my favorite authors, writers and consultants Adrian Slywotsky’s work that depicts twenty-two “profit patterns”. (The Profit Zone: How Strategic Business Design Will Lead You to Tomorrow’s Profits, Times Business, 1997 by Adrian Slywotsky and David Morrison). But other ways undoubtedly exist and maybe you can suggest other ways.

Once completed, the figure presents a visual of all of the key GCs currently in play. Each firm will have a dominant theme around two or more puretones. As we know, each firm cannot be all things to all people.

Step 2: Answer A Few Critical Questions About Each of the Current Key GCs

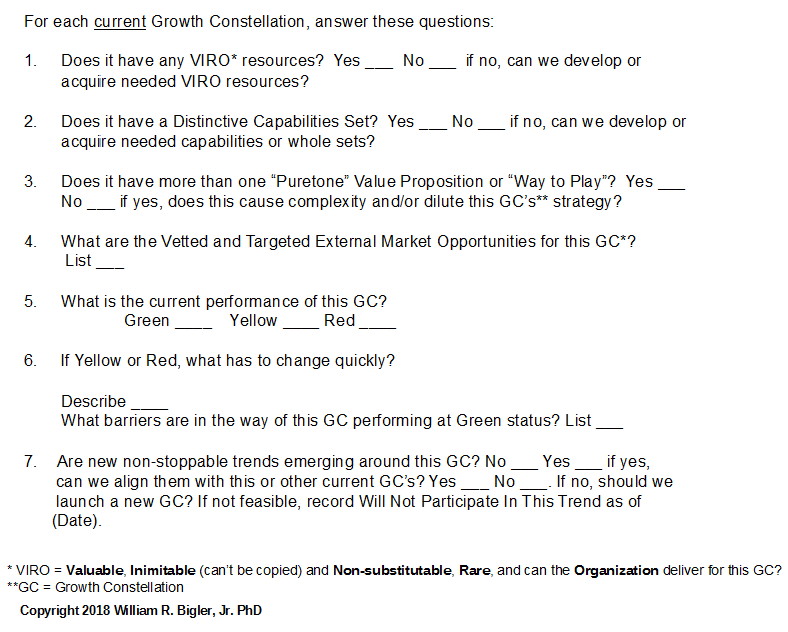

Figure 2 presents these questions:

Figure 2: A Growth Constellations Audit – Step 2

These straightforward questions provide a strategic and operational quick assessment of each GC. Using something as simple as an Excel spreadsheet could allow the auditor to sort using various questions. A key sort would be by Green, Yellow or Red as to the current performance of each GC. What does the portfolio of GCs currently “look like”? Is there a lot of Green or a lot of Yellow and Red? A sort as to the things that have to change quickly and barriers in the way could be very informative and give the management team a change program. Other sorts can give valuable insights.

A few key observations or issues emerge from this audit approach:

- Competitive strategy is not viewed from the firm or business unit level anymore. It is best viewed at the GC level. So a firm could have a lot of competitive strategies. This view can seem like blasphemy I know. And we run the risk of too finely identifying GCs. We could end up with hundreds of GCs if we are not careful. This can only lead to confusion. As I mentioned in the prior two-part article series, I do not know yet the appropriate level of granularity for larger mid-sized firm or business unit of a corporation. But this approach says the number is a lot more than just one or two, which would be “telescoping” back up to the firm or business unit level. A finer level of granularity though respects the reality of today’s competition. We are in a world of transient competitive advantage. A focus on the portfolio of GCs could allow management teams to be much more agile. Some need to be pruned, terminated or given the green light to more heavily invest in them.

- Based on #1, competitive strategy formulation using GCs is more like what one finds at an agile software/application development company. A competitive strategy cannot be depicted like we used to by claiming the business is a “low-cost provider” or premium priced “differentiator. As I have said, this is too high of a generalization. GCs are then more like projects in that agile software firm. Some are Value Players (low cost) and some are Premium Players. But look at the other thirteen puretone possibilities? By the way, I think this view and approach also applies to firms with a heavy fixed investment like manufacturing, retail, and others.

- The puretones listed are not really value-propositions in my view. See What Is Value. I do like their portrayal as “ways to play” much better.

- What we have presented here is a way to audit your current portfolio of GCs. Please recall from the two-part article series that new opportunities are bubbling up all over the world, at a breakneck pace. A proper view of your current GC portfolio should also include the “pull” from the future where new GCs will need to be formulated and resourced. This really puts a dynamic view into this current GC audit. In fact, the skill at new opportunity recognition amidst the crush of emerging new “unstoppable trends” will become a key competency according to this view.

This article hopefully has provided you an approach to audit and assess your firm’s portfolio of GCs if you found the first two articles applicable to your firm. If you use the approach, please let me know how it goes.

This article is part of a series on what causes a firm’s value to increase.

Dr. William Bigler is the founder and CEO of Bill Bigler Associates. He is a former Associate Professor of Strategy and the former MBA Program Director at Louisiana State University at Shreveport. He was the President of the Board of the Association for Strategic Planning in 2012 and served on the Board of Advisors for Nitro Security Inc. from 2003-2005. He has worked in the strategy departments of PricewaterhouseCoopers, the Hay Group, Ernst & Young and the Thomas Group. He can be reached at bill@billbigler.com or www.billbigler.com.