This article will be on the technical side. But I think it also presents concepts about competitive strategy, finance and wealth creation that are very important for senior management and strategy and finance professionals. One last point before we begin. I am mindful of the raging debate about shareholder capitalism and stakeholder capitalism. While I am a shareholder value proponent, I need to table this discussion for this article. This debate will not be resolved soon, maybe never. But in the meantime, senior management along with strategy and finance professionals must lead and manage for value and wealth creation, whether enlightened or not.

When viewed as an interconnected system, Competitive Advantage Period (CAP) is a great way to think about crucial aspects of the strategic management of for-profit firms. CAP is the length of time into the future that good things are expected to be maintained while competitors try to take those good things away from you.

Competitive Advantage Period is the least well-understood aspect of stock valuation and has implications for executives in the strategic management of their firms to try to make a CAP happen. It will also explain the role of Executive Processes in this mix. I will try to offer insights for clarity couched in layman’s terms. This is an exciting vista for executives to manage for CAP and for investors to enjoy sustainable higher stock prices relative to peer firms from such strategic management.

As such this article will discuss six things:

- What is Competitive Advantage Period (CAP) and how does it figure into firm valuation? Quick overview of CAP.

- What is competitive advantage (CA)? (I know hundreds if not thousands of people have written on this but I hope to bring some value to the discussion).

- What causes CA?

- How is CA sustained over time?

- What is Competitive Advantage Period (CAP) Revisited

- Conclusions. How does CAP figure into valuing firms and competitive strategy?

1. What is Competitive Advantage Period (CAP) and How Does it Figure Into Firm Valuation? Quick Overview

Simply put, Competitive Advantage Period (CAP) is the length of time into the future that a firm’s competitive advantage will last and protect economic profits from fading due to competitive encroachment and rivalry. Figure 1 is an exhibit I use often and depicts the Seven Financial Drivers of firm valuation1. The reader can see the direction required (up or down) for that Driver’s contribution to Shareholder Value (SHV) creation and further growth in SHV. Notice the last Driver is a firm’s CAP.

Readers might be surprised to learn that CAP is real and that it is “baked into” a firm’s current stock price. CAP is 1 ÷ the Fade Rate of a firm’s Cash Flow Return on Investment (CFROI) per year2,3. Fade is the rate over time at which CFROI regresses to the average level of CFROI in an industry. The average level is usually the long-term weighted average cost of capital of about 6% or sometimes below this level for very problematic industries and as such for many of the firms within those industries.

As examples, a fade rate of 2% per year of Cash Flow Return on Investment (CFROI) means a CAP of 50 years! (1 ÷ .02/year = 50 years). For example, if CFROI were 10%, a 2% fade would be .2 of that 10% leaving 98% for that year. A 50% fade rate would be 5 of that 10% leaving 5 or 50% for that year. A fade rate of 50% would mean a CAP of just two years (1 ÷ .50 = 2). As Holland and Matthews (2018) and Madden (2020) point out “fade happens”.

Fade is caused by your competitors noticing your high economic profits and wanting some of that pie and entering against you. The ensuing competitive rivalry causes marketing costs to inflate, prices to drop and other expenses and investments to be taken by your firm and your competitors.

2. What Is Competitive Advantage (CA)?

I have written on this at length as have many others, including of course the guru Dr. Michael Porter4 of the Harvard Business School whose seminal 1985 book, Competitive Advantage, introduced the topic. Simply put, a competitive advantage (CA) is something the firm does that causes its costs to deliver to be the lowest in its competitive space (the Low-Cost Provider- LCP) or its products and services to be able to command an absolute price premium over rivals (the Differentiator). Note a dual advantage of both lowest costs and premium prices can happen, but usually for only short periods of time. Again fade happens to all industries and firms within them. Count on it and plan for it.

Both kinds of competitive advantage have the following key aspect: competitors find it hard to copy the competitive advantage in the short to mid-term. And they find it hard to copy the means to bring the competitive advantage about as well (discussed below). This is a very simple definition, but the “something” in the definition is what scores of strategists are writing about recently.

I think the question of what is CA is better asked as what is evidence that a firm enjoys a CA? And if the firm does enjoy a CA, what is the “something” that causes it? This is discussed in #3 below.

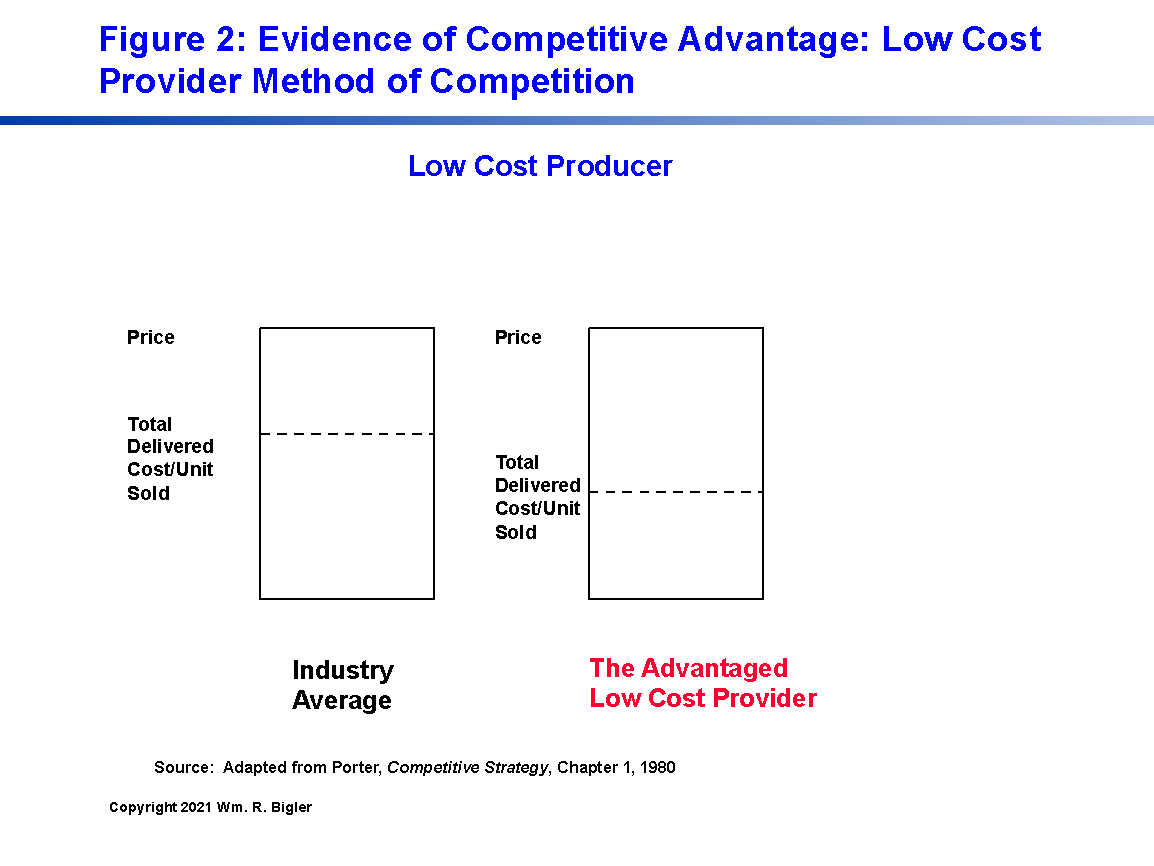

For evidence that a competitive advantage exists, we only need to revisit Dr. Porter. He referred to the below as “generic strategies” but I find that Figures 2 and 3 are better construed as “evidence that a CA exists”. I also sometimes refer to these Figures as “methods of competition”.

As the reader can see, the Advantaged LCP can Price at the Industry Average Price but has the lowest Total Delivered Cost/Unit Sold. For readers not familiar, several industry data sources like IBIS World and others can provide some data on industry prices and costs.

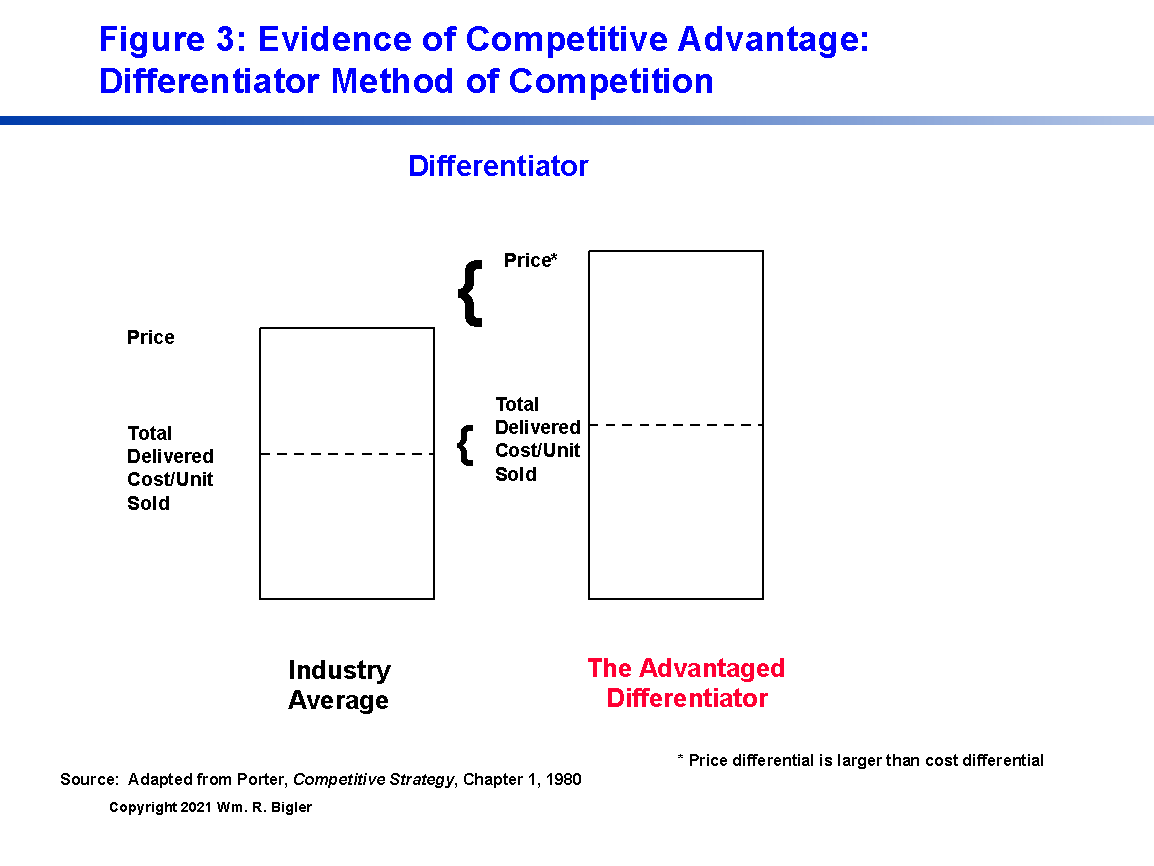

Figure 3 depicts evidence of a Differentiator competitive advantage.

Notice that the advantaged Differentiator can consistently Price above the industry average price line. Their cost/unit sold is larger than the industry average cost but the price differential is larger than the cost differential. How can this “willingness to pay” happen over and over again? It is because customers love the value and satisfaction they receive from the associated products and/or services and gladly pay the premium price.

3. What Causes Competitive Advantage?

As far as the “something” that causes a competitive advantage discussed above, in my experience and view it is not just one thing that many writers claim. The following will take us through a sojourn of what have been felt to be important topics in strategic management over the last forty years. In my view then competitive advantage is caused by not just the following:

-

- A firm’s Value Chain and Its Activities (Inbound Logistics to After-Sales Service)

- A firm’s Capabilities – (a bundle of processes, routines, and skills that are unique to a firm and hard to copy)5

- A firm’s Competencies – (skills that are hard to copy and that directly drive the cost or price advantage)

- A firm’s Ability to Protect Intellectual Property via Patents

- A brilliant choice of “Where to Compete”

- A brilliant move to Protect This “Where to Compete” Choice via Barriers to Further Entry by Current and New Rivals

- A firm’s Operating and Support Processes

- A firm’s Brand

- A firm’s Corporate Culture that is “strong” and cannot be copied

- A firm’s R&D Capabilities (subset of #2)

- A firm’s Company Wide Innovation Process

- A firm’s Ability to Attract and Retain Great Employees

- A firm’s Loyal Customers

- A firm’s Loyal Suppliers

- Aligning all of the above dynamically with the external environment

CA is caused by sub-sets of the things above that are unique to each firm or are common solutions for many firms but are configured uniquely. Or the firm is mature enough (that is it has been around for a while) that all of these have been added in over time and configured uniquely and well. Also the sub-set needs to conform to the dictates of #15 as well – they need to align with a changing external environment6. The choice of which sub-set to use evolves over time via explicit choice or trial-and-error. This grouping into sub-sets is one of the true art forms (in addition to the science) of strategic management from my experience.

4. How is Competitive Advantage Sustained Over Time?

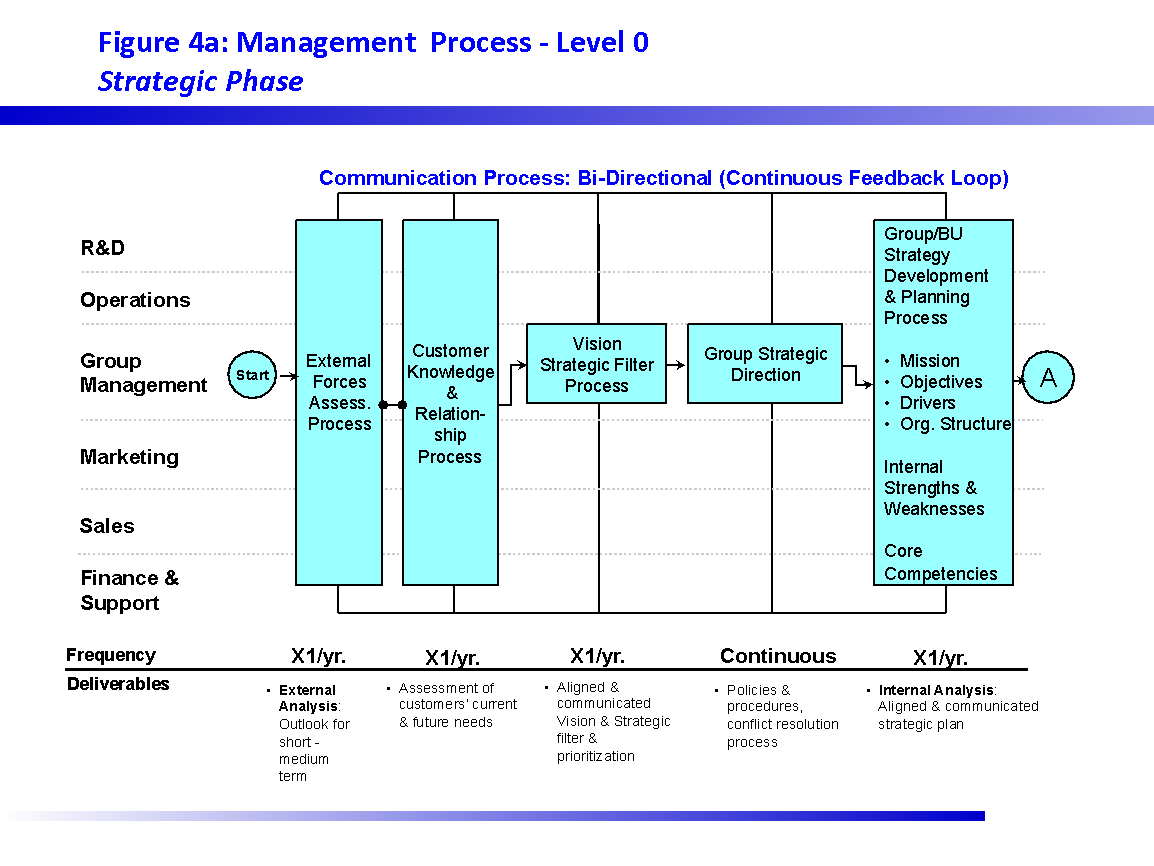

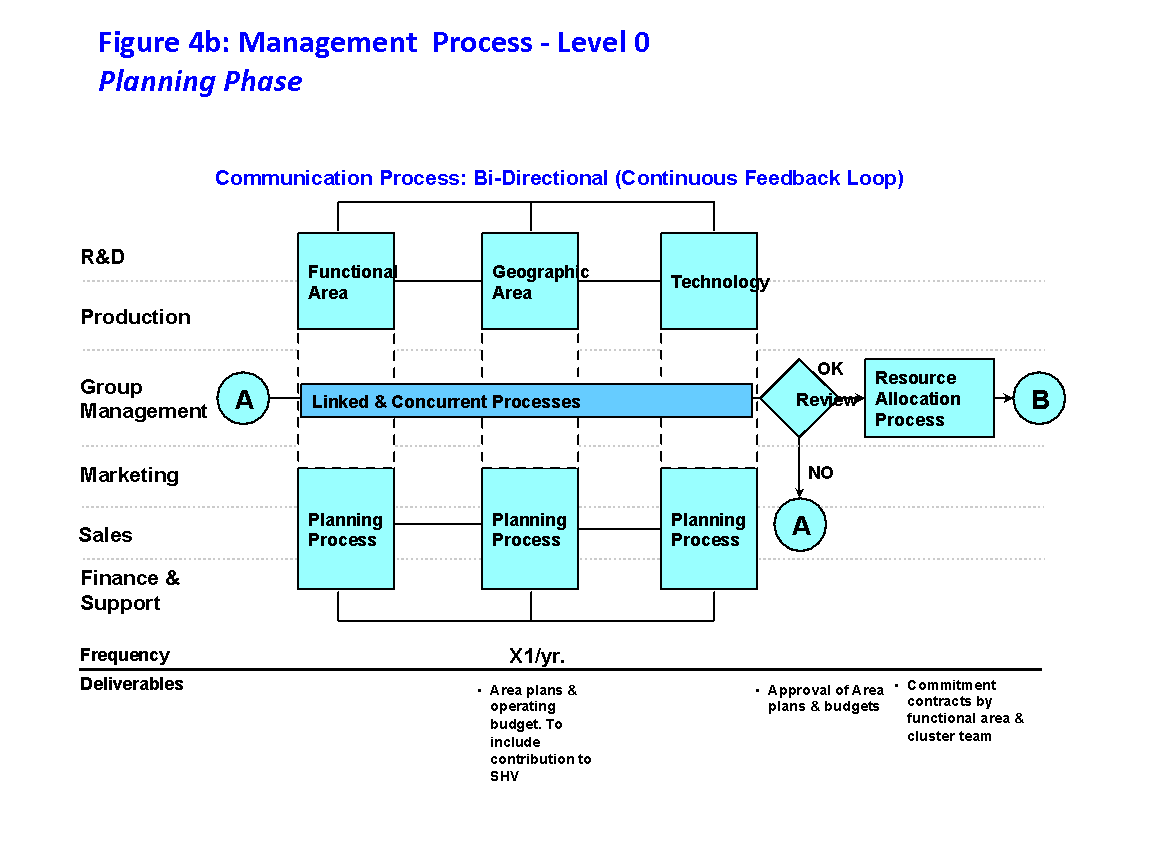

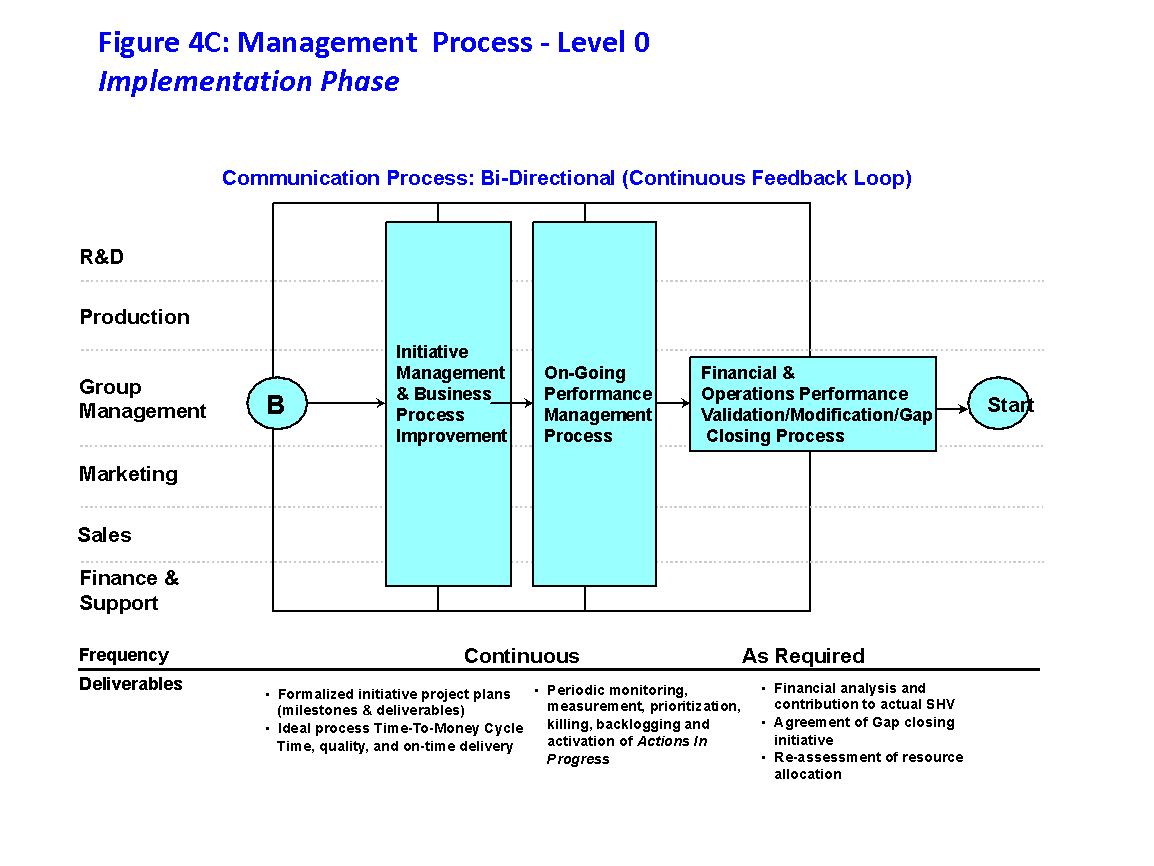

What I omitted from the above list is the notion and reality of Executive Processes in #7 above. This was by choice. Configuring what the Top Management Team (TMT) does in process terms is not well known, but I think it is a powerful lever. In fact, I think of the fourteen items above, Executive Processes offer the most leverage in sustaining CA over time. Figures 4a, b and c depict an example of the work of the TMT cast in process terms.

A key issue in strategy formulation and execution is alignment, especially in far-flung, large company settings. The accountabilities to lead the fifteen items above fall all over an extended enterprise. Some accountabilities are in the functions, some in the geographies, some at the business units, and some at the corporate level. It is safe to say it is only the TMT that can align all of these elements, as sub-units cannot be expected to lead and manage for the organization as a whole, as the TMT should.

Exhibits 4a, b, and c were actually done in 1998 for two clients and are an older rendition of what I currently use, but they make my point. One company was, and is, a well-run railroad corporation, and the other a not-so-well-run corporation in the medical imaging field. The reader can see that the work of the TMT cast in process terms that uses Time as a reference point can give the TMT a drumbeat of activity, deliverables, and accountability. These help ensure that the work of the TMT is done as a drumbeat within an Executive process. This is much better than calendar-driven work that may “fire up” when not needed, only because the calendar says it is time to start something. Note the x1/yr. designation means that process “fires up” once per year but its process runs with its steps over the year or part of a year. It ‘fires up” when it needs to do so, finishes, and starts its process over again when “pulled” as needed.

5. What Is Competitive Advantage Period (CAP) Revisited?

Competitive Advantage Period (CAP) is the number of years a firm’s return on capital is expected to exceed its cost of capital due to the firm’s sustainable competitive advantages (Holland and Mathews, 2018, p-169). Furthermore, it is the length of time into the future that Fade is expected to not take its toll greater than the historical average Fade for a firm’s industry. Again, fade happens and value creating and value growing firms beat the industry average fade.

Many investors and executives are not aware that CAP is “priced into” the current stock price of publicly traded companies. For example, Macy’s had a 38-year CAP priced into its stock price in 2015. By 2017 its expected fade rate increased from 2.6% to 14.5% and its CAP fell to 7 years. And in its heyday, Blockbuster had a 50-year CAP priced into its stock. Of course, Netflix changed this for the worse.

In the Macy’s example, investors and analysts felt (the firm’s) competitive advantage was large enough and sustainable enough to warrant its high stock price relative to its peer firms. A CAP of 38 years is better than a CAP of 10 years which is better than 2 years and certainly better than a CAP of 0 years. But Macy’s movement from 38 years to 7 years was not good.

6. Conclusion: How CAP Figures Into Valuing Firms and Competitive Strategy?

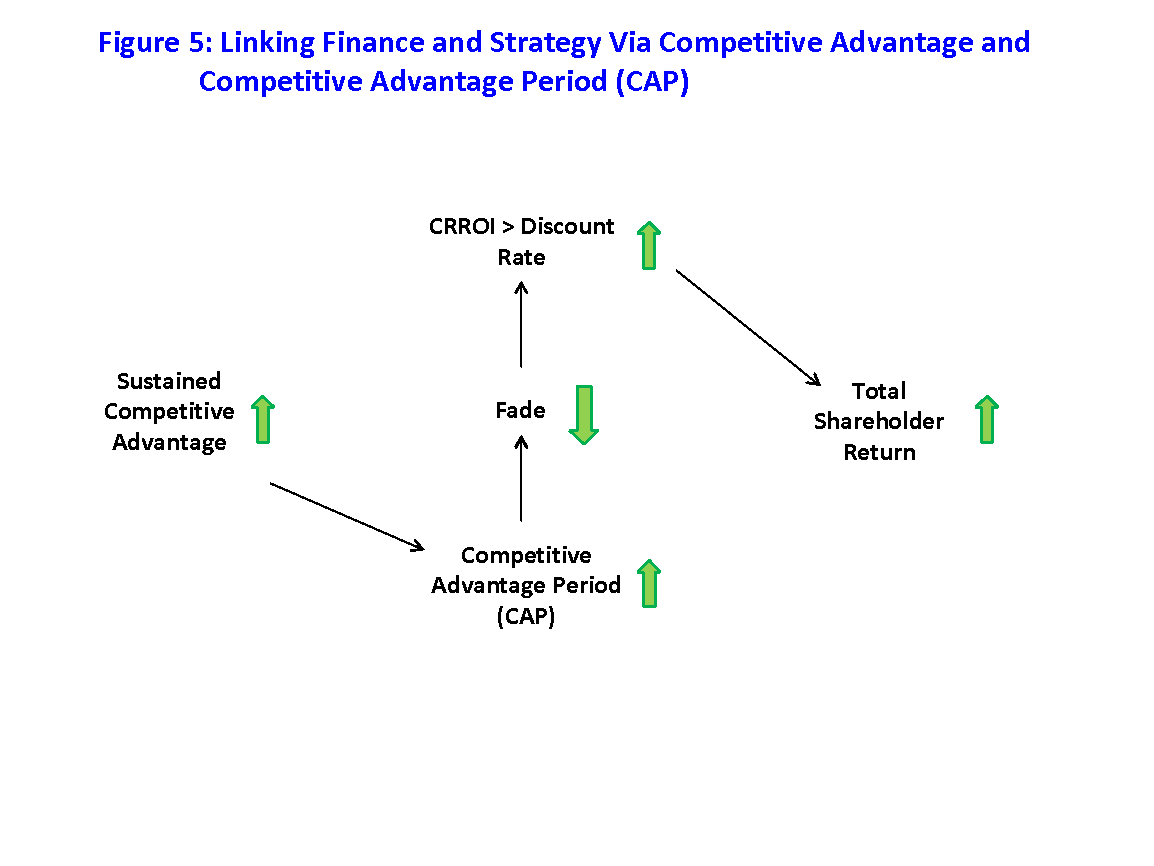

If I have been successful, the reader should have an indication of how CAP figures into valuing firms, their stock prices, and dividends, which equals Total Shareholder Return. Also, the reader should have a notion of how competitive advantage, method of competition, competitive advantage sustainability, and fade works in firm valuation and competitive strategy. Figure 5 summarizes the causation of our discussion:

Notice both competitive strategy and finance figure in together in optimizing Total Shareholder Return. Both are required from our discussion and the causative model of Figure 5. Sustained Competitive Advantage starts a cycle of value and wealth creation. This is an important point that some of my finance colleagues miss. This drives increases in CAP, which lowers Fade. This then allows for CFROI to be greater than the Discount Rate (which is the required return from debt and equity investors), the classic condition that single-handedly drives increases in Total Shareholder Return.

A key takeaway here is that pure financial engineering and short-termism will not increase Shareholder Return. The strategy and finance departments must “be joined at the hip” ((Holland and Mathews, 2018, p-359) and work closely together to serve the CEO and Top Management Team, and indeed the entire organization and investors. Other stakeholders win as well which is a topic for another article.

This article is part of a series on what causes a firm’s value to increase.

Dr. William Bigler is the founder and CEO of Bill Bigler Associates. He is a former Associate Professor of Strategy and the former MBA Program Director at Louisiana State University at Shreveport. He was the President of the Board of the Association for Strategic Planning in 2012 and served on the Board of Advisors for Nitro Security Inc. from 2003-2005. He is the author of the 2004 book “The New Science of Strategy Execution: How Established Firms Become Fast, Sleek Wealth Creators”. He has worked in the strategy departments of PricewaterhouseCoopers, the Hay Group, Ernst & Young and the Thomas Group among several others. He can be reached at bill@billbigler.com or www.billbigler.com.

Citations

- Rappaport, Alfred, Creating Shareholder Value: The New Standard for Business Performance, Free Press, 1986, 270 pages. And the revised edition 1998, Free Press, 205 pages.

- David Holland and Bryant Matthews, Beyond Earnings: Applying the Holt CFROI and Economic Profit Framework, Wiley, 2018, 383 pages.

- Bartley J. Madden, Value Creation Principles, Wiley, 2020, 250 pages.

- Michael Porter, The Competitive Advantage: Creating and Sustaining Superior Performance. NY: Free Press, 1985. (Republished with a new introduction, 1998.)

- Paul Leinnwand and Cesare Mainardi, Strategy That Works: How Companies Close the Strategy-to-Execution Gap, Harvard Business Review Press, 2016, 262 pages.

- William R. Bigler, Jr., “A New Vista for Strategic Management: Continuously Aligning the Inside With the Outside”, Management Accountants Journal, Spring 2019, Vol. 20, No. 3.