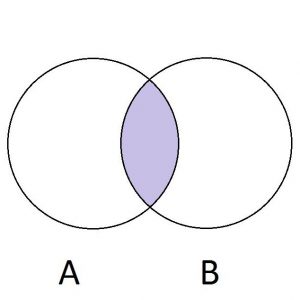

This article will introduce an approach for CA that is dynamic and thus is a flow or a speed or a rate notion. The Positioning School is not out in my view. My dynamic view is a complement to the positioning view of CA.

Notes on Growing Wealth in the For-profit Firm 2021

January 2021 will be the beginning of the tenth year of this series of articles on what causes the valuation of the for-profit firm to increase. The topics are not just purely financial and include those plus topics and causes of wealth creation and growth such as competitive strategy formulation, strategy execution, process excellence, innovation, the leadership of strategy, and much more. We are honored that so many people have found our points of view useful for their efforts, whether in industry or consulting. We pledge to try to bring important and interesting topics to you in 2021. Very best regards, Bill Bigler.

Can We Link Competitive Strategy Frameworks to Value Creation Principles and Vice Versa? A Promising New Vista – Part 2

I will review the section covering Figure 1 from Part 1 below to orient new readers. Then I will discuss the fourth and fifth examples of how we might link competitive strategy frameworks with value creation principles, most often discussed as creating and growing shareholder value (SHV). I am very mindful of the current debate over shareholder capitalism versus stakeholder capitalism. This discussion must be tabled though for this article. And as I mentioned in Part 1, other strategy frameworks could be used here. Roger Martin’s framework in Playing to Win comes to mind, as do others.

Can We Link Competitive Strategy Frameworks to Value Creation Principles and Vice Versa Part 1

My observation is that competitive strategy professionals and academics typically do not know much about firm value creation principles and finance professionals and academics do not typically know much about competitive strategy. I know there are outliers in each group, but am I correct in saying this? If I am, is this situation caused by each set of professionals and academics ceding the ground to the other group thinking “they will cover their areas of expertise” so we don’t need to do so?

The Top Management Team As A High Performance Team Revisited: Needed For Long-Term Value Creation and Growth?

Do we want or need High Performance Teams (HPT) in our VUCA 2021 world? More directly for this article, do Top Management Teams (TMTs) need to be HPTs for long-term value creation and growth? When we view the TMT as a proposed HPT, would we rather want or need them to be the good or useful version of a group of distributed and unconnected powerful “feudal barons and baronesses”. I know this seems ludicrous because teams, and the special version of a team called a HPT, seem to have knee jerk and near universal support that they are a “good” no matter what.

Where Strategy and Finance Intersect- Competitive Advantage Period (CAP) and Executive Processes

This article will be on the technical side. But I think it also presents concepts about competitive strategy, finance and wealth creation that are very important for senior management and strategy and finance professionals. One last point before we begin. I am mindful of the raging debate about shareholder capitalism and stakeholder capitalism. While I am a shareholder value proponent, I need to table this discussion for this article. This debate will not be resolved soon, maybe never. But in the meantime, senior management along with strategy and finance professionals must lead and manage for value and wealth creation, whether enlightened or not.