The strategic management of for-profit firms seeks, among other things, to secure the most advantaged future as is possible in today’s VUCA business world. VUCA, of course, stands for Volatile, Uncertain, Complex and Ambiguous.

January 2019 will mark the eighth year of writing articles about what increases firm valuation for the for-profit firm. We have an exciting year plan and I hope you will continue to follow this series of articles and comment on them. The comments are very appreciated and help me learn. Best regards, Bill and the team at Bill Bigler Associates.

The strategic management of for-profit firms seeks, among other things, to secure the most advantaged future as is possible in today’s VUCA business world. VUCA, of course, stands for Volatile, Uncertain, Complex and Ambiguous.

Part 2 picks up from Part 1 with a discussion of Question #s 4-7. In case you missed Part 1 for a discussion of Questions 1-3 and would like to read it click here. And this is a little long but I think worth your time.

This article will discuss seven of the most challenging questions that I have dealt with in firms over the last thirty years simply as examples that shed light on the purpose of this article. And that is why there are so many answers to the questions for the field of strategy conditioned with “it all depends on the context” or “it all depends on the nature of industry maturity”, etc. I thought we would have had clear guidance by now, so it is surprising to me that these remain perennial problems.

This is a follow up on an article to I wrote earlier this year titled Time, Speed and the Process Revolution: Why Are These Disciplines Disappearing? If my observations are correct…that process disciplines from a management viewpoint are disappearing, I would like to try one more time to raise a clarion call that this is a problem.

This article was in development before the week of August 19, 2019, when the Business Roundtable (BRT) announced their new statement of purpose of the corporation. Thus I think this article and others like it are even more important. The new statement by the BRT, in brief, is that shareholders are no longer the sole recipients of financial value created by publicly traded firms. Other stakeholders will be participating in that value as well.

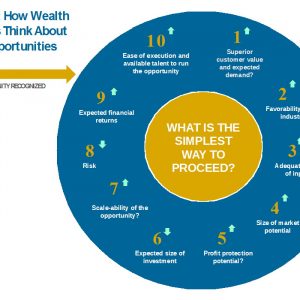

We’ve seen recent renewed interest in how to think strategically. The offerings are good for the most part in my view. I think a focus on how ‘winning wealth creators’ think about and assess new opportunities before their investment could serve as a useful addition to any strategic plan.

As I have written in this series, I think the most useful superordinate goal of the for-profit firm is growing its valuation. Superordinate is defined as “a thing that represents a superior order or category within a system of classification”.

There are at least hundreds of definitions of competitive strategy for for-profit firms. In my view, the useful differences in definitions are based on changing contexts for businesses, not from someone trying to re-invent sliced bread. My favorite definition of competitive strategy from the context or lens of making strategic decisions is below. This definition has been suggested by several strategists including Donald Sull of MIT and is:

In 2019 time and speed are still important operational and strategic weapons for firms. Just look at Amazon moving to next day and now same day delivery. But the very rich disciplines of process innovation and process management seem to be disappearing in many or even most firms. This article, part of my series on what causes the valuation of the for-profit firm to increase, will in part be a community call to confirm your experience that indeed these rich disciplines are disappearing. If so, why? Is this a problem? I believe it is a problem if my recent observations are correct.

There is an accompanying slightly more in depth article just published in LinkedIn titled “Diagnosing the Strategic Health of Your Firm At Lightning Speed: How You Can Do It”, but if you would like to go to the survey directly, here is the link https://www.surveymonkey.com/r/GKF9889.

A few weeks ago I was at a dinner party and mentioned to a CEO of a large privately held for-profit firm that I could diagnose the strategic health of his firm by using two brief surveys and get Findings and Implications to him within three weeks. He did not believe me.