This article will introduce an approach for CA that is dynamic and thus is a flow or a speed or a rate notion. The Positioning School is not out in my view. My dynamic view is a complement to the positioning view of CA.

Author Archive for Adam Newdow

Can We Link Competitive Strategy Frameworks to Value Creation Principles and Vice Versa? A Promising New Vista – Part 2

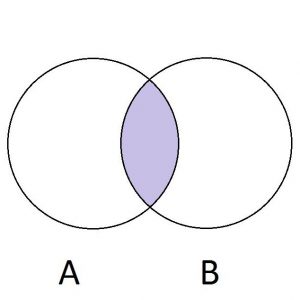

I will review the section covering Figure 1 from Part 1 below to orient new readers. Then I will discuss the fourth and fifth examples of how we might link competitive strategy frameworks with value creation principles, most often discussed as creating and growing shareholder value (SHV). I am very mindful of the current debate over shareholder capitalism versus stakeholder capitalism. This discussion must be tabled though for this article. And as I mentioned in Part 1, other strategy frameworks could be used here. Roger Martin’s framework in Playing to Win comes to mind, as do others.

Can We Link Competitive Strategy Frameworks to Value Creation Principles and Vice Versa Part 1

My observation is that competitive strategy professionals and academics typically do not know much about firm value creation principles and finance professionals and academics do not typically know much about competitive strategy. I know there are outliers in each group, but am I correct in saying this? If I am, is this situation caused by each set of professionals and academics ceding the ground to the other group thinking “they will cover their areas of expertise” so we don’t need to do so?

The Top Management Team As A High Performance Team Revisited: Needed For Long-Term Value Creation and Growth?

Do we want or need High Performance Teams (HPT) in our VUCA 2021 world? More directly for this article, do Top Management Teams (TMTs) need to be HPTs for long-term value creation and growth? When we view the TMT as a proposed HPT, would we rather want or need them to be the good or useful version of a group of distributed and unconnected powerful “feudal barons and baronesses”. I know this seems ludicrous because teams, and the special version of a team called a HPT, seem to have knee jerk and near universal support that they are a “good” no matter what.

Where Strategy and Finance Intersect- Competitive Advantage Period (CAP) and Executive Processes

This article will be on the technical side. But I think it also presents concepts about competitive strategy, finance and wealth creation that are very important for senior management and strategy and finance professionals. One last point before we begin. I am mindful of the raging debate about shareholder capitalism and stakeholder capitalism. While I am a shareholder value proponent, I need to table this discussion for this article. This debate will not be resolved soon, maybe never. But in the meantime, senior management along with strategy and finance professionals must lead and manage for value and wealth creation, whether enlightened or not.

The Case of Rolex: Introduction to a Study in Competitive Strategy, Longevity, Valuation and Full Potential Using a Comprehensive Model of Firm Valuation

This short piece is an introduction to a comprehensive article applying my model of causation among twenty-two Elements of competitive strategy and firm valuation as a firm moves to its Full Potential. I will apply my model to the Rolex watch company and this longer article will be the first in a new series of case studies on firms.

The Case of Rolex: Excerpt From a Study in Competitive Strategy, Longevity, Valuation and Full Potential Using a Comprehensive Model of Firm Valuation

This short article is excerpted from a much longer article applying my 22 Element Causal Model of firm valuation and Full Potential to the Rolex watch company. This excerpted article follows from a first excerpted article on What Is Causation in Business that was published two weeks prior.

How Causation in Business Works

This very short article (for me given my recent lengthy tomes) is a pre-amble to a comprehensive article I will publish in a few days (today is October 19, 2020). The upcoming comprehensive article will be on applying my full causal model of what increases a for-profit firm’s valuation as a firm moves to its Full Potential to the Rolex watch company.

How To Link Competitive Strategy, Culture and Increases In the Market Value of the Firm

Most of us have heard the phrase “culture eats strategy for lunch.” While trite, there is truth to this phrase. The phrase suggests that culture is a beast, here to stay and difficult to change for the better. This article is for those firms who find they need to change a culture either because it has become toxic or it no longer supports and aligns with the competitive strategy and has become a barrier to performance as measured by increases in the firm’s valuation or its market value.

A Board of Directors’ Process for Maximizing Shareholder Value – Part 2

How can we aid the board of directors in helping to drive increases in shareholder value (SHV) in the publicly traded firm. The principles apply to private for-profit firms as well as they try to maximize owner wealth. In part II of this article readers will learn why this board process has huge implications for corporate culture change in many firms.

A Board of Directors’ Process for Maximizing Shareholder Value – Part 1

This two part article will present a simple and linear looking process to aid the board of directors in helping to drive increases in shareholder value (SHV) in the publicly traded firm. But the principles apply to private for-profit firms as well as they try to maximize owner wealth. The reader will see, this board process has huge implications for corporate culture change in many firms. Thus in the article, I hope to lay out the process and culture required for boards of directors to really up their games.

A Board of Directors’ Process for Maximizing Shareholder Value

This article will present a simple and linear looking process to aid the board of directors in helping to drive increases in shareholder value (SHV) in the publicly traded firm. But the principles apply to private for-profit firms as well as they try to maximize owner wealth. If the reader would like a little more background, please see A General Theory of Valuation and One Casual Model of Increasing Firm Valuation.