On September 19th Apple’s stock was trading at $702. On November 8th it had fallen to $538 a share. This was $154 billion in lost shareholder value in eight weeks. The culprit was expected rising costs to land their products on shelves from their factories. Now most investors and analysts thought Apple executives and managers would rebuild the lost value, and they indeed are. But a permanent destruction of shareholder value or firm valuation in the case of the private firm is something to be avoided if at all possible. Why?

Forum Newspaper Articles Series

Competitive Advantage Through People?

If you have followed this series of articles on the strategy and leadership drivers of firm valuation, I bet many of you are saying to yourselves, “Oh oh … here comes the soft and squishy one”. But I want to demonstrate to you that people can be a source of enduring, hard-for-a-competitor to copy competitive advantage for your firm or organization.

What Do Private Equity Investors Want From Their CEOs?

The role of the Chief Executive Officer (CEO) is crucial in any company for its success and ability to create wealth for its shareholders/owners or other measures of performance if the organization is not a publically traded corporation.

Futuring: The Exploration of the Future – Part 2

Recall last month we defined futuring as a subset of strategic planning and it is the field of using a systematic process for thinking about and picturing possible futures and then setting the probability for each occurring. We also gave examples from 52 Trends Shaping Tomorrow’s World by Marvin Cetron and Owen Davies. If you were able to read Part 1, were you able to consider the implications of those thirteen trends for your organization?

Futuring: The Exploration of the Future – Part 1

Is it possible to know the future with certainty? The answer is no most of the time. But futurists think much more can be done than to just let “the future sneak up on you”.

Strategy, Firm Valuation, and Boards of Directors

Boards of directors should play a more direct role in helping to grow the value of their firms. This is a relatively new mandate as many boards historically have served only a high level review role during quarterly board meetings. But firms like Newell/Rubbermaid, SABMiller Beer and Whole Foods Markets are charting a new course for transparency of operations and board involvement.

Strategy and Key Manager Compensation – A Means to Grow Firm Value

I first started consulting in 1985 in the strategy subsidiary of the Hay Group, one of the leading compensation consulting firms in the world. When they performed their annual Employee Satisfaction Survey for clients, the best score any company could muster for positive satisfaction with base compensation was 50%. The global average score for positive satisfaction with base compensation was only 25%!!! What do these data suggest? Most people are not satisfied with their pay and want more money.

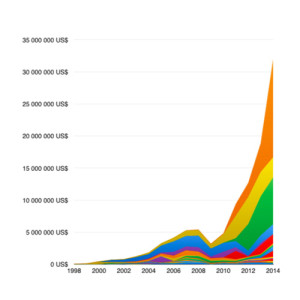

Globalization of Business and Northwest Louisiana

Global business initiatives can substantially help increase the value of a firm if they are done well. But evidently businesses in Northwest Louisiana are not embracing the revolution going on in global business yet.

The Strategic Planning Process: Does Your Organization Need One?

Can you predict your organization’s future with certainty? Can this prediction then enable your firm to move to that future with supremacy and advantage? When strategic planning was popularized right after World War II, it promised to do just this. We now know, though, that nothing can do this short of an organization enjoying a lasting monopoly.

Enterprise Wide Risk Management

Serious employee accidents, information technology melt down, white-collar crime (valued at billions of dollars globally), supply chain shortfalls, board governance issues, external/internal audit strife, competitive encroachment or leapfrog, patent/trade secrets leakage, changes in the White House….

The Process Revolution and Profitable Revenue Growth

What do you think is the root cause of why some firms can enjoy year after year profitable revenue growth and other cannot? My answer: blow up your functional organization structure to become a Process Driven Company. Wow – you might be saying, “what about marketing and selling? customer service? new product development? human resources? Firms like Hewlett Packard, Siemens Lighting, Danaher and others have been honing Process Driven Skills for a long time.

Innovation: The Hot American Business Topic – Part 2

In the last article, I built the case for why your firm should think about whether the innovation revolution that is sweeping publically traded companies would be right for it. In Part 2 I want to give you a glimpse of some of the “secrets” to innovation some leading firms are using. There are many approaches being used but I like the approaches by IDEO, Strategos and Booz and Company the best.