How many times have you heard an executive say we have a competitive advantage over our rivals? The business press has written that firms like Amazon and Apple have a competitive advantage. What do these people mean by this?

Dr. Michael Porter, perhaps the world’s most famous and respected strategy professor, wrote a seminal book in 1985 titled Competitive Advantage: Creating and Sustaining Superior Performance. Since the book was read and studied all over the world, I thought the concept of competitive advantage was settled a long time ago. However it appears this is not the case. My hypothesis is succeeding generations of executives and managers have to learn this topic anew and this is to be expected, but students do not read the original Porter book anymore in most cases. In the ensuing thirty-two years since the book’s publishing, this topic seems to have gotten misconstrued. In my view, some strategy professors don’t understand it correctly themselves. I will share with you in this article how I approached the issues surrounding competitive advantage and what it is with clients for over thirty years. As I will try to demonstrate, the question is not whether or not our firm enjoys a competitive advantage. The better question we need to ask and answer is “What evidence do we have that we enjoy competitive advantage over rivals?”

Amazon and Walmart, contemporary rivals.

You frequently hear executives say: “Our new sales force software system will give us a competitive advantage”. Or “Our culture gives us a competitive advantage”. Or “Our new innovation process will give us a competitive advantage”. Now one would think a robust innovation process would give some form of competitive advantage. Maybe. I could go on and on listing various things executives and managers think give or will give them competitive advantage.

As I state above, these items from the functional areas and other initiatives could contribute to a firm enjoying competitive advantage over rivals. But many times they only increase the expenses and/or investments a firm makes without contributing to competitive advantage. Strategists call these kinds of expenses and investments those that bring a firm to parity (equality) with rivals and allow them just to stay in the competitive ballgame. These offer no contribution to competitive advantage. The bar to knowing that a functional area or some investment contributes to competitive advantage is quite high.

Part of this confusion is due to terminology. For years firms have used the classic SWOT (Strengths, Weaknesses, Opportunities and Threats) analyses in their strategic planning efforts. When assessing the laundry list of Strengths in the normal strategic planning retreat, executives are generally and rightfully proud of what they think they are good at doing. They just assume these supposed strengths provide competitive advantage. Many times they are just parity contributors or upon further analyses may not even need to be performed any more at all. Over the years customers really have grown to not care about those aspects of what your firm is doing. Yet they are still on the Strengths list just increasing expenses and investments.

As I mentioned above, a good frame of reference for thinking about competitive advantage is asking the question “What evidence do we have that we enjoy competitive advantage?” This suggests data, analyses, and assessment of causation. Assessment of causation is hard work, but it can and must be done in my view. However, in my experience this is rarely done at many or maybe even most firms. But what is competitive advantage in the first place?

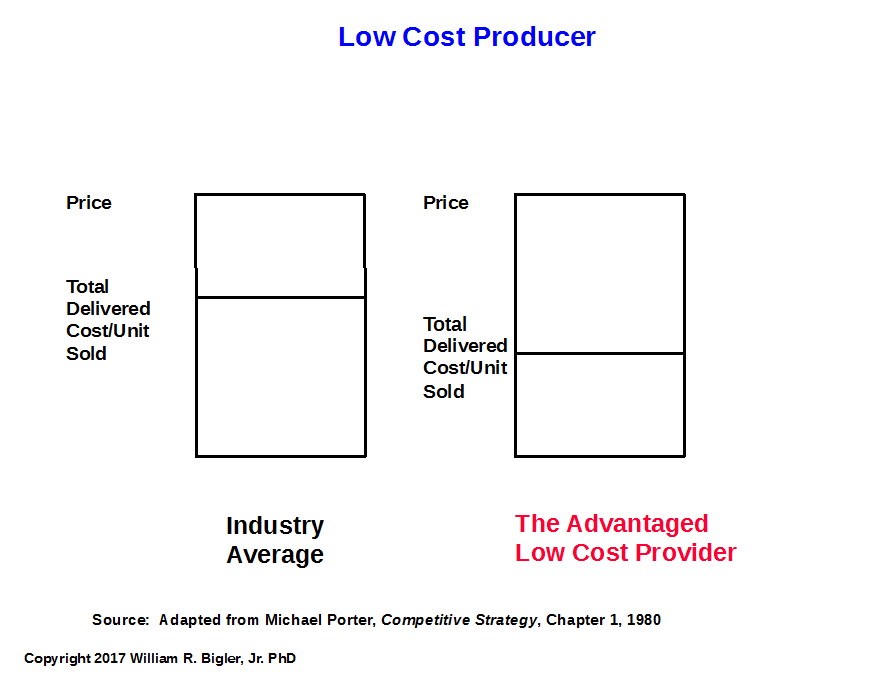

As Dr. Porter wrote many years ago, it is one of two realities. From his first landmark book in 1980 titled Competitive Strategy, he referred to these as “generic strategies”. The first reality is that a firm has a total cost (not price) per unit sold position that is the lowest with respect to the industry average per unit costs and at the same time the firm is doing enough cool things that allow it to charge prices at the industry average price line. Think Amazon and Wal-Mart. See Figure 1 for a graphic of this reality. It is adapted from a video that Dr. Porter did around 1982.

Figure 1: Evidence of Competitive Advantage: Low Cost

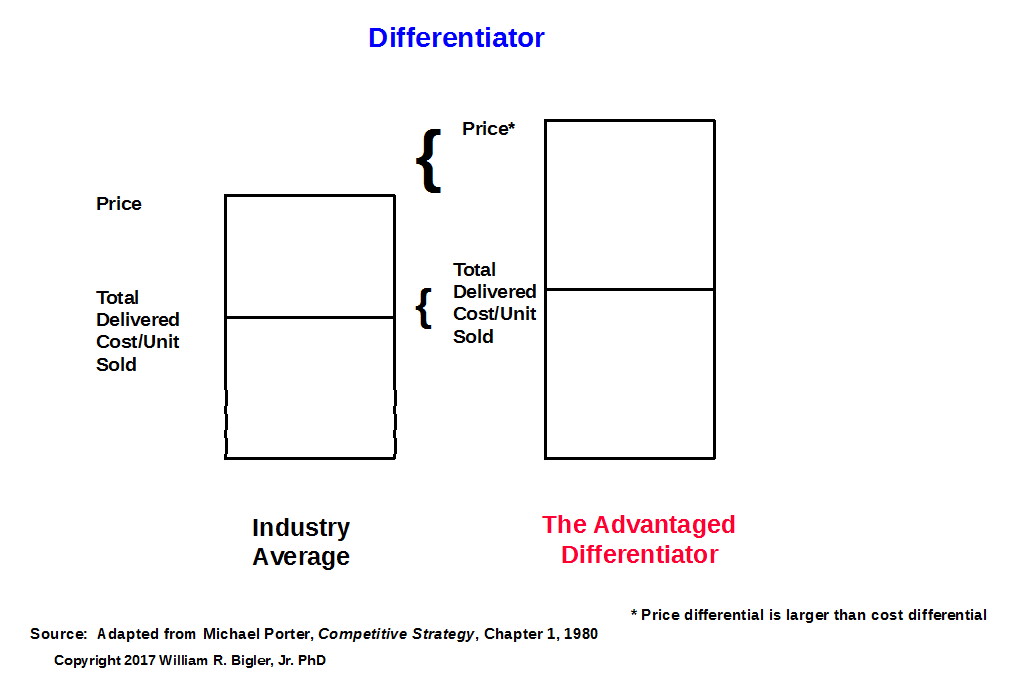

The second reality is being able to enjoy charging a sustained premium price over the industry average price line, and having customers love paying it. Think Mercedes, BMW, Rolex, etc. Figure 2 depicts this reality.

Figure 2: Evidence of Competitive Advantage: Premium Price Provider or Differentiator

In 1985 Dr. Porter did state that a firm could enjoy only one form of competitive advantage and must make a clear choice of only one. But since then others have stated that a dual advantage of lowest per unit costs and premium prices at the same time is possible, most often for short periods of time. Think of Apple’s iPhone here.

It is simple enough to do a cursory analysis and then draw these figures for your firm and industry and claim your firm has a competitive advantage. What real evidence do we have that we really do enjoy a cost, premium price or dual competitive advantage? Cost per unit sold can be measured and rivals costs per unit sold can be assessed and estimated via legal competitive intelligence. And being able to charge premium prices over time relative to rivals can be measured as well. Some firms go an extra step here and use the American Customer Satisfaction Index or Net Promoter Scores as more data to suggest the firm has the customer loyalty to be able to charge premium prices and have customers love their purchases.

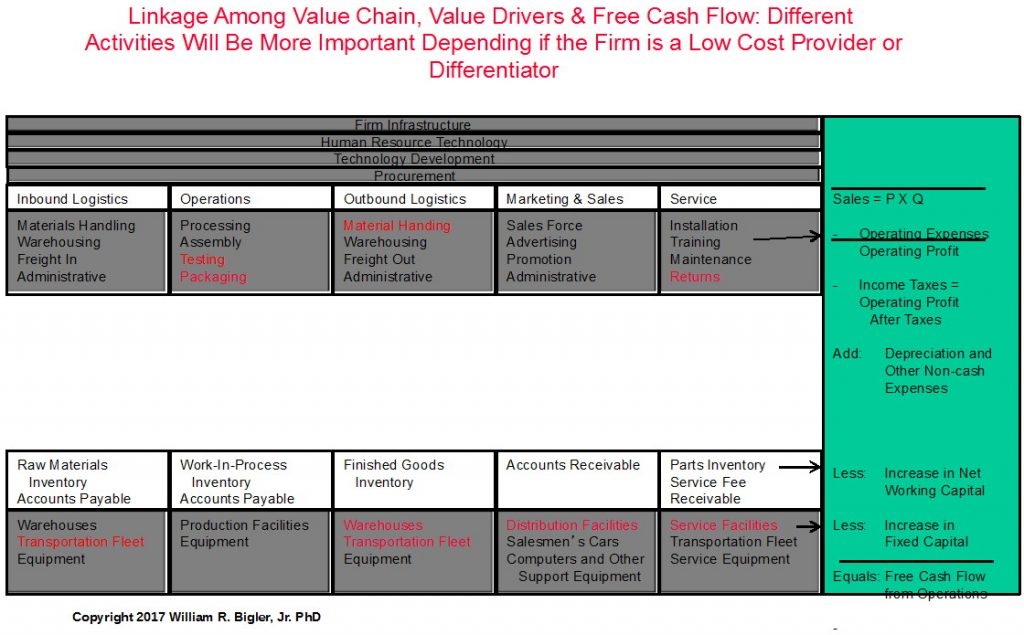

But this is still not enough to prove causation from my experience. Another great tool Dr. Porter introduced in Competitive Advantage is the Value Chain, shown in Figure 3.

Figure 3: The Acid Test for Competitive Advantage Causation

The chart depicts the flow of activities from left to right of how a firm can create value for customers. The top row under Inbound Logistics, Operations, Outbound Logistics, Marketing and Sales and Service are expenses a firm bears to add value for the customer. The middle row is working capital investments and the bottom row is fixed capital investments. But I added the far right panel some twenty-five years ago that depicts the simple formula for free cash flow from operations. Sales equal Price X Quantity Sold and the other elements of free cash flow are apparent. The elements in the panel are also most of the pure financial drivers of shareholder value or owner wealth for private for-profit firms. In my view, we must be able to show which low cost or differentiator activities are causing free cash flow return on investment that is greater than the weighted average cost of capital. To not take this step means we cannot claim any aspect of our business causes a true competitive advantage.

In my view, firms must add the analyses and prove the causation to claim a competitive advantage exists. If they don’t, mere talk is very cheap and the firm loses the opportunity to gain real insights into their firm’s strategy and operations and if competitive advantage exists.

This article is part of a series on what causes a firm’s value to increase

Dr. William Bigler is the founder and CEO of Bill Bigler Associates. He is the former MBA Program Director at Louisiana State University at Shreveport and was the President of the Board of the Association for Strategic Planning in 2012 and served on the Board of Advisors for Nitro Security Inc. from 2003-2005. He has worked in the strategy departments of PricewaterhouseCoopers, the Hay Group, Ernst & Young and the Thomas Group. He can be reached at bill@billbigler.com or www.billbigler.com.