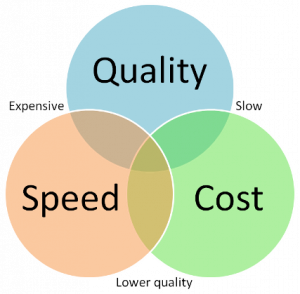

Speed, Quality, and Cost are three key watchwords of Operations Excellence (OE). Historically a for-profit firm could enjoy best-in-class levels of two of these three watchwords, but not all three at the same time. In today’s business world, the firm needs to have all three at best-in-class levels just to survive. OE is a huge contributor to organization performance and growth the market value of the firm.

At a higher level of abstraction, any firm takes in Inputs, Transforms those Inputs into Outputs, Delivers those Outputs to customers and performs some type of After-sales Service. This is true in manufacturing, where this is easily seen as well as in service industries. A bank, for instance, takes in Inputs (information about the loan customer and the general economy and interest rates) and transforms those Inputs to produce a loan. And we can measure customer satisfaction as a result of OE efforts. Manufacturing kinds of businesses use fill rates and on-time-delivery as measures of customer satisfaction. Other industries use measures such as Net Promoter Scores.

OE is a large body of knowledge with scores of tools that are constantly being improved. Danaher and Amazon are in my view two firms who constantly amaze nearly everyone at their ability to continuously perfect OE. In this short article, I will try to describe the central features of OE that help to provide competitive advantages for the for-profit firm. Along the way, I will comment on my opinions of the Balanced Scorecard (BSC) and its appropriate role in OE. It has gotten fashionable to bash the BSC these days. Some of this criticism is justified; others are not in my view.

Many of the ideas here come from my tenure at the Thomas Group in the late 1990s. Thomas Group was then one of the leading consulting firms in OE and my two and one-half years there were some of the best in my entire career. Phil Thomas, the founder, adapted cycle time (speed) and re-work improvement in semiconductor chip manufacturing at Texas Instruments to all of a firm’s operating processes. The reader might be thinking this knowledge might be somewhat dated. But it is not in my view, as TG distilled the essence of OE into a number of principles and tools that are timeless.

Let’s return to the three watchwords from above: Speed, Quality, and Cost. As I mention, in the past a firm could enjoy best-in-class levels in two of the three, but not all three at the same time. If our firm was fast and low cost, quality could and did suffer. If our firm enjoyed quality and acceptable cost position, our firms could be slow. If our firm enjoyed speed and quality, costs could be too high. As the ensuing competition from Japan and then China hastened, all three watchwords were needed just for a firm to survive. What allowed the firm to thrive was good strategy and innovation. Great firms like Amazon overlay a strategy and innovation engine on top of their firm’s foundation of OE.

How do firms then enjoy Speed, Quality, and Cost at the same time then? I have written several articles in this series over the last five years that describe the Process Revolution and how it allowed firms to enjoy all three watchwords at the same time. The essence of those articles is to view your firm as a portfolio of Executive, Operating and Support processes. For each of the subprocesses in each category, we apply great process principles and disciplines. That is, each process is designed to be as fast as it can be with little or no re-work in each process. Reducing re-work to near zero automatically takes costs out of those processes. What is gained from such work is high levels of customer satisfaction, whether in Business-to- Business spaces or in Business-to-Consumer spaces. Jeff Bezos in the early days of Amazon had this tongue-in-cheek statement (Amazon.com: 1994-2000, Harvard Case study 9-801-194):

“We’ve done extensive analysis and found that our customers actually want us to ship products to them.” I think we would all agree Amazon did just that and set the benchmark for supply-chain kinds of businesses. Now, this is not easy work. If the reader is interested, peruse a copy of the Harvard Business School case study on Danaher. There you will see all of the tools they use in their internal “university” to bring this level of process discipline to manufacturing, business-to-business kinds of firms. These tools, plus their penchant and culture for constant continuous improvement, is called their Danaher Business System and is worth anyone’s further study. Go to your brokerage firm’s research tool and portray Danaher’s ten-year (or all available years’ data) stock price history. You will be impressed.

Where does the BSC fit into OE? I was one of the first to gain a certification of completion in the BSC methodology in 1996 during a weeklong training session. Then the BSC was touted as an alignment tool – nothing more. In my view, the BSC in 1996 was a nice tool that extended the classic 1965 book by George Edirne titled Management by Objectives. If the BSC had stayed being viewed as an alignment tool, the recent criticisms would not have a leg to stand on from my view. But in the ensuing years, the BSC folks began saying the BSC could aid immensely in strategy formulation, strategy execution, and innovation. They also touted the tool could aid in fundamental culture change and even leadership development. This is too much to ask of one tool in my opinion.

Alignment of objectives and initiatives and allocating resources to those initiatives is a huge challenge in of itself, especially in larger, geographically far-flung enterprises. Alignment should be the fourth watchword in OE in my opinion. If the reader would use the tool only as an alignment tool, I think they would enjoy the fruits of the tool and forego the apparent cynicism that has ensued inside of firms who think it can do almost anything.

What is your firm’s approach to OE?

This article is part of a series on what causes a firm’s value to increase

Dr. William Bigler is the founder and CEO of Bill Bigler Associates. He is the former MBA Program Director at Louisiana State University at Shreveport and was the President of the Board of the Association for Strategic Planning in 2012 and served on the Board of Advisors for Nitro Security Inc. from 2003-2005. He has worked in the strategy departments of PricewaterhouseCoopers, the Hay Group, Ernst & Young and the Thomas Group. He can be reached at bill@billbigler.com or www.billbigler.com.