It is now July 2018 and in our current period of tariffs, sanctions, and other global issues, business growth is once again a hot but perhaps a perplexing topic, if only because growth might become constrained. However, the stock market is again approaching all-time highs so why worry about further rounds of profitable revenue growth? The answer, as we all know, is that further growth in the market value of the firm, and thereby stock prices, is caused by expectations of continued growth in free cash flow return on investment (FCFROI) on into the future. No expected growth in future FCFROI and stock prices for publicly traded firms and owner wealth for private for-profit firms fall.

So a framework to allow each firm to picture continued profitable revenue growth, which fuels future FCFROI, can be very useful. In a period of constrained growth due to the various barriers mentioned above, my experience shows that a framework and a process for profitable growth that all people in your firm understand is always very useful. Here growth is viewed as an ongoing process, not one or two-time big home runs.

The purpose of this article is to provide the conclusion that each firm should select a framework for innovation and growth that is at the correct level of complexity and granularity for that firm’s style of learning and action. And by firm I mean senior management and people all throughout the firm who will participate in the innovation and growth efforts.

I have written in this series about two frameworks I have developed to picture business growth – the Business Performance Engine and Growth Constellations. But those frameworks are comprehensive and thus on the complex side. In this article, I want to write about business growth frameworks that are simpler and thus more accessible. Again, what I have learned is every for-profit firm needs a robust but simple way for everyone in the firm to view and contribute to profitable business growth.

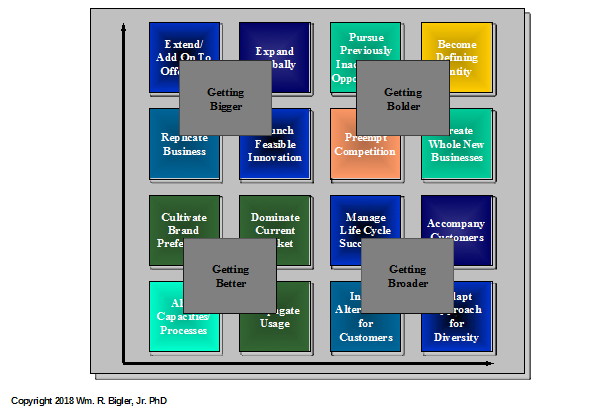

In 1994, I was on a team at the consulting unit of H. Ross Perow’s firm EDS, now owned by Hewlett Packard, who developed what we called the 4Bs framework. I have tinkered with and improved this framework ever since and Figure 1 depicts its current form:

Figure 1: The 4B’s Framework

This framework seems to have hit the right balance of simplicity and depth and many executives have used it to picture and make growth operational and executable for their firms. This depiction is a generic chart that provides a starting point for thinking and action. Most firms customize this depiction but some have used it as is. In 2003 I developed an audit/diagnostic tool called AAME for GOLD, which stands for Analysis, Architecture, Mobilization and Entrepreneurship for Growth Opportunities at Lightning Deployment. A mouthful I know, so some firms dubbed this A4G. This tool places a firm at baseline on which of the 4Bs – Getting Better, Bigger, Broader and Bolder, the firm currently resides. Ten firms have used the diagnostic and tool to picture growth and make profitable business growth operational. The prescription in the 4Bs framework is the firm must move from its baseline location, say from Getting Better towards Getting Bolder, for the market value of the firm to grow. It does this by setting an innovation and growth roadmap. This journey can take from ten to fifteen years to come to fruition. The journey usually runs from Getting Better through Getting Bigger and Broader, towards Getting Bolder.

You will notice each of the Bs has four cells for further brainstorming of growth ideas. The drill down on each cell includes key processes that are required to operate in each cell and the barriers that typically prevent growth. Some strategic planning departments have used this drill down in their efforts. The point I want to make here is that your firm’s approach to growth should include a diagnostic effort to assess where the firm really is at the start of its growth process. Each firm needs to know where it is headed, but it also must have an honest assessment of where it is “at baseline”. If your firm does not have such a diagnostic and assessment tool, it can fairly easily develop its own.

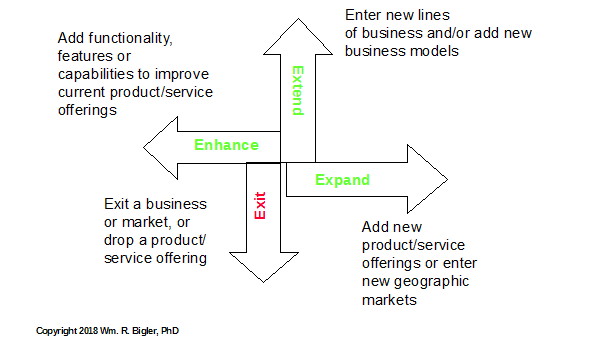

Another simple framework that I think has much value is that from Lynda Applegate of the Harvard Business School in her depiction of Amazon’s growth after the 2000 time frame. She did not intend this to be a growth framework per se, but I think it is useful for firms who have the luxury of trying a lot of small experiments. Some will work and others won’t but this kind of growth framework brings venture capital ideas into the established firm. The framework is shown in Figure 2:

Figure 2: Amazon Strategic Options to Enhance Shareholder Value in 2000

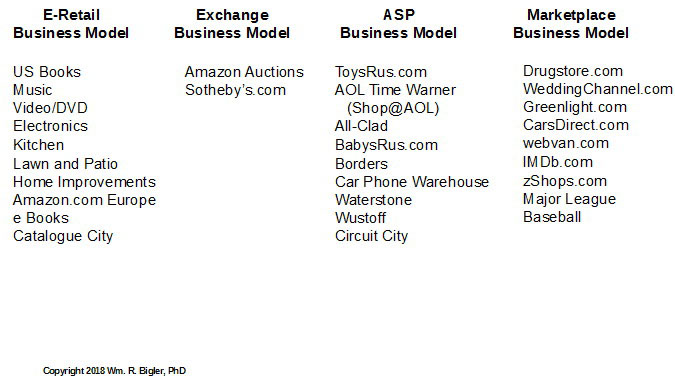

Figure 3 lists the myriad growth initiatives Amazon launched after the 2000 time period.

Figure 3: Amazon’s Enhance, Extend, and Expand After 2000

Some of these initiatives worked and others did not. But after the 2000 time period, Amazon added 1-Click, same-day delivery, drones and many other initiatives as experiments at lightning speed.

What simple but rich framework, along with its diagnostic and assessment tool does your firm use to picture and chart an innovation and growth path? There are hundreds of growth frameworks out there from which your firm can use as a starting point. But if your firm does not have such a framework and process, innovation and growth can be piecemeal, disjointed, and even ruinous to growth in the market value of your firm.

This article is part of a series on what causes a firm’s value to increase.

Dr. William Bigler is the founder and CEO of Bill Bigler Associates. He is a former Associate Professor of Strategy and the former MBA Program Director at Louisiana State University at Shreveport. He was the President of the Board of the Association for Strategic Planning in 2012 and served on the Board of Advisors for Nitro Security Inc. from 2003-2005. He is the author of the 2004 book “The New Science of Strategy Execution: How Established Firms Become Fast, Sleek Wealth Creators”. He has worked in the strategy departments of PricewaterhouseCoopers, the Hay Group, Ernst & Young and the Thomas Group. He can be reached at bill@billbigler.com or www.billbigler.com.