Your Current Products and Services Are Not Your Competitive Strategy – Part 2

This is Part 2 of an article started last week.

The established firm usually has at least a somewhat loyal set of base or core customers or in the case of Apple rabidly loyal customers, who provide a safety net for it. Sometimes these base customers are locked-in to using your firm because you have built up switching costs. This is where it would be more expensive for the base customer to leave your firm because they would have to buy a competitor’s dominant product and then all of the complementary products that make the dominant product really add value. This was the genius of IBM for many years. If you bought one of their mainframe computers, you had to buy their card readers, workstations, etc. Apple is trying to do this by making all of its products and services add more value together than one-by-one. The reality of switching costs is apparent in the digital landscape today as well. Today’s automobiles are really computers on wheels. Once we make our choice of car brand, we are locked into their configuration for Apple versus Android for our car phone configuration, type of GPS configuration, etc., until we sell the car and maybe switch to a different car company and start that process over again.

In addition, the innovative established firm can co-create new products and services with their base customers, dramatically lowering the cost and time to market for those new products and services. The new venture does not have these luxuries.

How can we then make sense of all of this for the business world today? I think the phrase growth constellation is a good one for this purpose.

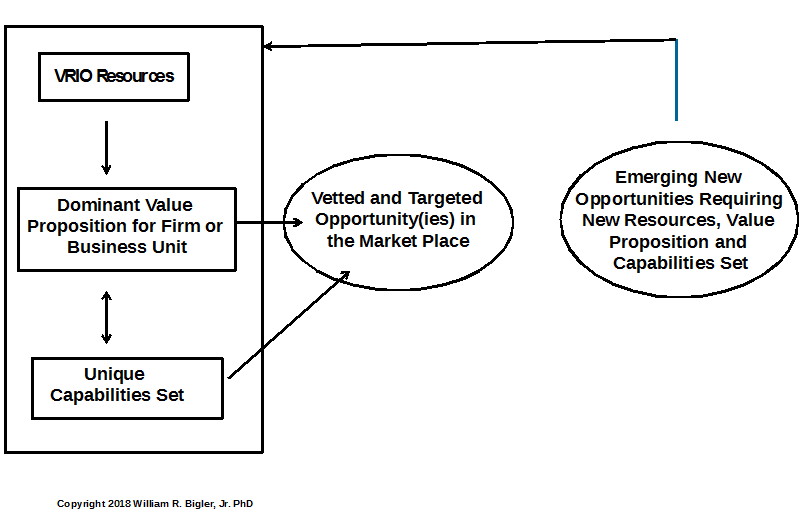

My definition of a growth constellation is: a bundle of valuable resources and unique capability-sets aimed at a particular opportunity or related set of opportunities in the marketplace. Configured well, this allows the incumbent firm to enjoy some form of competitive advantage for a while over rivals. The word constellation was used in a strategy article in 1999 “Constellation of Competitive Advantage: Components and Dynamics” by Hao Ma. I liked the article then and I like the phrase growth constellation now.

So growth constellations are in part valuable resources and unique capabilities sets. But the criticisms of the original RBV were that it was too internal. It ignored the external environment and in particular ignored emerging opportunities in the marketplace. In 1991, I think new opportunities were more slowly forthcoming and/or were viewed in terms of what the current valuable resources and unique capabilities sets would be aligned with. New opportunities that could not align with the current constellation were largely ignored. The phrase I heard frequently was “we just cannot participate in this opportunity now and will forego it”. But in today’s world with globalization, the world wide web (WWW) allowing firms like GE to wrap information around physical products for more value to customers (CAT scanners for doctors and patients for instance), and the WWW allowing reach and depth of information transmission at lightning-speed at very low cost, new opportunities are popping up at breakneck pace. What if your firm’s valuable resources and unique capabilities sets cannot deliver for those new opportunities? Ignore them or figure out a way to participate? I think the time has come to figure out a way to participate in more new opportunities. Not every one, but more than has been conceived previously.

Figure 1 is a depiction of how I think this discussion can fit together to aid firms with their competitive strategy making. I do borrow the idea of a firm’s value proposition from a recent good book titled Strategy That Works by Leinwand, Mainardi and Kleiner, 2016.

Figure 1: A Growth Constellation For A For-profit Firm.

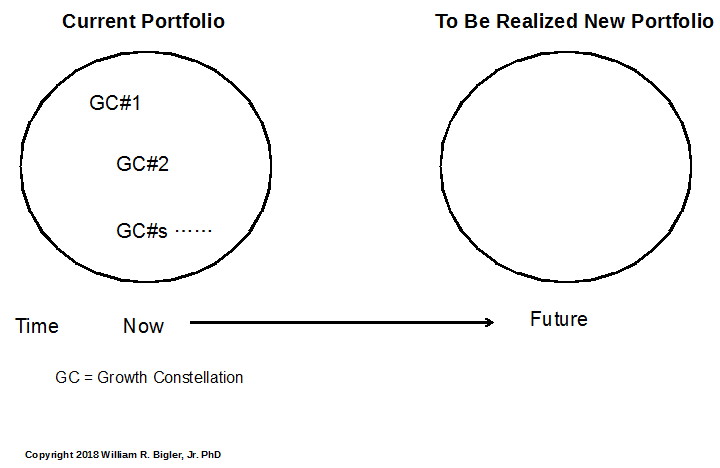

We can now use this cumulative discussion to suggest a new definition for your firm’s competitive strategy: it is the kind of portfolio of growth constellations in your business now, with a pull of what changes are likely to occur that will require new growth constellations. I cannot give a specific number yet but any mid-sized for-profit firm or business unit of a corporation has a multitude of growth constellations. I am working on ways to categorize portfolios of growth constellations. We could categorize by industry, geography, technology, customer, etc. I think the best way will be around the kind of value proposition for like sets of customers, but as of this writing I am not sure.

Figure 2 depicts this hypothesis.

Figure 2: A Portfolio of Growth Constellations.

How many growth constellations does your firm currently have? How would you describe this portfolio? What emerging new trends and opportunities should your firm participate in and that might require adding new growth constellations?

This article is part of a series on what causes a firm’s value to increase.

Dr. William Bigler is the founder and CEO of Bill Bigler Associates. He is a former Associate Professor of Strategy and the former MBA Program Director at Louisiana State University at Shreveport. He was the President of the Board of the Association for Strategic Planning in 2012 and served on the Board of Advisors for Nitro Security Inc. from 2003-2005. He has worked in the strategy departments of PricewaterhouseCoopers, the Hay Group, Ernst & Young and the Thomas Group. He can be reached at bill@billbigler.com or www.billbigler.com.