I think you should read and ponder this article. Really. I know it is a little longer than usual but I think it will be valuable for you and I arrogantly say your career. This is whether you are a junior manager or an executive. Now let me back this bold claim up.

A few weeks ago I was at a dinner party and mentioned to a CEO of a large privately held for-profit firm that I could diagnose the strategic health of his firm by using two brief surveys and get Findings and Implications to him within three weeks. He did not believe me. I arranged for him to discuss this with a former client for whom I had done this. I can’t discuss this further due to confidentiality agreements, so here I want to hopefully interest you in reading this article and ideally ask you to spend a little time with a free survey discussed but in extremely excerpted form. Don’t worry you will still get “the meat”, but here we all can collect some newer data and learn from it together.

I think it is possible to diagnose the strategic health of nearly any for-profit firm quickly and efficiently. You do not need months or a year (I actually observed this) and the spending of a lot of money. The purpose of this article is to discuss why quick and efficient diagnosis is even possible and to demonstrate this by taking excerpts from some of our popular diagnostics as an example. I feel confident you will gain strategic insights into your firm if you read and ponder this article and especially if you use the free and anonymous survey mentioned next.

Over the last twenty years, my firm and I have developed a series of popular diagnostic survey tools to assess the strategic health of nearly any for-profit firm. The essence of these is what I want to share here. Whether the firm is a business unit of a larger corporation, a firm in a private equity portfolio of firms, or a private mid-sized for-profit firm, each has benefited. The benefits gained have been strategic health insights around customers; strategic initiatives; executive, operating and support processes speed and the amount of re-work within these processes; and the barriers that might be in the way.

The diagnostic surveys are constructed to give the maximum amount of information for as little time spent by participating executives and managers as possible. In fact, one CEO of a Fortune 500 corporation was surprised at how much information such a diagnostic can produce with so little time used by each participating executive – about an hour and a half for each of the fifty-four top executives using two diagnostic tools. The report generated from these top fifty-four officers was used as one of the roadmaps for the next fourteen months. If you would like, please look at the Welcome and Testimonials sub-section in the About Us section of our website, www.billbigler.com, for support of these claims.

But my intent is not marketing for our services here. I am sure other good approaches to diagnoses are out there. The purpose of this article is to:

- Discuss why quick and efficient strategic health diagnosis is even possible.

- Extract from our popular diagnostic tools to demonstrate this assertion.

- Thus, provide for you some key strategic health insights into your firm, anonymously and at no cost to you.

- Why quick and efficient strategic health diagnosis is even possible

All for-profit firms have these attributes:

- They are in dynamic alignment (for good or bad) with their external environments.

- They take Inputs from that external environment and transform them into outputs that hopefully will be demanded and for which customers will pay a price required to eventually produce free cash flow return on investment that is greater than the weighted average cost of capital. Thus, there is an impetus to transform these inputs into outputs as efficiently and effectively as possible.

This dynamic system is the reason why quick and efficient strategic health diagnosis is even possible. What is at the root cause of this system? It is the fact that customers have accountabilities to get things done for their appropriate benefactors. I know this is a rather crude way to put it but I think it is the rock bottom causal truth. Thus customers are always in a buying impetus, even though they may tell you they are not.

Notice customers have needs, jobs-to-be-done, wants, and all kinds of things. But bottom line, they are accountable to their bosses, their families, etc. and to themselves to get things done. Sure I might be a “couch potato” for part of my day. But sooner or later I must get things done (like consuming food and water) or I will cease to exist. This is true even for luxury or nice-to-have products or services. The customers, in this case, have accountability to themselves for a form of happiness they have become accustomed to. This will play out below in the diagnostic question around your firm’s Market Rhythm. Note I need to be brief here. But if you are interested there is a detailed Working Paper on this at www.billbigler.com under Publications titled Vital Diagnosis.

2. Extracting from our popular diagnostic tools to demonstrate this assertion.

Given our brief discussion above all, we need to quickly and efficiently diagnose the strategic health of a for-profit firm is the following knowledge about it:

- Strategic Initiatives

- How often its best customers buy from it (this is the firm’s Market Rhythm)

- Average executive, operating and support processes cycle times

- A mix of four kinds of barriers that may be in the way

I have written on all of these topics in differing contexts in this series of articles, However here we want to discuss the measurements of each for strategic health implications, which I have not discussed before.

- Strategic Initiatives Key Measurement

How long does it take to complete a typical strategic initiative at your firm as per the original business case for that initiative? Note if an initiative is late it is late. This is even if the customer has given permission for a “slip date”. Average responses from our clients over the years and a host of industries have been fourteen months but one firm was seven years to complete the typical strategic initiative!

- How Often Do Your Best Customers Buy Key Measurement

This can be estimated by delving into the dates of buying by a sample of customers using their identification numbers in your data system. When we first started testing this concept in 1998 at Neiman Marcus, their response was about once a month. A firm’s Market Rhythm is about four to five times faster than how often your best customers buy. For Neiman Marcus, this would mean a Market Rhythm of about every four or five days. The average Market Rhythm over the years for our clients has been one month for a buying cycle of twenty weeks.

- Average Executive, Operating and Support Processes Cycle Times Key Measurements

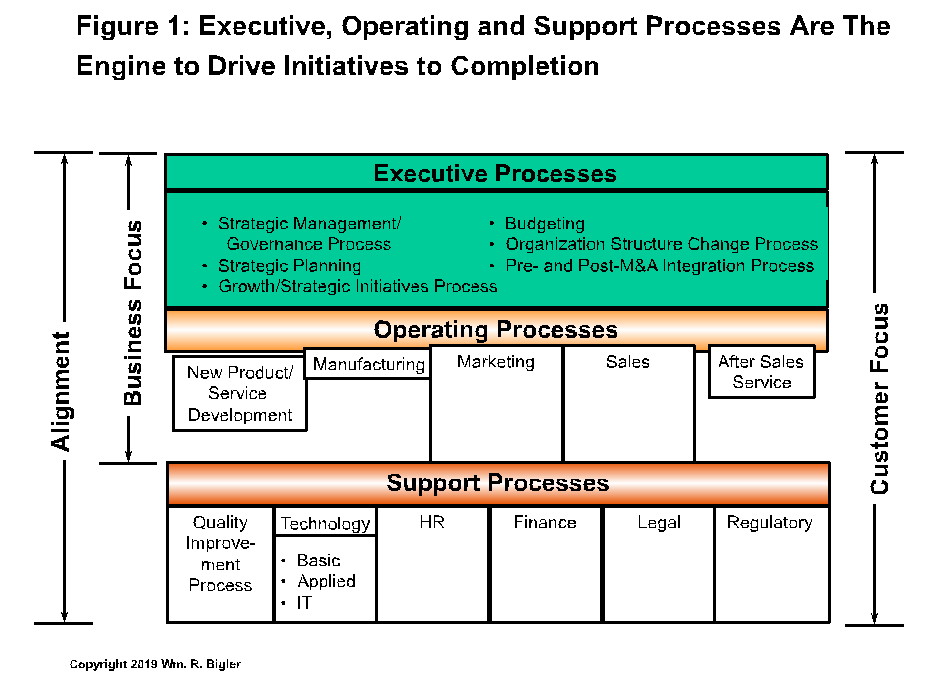

Figure 1 shows a high-level depiction of example Executive, Operating and Support Processes:

Each process can be measured in terms of its cycle time to complete and the amount of re-work in each process. Long cycle times and a lot of re-work are not good in today’s world, other things held constant. As an aside, re-work is measured as “first pass yield” or FPY: which is the percentage of time something goes through its process with no re-work. A 100% FPY means a process has no re-work. A FPY of 60% means a process has re-work 40% of the time stuff goes through that process. Here are the average cycle times and FPY percentages over the years from our clients, again across a host of industries:

Executive Processes – average cycle time thirteen and one-half months (but a high of three years); FPY 70% or re-work 30% of the time.

Operating Processes – average cycle time nine months and FPY of 60% or re-work 40% of the time.

Support Processes – average cycle time fifteen months and FPY of 50% or re-work 50% of the time.

- A mix of four kinds of barriers that may be in the way

See ‘Four Kinds of Barriers in the Established Firm’ for more background if interested. Here are the averages for the prevalence of each of the four kinds of barriers. Recall the order below is the order of how easy the barrier is to identify and remove. Subject matter barriers can be thorny problems but typically can be the most easily identified and removed. Culture barriers are the most difficult to identify and remove and can cripple a firm. The average measure here is the percentage of people across our client firms who said their firm was seriously hampered by each kind of barrier at the time of the survey:

Subject Matter Barriers – 30%

Process Barriers – 70%

Structure Barriers – 30%

Culture Barriers – 60%

Note Structure Barriers scored tied for the lowest average but when a Structure Barrier was evident it was very negatively impactful.

Putting It All Together: Diagnosing the Strategic Health of Your Firm Using the Four Measures

Ok now let’s use these measures with a disguised real scenario:

Let’s say your firm’s four measures are (these are actual disguised client’s measures):

- Length of time to complete one strategic initiative – five years

- Market Rhythm – five weeks (buying cycle twenty five weeks)

- Average process cycle times:

- Executive – fifteen months

- Operating – fourteen months

- Support – seven months

- Mix of barriers (recall the measure is the percentage of people saying the kind of barrier seriously was hampering the firm at the time of the survey):

- Subject matter – 90%

- Process – 100%

- Structure – 5%

- Culture – 100%

Conclusion: this firm is on life support strategically.

Some good news is with the average Operating Process cycle time of fourteen months, it was making some products and selling them. But the end was in sight if this situation is not fixed due to Strategic Illness. With a Market Rhythm of five weeks (recall the buying cycle was four to five times longer or twenty-five weeks) the firm’s Processes should have been lightning fast with little re-work. It should have innovated and executed strategic initiatives in a no longer time span than five times its Market Rhythm or twenty-five weeks (six months) or about the Buying Cycle. It should only have Subject Matter barriers to worry about and the number reporting a serious issue with the Subject Matter barriers should be less than ten percent. The percentage of people saying there were serious issues with Process, Structure and Culture barriers should be 10% or lower. With Red Ink all over the place, this is a serious strategic situation.

What would you do to fix this situation just looking at the data and our rule of thumb best practices? By the way, this firm did not use our services after this strategic health audit was delivered. Not that we could have saved it, but it filed for bankruptcy five years later. How does your firm score on these four questions and what are the Implications?

This article is part of a series on what causes a firm’s value to increase.

Dr. William Bigler is the founder and CEO of Bill Bigler Associates. He is a former Associate Professor of Strategy and the former MBA Program Director at Louisiana State University at Shreveport. He was the President of the Board of the Association for Strategic Planning in 2012 and served on the Board of Advisors for Nitro Security Inc. from 2003-2005. He is the author of the 2004 book “The New Science of Strategy Execution: How Established Firms Become Fast, Sleek Wealth Creators”. He has worked in the strategy departments of PricewaterhouseCoopers, the Hay Group, Ernst & Young and the Thomas Group. He can be reached at bill@billbigler.com or www.billbigler.com.