I think the management of strategic initiatives at established for-profit firms is still the classic “Gordian Knot”. This phrase comes from Greek mythology and today means an intractable problem. With so much published on this over the last fifteen or so years, why is this the case? Let’s explore this, as poor strategic initiative management can slow the growth of the market value of the firm by at least 25% per year or cause even worse headaches.

What do we know or think we know about managing strategic initiatives? As I have defined them in other articles here, a strategic initiative in my view is any project large enough to directly affect the market value of the firm. New products, acquisitions, the launching of a new venture inside of a larger established firm, etc. are examples of strategic initiatives from my view. Here is the tip of the iceberg of what we “know” about strategic initiative management. These ten items are backed by some academic research and are the most important for me in my practice with firms and for my further research. What would you add?

- Established firms can tend to get into initiative overload, caused in part by our over-achiever orientation in the U.S.

- Many firms have trouble terminating strategic initiatives that have been approved and launched.

- We have good criteria to distinguish between day-to-day initiatives that keep the lights on and new large initiatives that go from being strategic (as defined above) to bet-the-company kinds of initiatives. So we have phrases like “run the business” versus “grow the business” initiatives and “working in” the business initiatives versus “working on” the business initiatives. Working “in” is day-to-day stuff (and is vitally important of course) and working “on” is the strategic stuff. We also have tactical versus breakthrough initiatives. To go on would be redundant.

- Good project management is posited to able to execute all of these kinds of initiatives. But see my point #9 below.

- A proposed new strategic initiative should go through some kind of Business Case Format to assess why we would want to do a given initiative in the first place and it should be expected to earn at least the firm’s weighted average cost of capital (WACC).

- We should put our best leaders on new strategic initiatives and not put inexperienced managers on them so as to give them “good training”.

- We think we can align certain kinds of initiatives with certain methods of competition. Low-Cost Provider (LCP) initiatives are different than Differentiator kinds of initiatives, using Dr. Porter’s framework. There is some overlap as some firms like Apple did enjoy a dual competitive advantage for a time, while some initiatives are sound for the LCP but not for the Differentiator and vice versa. But it is a good categorization scheme to highlight different initiatives for each of the two primary methods of competition. For example, automation and anything that can reduce labor costs are important initiatives for the LCP. A keen knowledge of customers’ “jobs to be done”, pain points, and mission critical customer requirements offer a slate of appropriate strategic initiatives for the Differentiator. But for firms like Walmart, Amazon and Apple, maybe there is more overlap than pure bifurcation, so this point might be blurred a bit.

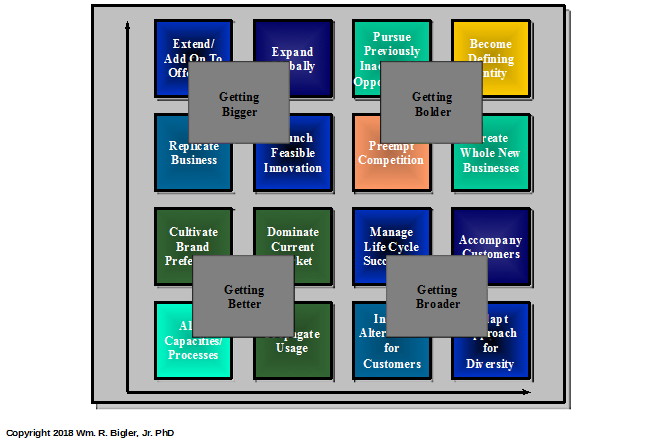

- Advanced approaches to managing strategic initiatives pull potential initiatives from a prudent Innovation and Growth Roadmap that has been made with some foresight about what the firm can become. This is a forward-looking view of the path the firm could take to grow its market value. Many approaches exist. Figure 1 portrays my “4Bs” framework first developed in 1996 with a team while at EDS. I have improved it since then and it is one of my most popular tools with firms. Note what is depicted is generic. This and any tool in my view needs to be customized for each firm:

Figure 1: 4B’s Framework

An audit approach can place where the firm is at “baseline” and then it can plan a time-phased path to select strategic initiatives at the right time from the Roadmap. I am sure many audit approaches exist. My audit approach, called AAME for GOLD, usually depicts firms more inexperienced at strategic initiative management somewhere in the lower left-hand corner at baseline. The Innovation and Growth path would move to the upper right-hand quadrant over time to grow the market value of the firm. My recent research shows relatively few firms have developed a pre-conceived Innovation and Growth Roadmap. This is why I suggest that this is an advanced approach to strategic initiative management.

- We should install some kind of initiative management process as a key executive process for the firm to actually manage the approved new strategic initiatives from inception to completion. In my view, good project management is necessary but not sufficient. Good project management is useful just about anywhere in your firm. But an executive process to manage the approved initiatives has added features to that found in project management alone. (Please see Chapter 4 of my 2004 book titled The New Science of Strategy Execution: How Established Firms Become Fast, Sleek Wealth Creators. I devoted this entire chapter there titled The Initiative Management Process and I can send a pdf of it to anyone interested free of charge. It was the most popular chapter of the book).

- This point comes from #9 but it is important to highlight. We all know the power of cross-functional teams. They make up a process and do many things better than silo-ed functions. And they are especially important in strategic initiative management. But even more important are cross-process interactions and linkages. Think of the interactions among say the customer insight process, the new product development process and the supply chain process to highlight a few of the many possible interactions among all of the key executive, operating and support processes in a firm. I could write a whole book on this so this brief comment will have to suffice here.

With so much knowledge out there on strategic initiative management, why is this still a Gordian Knot problem for so many firms? Drumroll, please….

I think many firms simply do not want to elevate the important topic of identifying and removing four kinds of barriers in the for-profit firm. I have discussed this in this series before (The four kinds of barriers in the established firm). There I discuss four kinds of barriers in the established firm – Subject Matter, Process, Structure and Culture barriers. The well-run firm will only have Subject Matter barriers as any firm that is innovating and growing will have new stuff to learn. But here I want to emphasize identifying and removing the four kinds of barriers as an executive process. Not elevating the crucial importance of barrier identification and removal is a culture, leadership and process problem and is not found anywhere in the ten points above.

It is my view that many firms seem to think that making barrier identification and removal a visible and direct aspect of strategic initiative management will cause dissension and conflict. Many times we prefer to not notice the proverbial “elephant in the room”. In its most pristine form, a good barrier identification and removal process does not single out particular people as barriers. Executive, operating and support process deficiencies are the cause usually, not specific people, according to this view. This is very similar to Dr. Deming’s view about quality years ago.

But those who have seasoned experience in managing strategic initiatives (or just managing in general) know that in reality, particular people can indeed be barriers. One might ask why a firm’s annual or semi-annual performance review process has not identified those people who need coaching or counseling. This is a good question. My recent experience and research shows many firms still do a terrible job of evaluating people, especially where negative feedback is involved.

I think barrier identification and removal is an executive and senior management skill and process that must be given more visible priority. The visible and swift identification and removal of the four kinds of barriers, along with coaching, counseling or as a last resort outplacement of people who just will not fit, is a next vista to improve strategic initiative management. Can’t we do a mind-shift that says it is actually more humane to have open and frank discussions about barriers now than to hide them? The great book Crucial Conversations years ago tried to make this point. But this book did not focus solely on strategic initiative management. And General Electric has had direct conversations at the backbone of their operating culture and performance review system for years. Why are so many firms loathe to elevate barrier identification and removal in importance? First of all, do you agree with my point here? If you do, what do you think the cause is of the disinclination to elevate the art and science of barrier identification and removal?

In my view this one skill of elevating direct and frank discussions about the four kinds of barriers and their removal can reverse the retardation of the growth of the market value of the firm suggested at the beginning of this article. What are your solutions for this Gordian Knot problem?

This article is part of a series on what causes a firm’s value to increase.

Dr. William Bigler is the founder and CEO of Bill Bigler Associates. He is a former Associate Professor of Strategy and the former MBA Program Director at Louisiana State University at Shreveport. He was the President of the Board of the Association for Strategic Planning in 2012 and served on the Board of Advisors for Nitro Security Inc. from 2003-2005. He is the author of the 2004 book “The New Science of Strategy Execution: How Established Firms Become Fast, Sleek Wealth Creators”. He has worked in the strategy departments of PricewaterhouseCoopers, the Hay Group, Ernst & Young and the Thomas Group. He can be reached at bill@billbigler.com or www.billbigler.com.