The recent book The Age of Agile by Stephen Denning, 2018) is the presenter of the (not a) new management paradigm. Whether it will be replaced with another the new management paradigm will remain to be seen. And while there are many frustrating “red herring” arguments throughout the book, mostly against the activist hedge fund view of shareholder value, top management teams extracting value instead of creating value and the toxicity of top-down command and control bureaucracies, I think this is a very good and an important book.

This article will not be a review of the book per se. But I want to use messages and passages from the book to emphasize my points about shareholder value (SHV) maximization and SHV disciplines I have written about or mentioned in five other of my articles in this series:

- Synthesizing Customer Value, People Value and Financial Value Through Formulas, Yes Formulas Part 1

- Synthesizing Customer Value, People Value and Financial Value Through Formulas, Yes Formulas Part 2

- Shareholders, Customers or Employees: Which Is More Important Part 1

- Shareholders, Customers or Employees: Which Is More Important Part 2

- Why Firm Valuation is the Key Metric

To make my main point again, shareholder value maximization, properly conceived and executed by its key disciplines, should be the superordinate goal of the for-profit firm. I realize I am starting to get in the minority here with all of the famous business leaders smarter and infinitely better known than I who are cited in this book decrying that shareholder value is a “dumb” idea. But I press on until someone can provide not only a total argument that I am wrong but also what the measurable superordinate goal of the for-profit enterprise should be if it is not SHV maximization.

Let’s focus on the rock bottom key aspect of valuing firms in developed countries. It is this: firms are shareholder value creators (for publicly traded firms or owner wealth creators for private for-profit firms) when their Free Cash Flow Return on Investment (FCFROI) is greater than that firm’s Weighted Average Cost of Capital (WACC). Here is the formula:

FCFROI > WACC

This is it. This is the rock bottom for valuing for-profit firms. Firms who earn just their WACC will have a constant valuation over time, which means that it is not growing. Firms who earn less than their WACC, even if they are showing positive earnings on their income statement, will be shareholder value or owner wealth destroyers. Firms like Credit Suisse, Holt, First Boston, et al who perform valuations of firms for security analysts, investor advising firms and investors have used this formula for at least fifty years. And replacing this formula with another bedrock formula is required for me to relinquish my views on the usefulness of SHV maximization or owner wealth maximization. Again I will cite Bartley Madden’s great little book Maximizing Shareholder Value and the Greater Good (2005) – (note you can download this jewel of a book for free on Bart’s website LearningWhatWorks.com). There he cites his studies of over 7000 firms over a twenty-year period and shows in vivid graphs the correlation of firms who have grown shareholder value with their employment and cash flow increases, propensity for innovation and other benefits for those firms and society. He chronicles Medtronic as a run-a-way shareholder value creator. Here is a quote from Bill George, then CEO of Medtronic, from page 43 of Bart’s book:

“The best path to long-term growth in shareholder value comes from having a well-articulated mission that inspires employee commitment.

Companies that pursue that mission in a consistent and unrelenting manner will create greater shareholder value than anyone believes possible. There are simply no shortcuts to creating long-term shareholder value. Sustainable growth cannot be achieved by a series of short-term actions. Real value can only be created by the hard work of dedicated, motivated employees that develop innovative products and services, establish intimate customer relationships, and build organizations over an extended period of time.”

What could the idea and measure be that could replace the rock bottom formula for valuation?

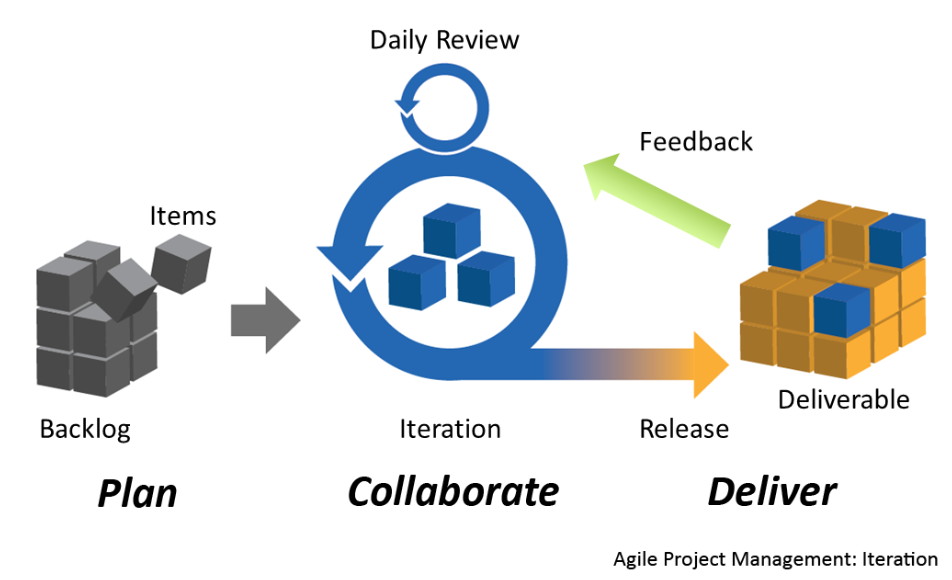

Mr. Denning cites Peter Drucker who stated that the only purpose of a business is to create a customer. How can you not agree with this? But Mr. Denning states many times throughout the book that the pursuit of shareholder value is injurious to firms seeking to have the customer be the number one goal of the firm. The greedy pursuit for short-term earnings, share buybacks and the like diverts an organization from focusing solely on the customer. Agile Management of the total enterprise is the means in his view to providing the context for and the means to viewing the customer as #1 and providing them with “instant, intimate, frictionless value at scale” (p-240). Agile comes from the software development world and Mr. Denning says that applying Agile concepts and approaches to manage the entire enterprise is the replacement for shareholder value disciplines for enabling the firm to focus on the customer.

Shareholder value pursuit and top-down command and control approaches enable too much friction and barriers according to the author to provide the instant, intimate, frictionless value at scale. Note: the author does not define customer value. He gets close to a definition by framing the attributes of a good value proposition, but does not define customer value directly (pp. 125-133). If you are interested take a look at my article in this series titled What Is Value.

Agile management of the total enterprise is comprised of:

- The Law of the Small Team

- The Law of the Customer

- The Law of the Network

Amazon, Spotify, Microsoft, Cerner, Barclays, and others are examples of established firms who have embraced or who are embracing agile management of the total enterprise, not just in software development. As far as measures of performance for the customer, many firms now use the Net Promoter Score or the American Customer Satisfaction Index. These measures of performance for customers are very good in my view. But should we make measuring the financial outcomes from serving customers, whether good or bad, of much lesser priority? This is a ridiculous question I know. Of course, we should put a keen emphasis on financial measurement but this is a question of means and ends and of balance. But I do agree with the book author that financial measures are outcomes of serving customers well and should not be viewed as being sacrosanct.

A question I had while reading the book is: can some companies who exhibit some attributes of top-down command and control be innovative and provide the instant, intimate, frictionless value at scale? I do not know about the instantaneous part but my answer is yes. Bill George’s Medtronic is innovative but uses some aspects of a top-down command and control approach to management. And Google search on Forbes magazine’s 100 Most Innovative Companies for 2018. Sure enough, we see Amazon, Workday, Netflix and other “usual suspects” who probably are closer to an agile approach to management. But we also see Unilever Indonesia, Vertex Pharmaceuticals, Marriot International and other firms who use some attributes of top-down command and control. Most of us have worked in a stifling bureaucracy in our careers and if we have now or did have an entrepreneurial bent we hated it. But the author seems to make the case that it is all or nothing. Either be Agile and prosper or use any form of top-down command and control and flounder.

Is there a way to rectify this seeming loggerhead? Maybe but I think the views have become just too polarized at this point in time. But let me try. Before we do this an aside. As of this writing in December 2018, the stock market has crashed into bear territory. I myself have lost on paper 30% of the value of my diversified investment portfolio of equity shares. Most pundits blame the wild swings and volatility to the robo-trading algorithms and not a problem with the rock-bottom way firms are valued. I tend to agree although I am not sure.

So let’s get back to rectifying these polar views. Actually, deep into the book, the author acquiesces by stating there is a notion of “true shareholder value”. This is my view and it refers to shareholder disciplines that keep the long-run health of the enterprise squarely in view. This is not the activist hedge fund or Darwinian private equity firm views of trying to “unlock financial value” in a firm quickly to sell (“flip”) the firm within five to seven years with nice gains. This does happen, more often than most would like. I have witnessed these actions first hand in my strategy consulting over the last almost forty years and those firms are indeed usually gutted of their abilities to further innovate. The new owner picks up the mess. But the author citing a great McKinsey book, Valuation: Measuring and Managing the Value of Companies, states, “most CEOs don’t have the financial smarts to master and implement” (p-183) to engage in true shareholder value disciplines. By implication, they revert to the “bad” form of shareholder value maximization. This assertion is a little condescending in my view and leaves the reader in a bit of a quandary as to whether executives cannot understand true SHV principles, knew them but forgot them or that the executives are truly short-term opportunists representing the activist hedge fund/Darwinian private equity points of view.

To end this blog length piece, let me point out an error (in my view) that this author and many others who dismiss shareholder value altogether make in their writings. They claim that these “bad management teams” only extract value and they do not create value. But a rock-bottom principle of long-term (true) shareholder wealth disciplines is this: you cannot extract value unless you create value in the first place. The only way I know of to extract value that has not been created first is to raise debt to pay for shareholder or owner distributions like dividends. I have seen this done before but obviously, this is a dangerous practice. I will write my next article on this important topic.

But even with my issues with the book, I think it is an important book to read and ponder and put to use.

This article is part of a series on what causes a firm’s value to increase.

Dr. William Bigler is the founder and CEO of Bill Bigler Associates. He is a former Associate Professor of Strategy and the former MBA Program Director at Louisiana State University at Shreveport. He was the President of the Board of the Association for Strategic Planning in 2012 and served on the Board of Advisors for Nitro Security Inc. from 2003-2005. He is the author of the 2004 book “The New Science of Strategy Execution: How Established Firms Become Fast, Sleek Wealth Creators”. He has worked in the strategy departments of PricewaterhouseCoopers, the Hay Group, Ernst & Young and the Thomas Group. He can be reached at bill@billbigler.com or www.billbigler.com.