I have just finished a brief client engagement this past week whose situation reminds us of what is at the core of your firm’s competitive strategy: the “value stories” that differentiate your firm and your firm’s key strategic initiatives. I was asked to help assess why a venture of three years was not making very many sales. In today’s world, if the value story is not superior and compelling, most of the time your firm or a key initiative is in trouble.

I used to use the phrase “value proposition”, as many do, to describe what your firm and its initiatives are really offering customers that you ask them to pay for. I learned the phrase “value story” from General Electric (GE) in teaching five of the Harvard Business School’s case studies on GE to my MBA students in their strategy course when I was in academia. I like it a lot better than value proposition as the phrase value story conveys an ongoing and unfolding process. Value proposition is too static in my view.

I wrote an article last year titled What Is Value and if you have time that article can help in presenting the message I want to convey here. That message is this: in today’s world if your firm and its strategic initiatives do not offer and deliver a superior value story relative to rivals, you will not sell many, if any, products and services. This is absolutely true in B2B (business to business spaces) but also applies to B2C (business to consumer) spaces as well. In B2B spaces if the value you are offering and delivering cannot be quantified, demonstrated and proved, you will not sell many products or services. Period. End of discussion. This applies to B2C spaces too, but we all have been amazed at what end consumers will buy – pet rocks, jeans with holes already in the knees, etc. Please add your favorite “dumb” product or service here. But these are usually relatively lower dollar items and thus are usually not that important to a person’s or family’s budget. For other B2C purchases like homes, cars, etc. the superior value story mandate applies.

Let’s take a look at this client situation mentioned above as a mini-case study for the rest of this article. I will disguise the industry and of course mention no names. But this is a clear example of the requirement of a value story that describes a value that should be quantified, demonstrated, and proved and also what went wrong.

The firm is a new venture in the pharmaceutical industry. The firm developed an online survey that could signal the presence of Alzheimer’s disease early in patients who might be prone to this disease. The target market was larger extended care facilities. The initial value story was this survey could lower the cost and time to assess the probability that Alzheimer’s could be or is present in a patient. Before this survey, these facilities did their own labor-intensive assessments, sometimes using psychiatrists to make the assessment. A lower level staff person, thus also lowering cost and increasing the simplicity of doing the assessment, could administer the online-survey. A report for the facility was automatically and immediately generated and was available as a download.

On the face of it, this appeared to be a compelling and superior value story. The value of the online-survey could be calculated as to exactly how much costs and time to complete could be lowered. As it turned out, what was of value to the extended care facility management was Revenue Optimization, not lowered costs or time to complete. Revenue Optimization would have the survey, taken every three months, signal early a patient’s worsening status so that service levels could be set early. Also, fees could be increased early to offset increased nursing and orderly care. This information was to allow the facility management to discuss with families the pending upcharges so as to not be perceived as gouging the patient and the families.

The real issue here was that the survey was designed to be an assessment and not a diagnostic. If the survey slipped into diagnostic status, the venture crossed over into practicing medicine, which is strictly forbidden. But the diagnostic level was required for the facility management to get the granularity to set revised service levels and appropriate fees.

Up to this date in May 2018, not many surveys have been sold. In doing discovery for this situation, it became apparent this survey was a product in search of a market. As we all know, this is not a good situation. The venture is now exploring other markets that will appreciate the assessment level of the survey. For this assessment level of granularity, the survey is excellent.

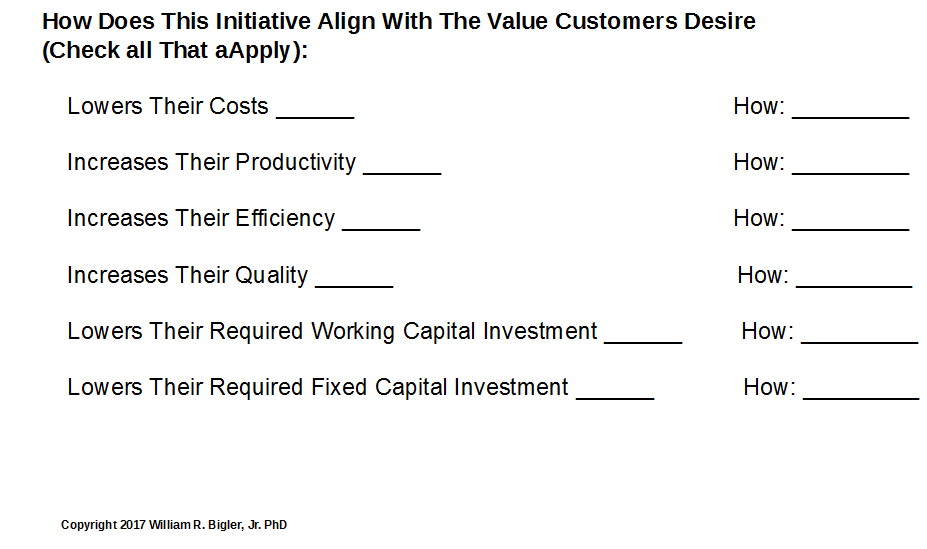

In 2005 I helped another client develop a very detailed Business Case Format. This format is based on all of the prior training in Value Selling I had taken to that point and I have refined it ever since. A business case is the reason and justification for why a firm would want to launch a new initiative in the first place. I created an initial list of thirteen things a customer might find valuable. Figure 1 takes excerpts from this list to give you an idea those possible elements of customer value.

Figure 1: Example Elements of Customer Value

An initiative that scores more “value story points” would be favored over those that score less or in a worse situation, has no elements of real value for the customer. Value, especially in the B2B situation can and needs to be calculated. What are your firm’s value stories? If there are none that can be calculated, demonstrated and proved, your firm or some of its initiatives are in trouble.

This article is part of a series on what causes a firm’s value to increase.

Dr. William Bigler is the founder and CEO of Bill Bigler Associates. He is a former Associate Professor of Strategy and the former MBA Program Director at Louisiana State University at Shreveport. He was the President of the Board of the Association for Strategic Planning in 2012 and served on the Board of Advisors for Nitro Security Inc. from 2003-2005. He has worked in the strategy departments of PricewaterhouseCoopers, the Hay Group, Ernst & Young and the Thomas Group. He can be reached at bill@billbigler.com or www.billbigler.com.