Sometimes a high level crow’s nest view of a topic is useful to remove confusion. As I have written in this series, I think the most useful superordinate goal of the for-profit firm is growing its valuation. Superordinate is defined as “a thing that represents a superior order or category within a system of classification”.

As I will detail below, in my view we are in a period of confusion of what describes for-profit firm valuation and how to increase it. The payoff from this article is removing this confusion and getting to the essence of firm valuation via a crow’s nest view that everyone can remember.

I know Peter Drucker, the famous and widely read management expert, wrote that the goal of a firm is to create a customer. Others have written on the value of people and one can add to this list. I have stated that all of these are important but are subordinate to the goal of growing a firm’s valuation in my view. Some (maybe many) folks disagree with this position today so part of the purpose of this article is to justify this position.

The three purposes of this article are:

- Provide a law-like crow’s nest view of what growing the value of the for-profit firm entails. This sets up an approach to:

- Provide an approach to sharing growing valuation through money payouts to the people of your firm.

- In summary, demonstrate why growing valuation should be the superordinate goal of the for-profit firm.

Let me start with a previously used story and analogy that will serve to simply show why a crow’s nest view of valuation is useful for our purpose. A foreperson and her/his crew have just been dropped off at the edge of an island jungle that is densely populated with trees, brush, vines, you name it and once in this canopy it is very dark. The crew has been given an objective of cutting fifty feet of this dense and dark jungle per day to cut a path from one side of the island to the other, in as straight a line as the terrain would allow. At the end of the second day, the foreperson proudly announces they have cut one hundred feet.

But did they accomplish their objective? Someone scaled a top of the highest tree on the island and noticed a weird path that was cut for the first one hundred feet. It went straight for eight feet then looped back around, straight for two more feet, then looped back toward the beginning, etc.

Whoops. What is the message of this simple story and analogy? Without someone “seeing the forest for the trees” or having a crow’s nest view, work can be very unproductive, even though there has been effort expended. “Don’t confuse effort with results” is a phrase one hears a lot in operations excellence circles.

This in my view has happened recently with the hundreds of recent writings about various frameworks that are “very far down in the weeds” that can cause one to become “lost in a jungle” or at least confused. Frameworks for agile management, innovation, strategy execution, risk management and even the firm’s competitive strategy itself have been presented. So have myriad articles on all of the functional area strategies – marketing, supply chain, manufacturing, information technology, human resources, after-sales-service, etc. While these articles are good in isolation, some purport to provide the crow’s nest view that I think a proper model of valuation does purport. Let’s try to improve on this problem with the three sections of this article.

1. Crow’s Nest of Model of the Valuation of the For-profit Firm

Valuation of a for-profit firm can be defined for the layperson as:

A believable future of a firm as reflected in an estimate of the amount of cash the firm is worth today if someone wanted to buy that firm.

There is a lot in this definition. Describing a future of a firm is usually codified in its strategic plan and other supporting documents or presentations. For that future to be believable, facts and reality must win the day – not hopes and certainly not misleading statements. The worth today involves the time value of money, which says cash today is worth more than promised cash in the future.

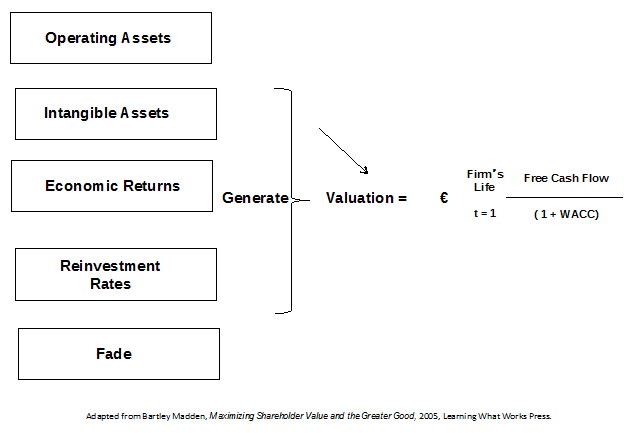

Figure 1 extends slightly, in my view, the brilliant work of Bartley Madden who has written some great, albeit advanced books on for-profit firm valuation. If you are not familiar with his work, just Google on his name and you can find his books. This model will serve as our crow’s nest view of how firms are valued:

Figure 1: Life-Cycle Valuation Model

While there is some knowledge required of finance to fully understand this model, a beginning understanding is pretty straightforward. First of all, the five things on the left of Figure 1 are the major pieces of what is required to grow the valuation of a for-profit firm. Five items are it – not forty, not fifty. Operating assets, economic returns, and reinvestment rates back into the business are pretty straightforward. Intangible assets are things like a proprietary process for R&D and new product development, a very unique and strong corporate culture (think Southwest Airlines, IKEA, and others), a strong brand and a suite of proprietary routines, procedures, and processes that have been built up over years. The common feature of all of these is that they are very difficult for a competitor to copy in the short to mid-term. Fade is a very fascinating topic that Bartley discovered when he was at Credit Suisse. He studied 7000 firms over twenty years and found that most of them experienced “downward fade” in free cash flow over time. This was caused by, my terms, the “crush of competition” that happens in firms who do not have an innovative approach that offsets this fade.

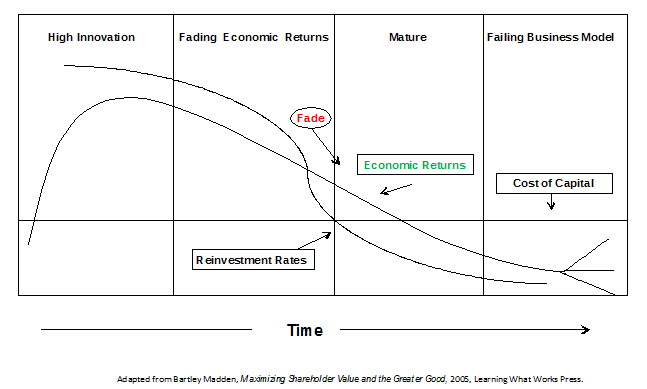

Figure 2 depicts these realities:

Figure 2: Business Competitive Life Cycle: Count on “Fade”

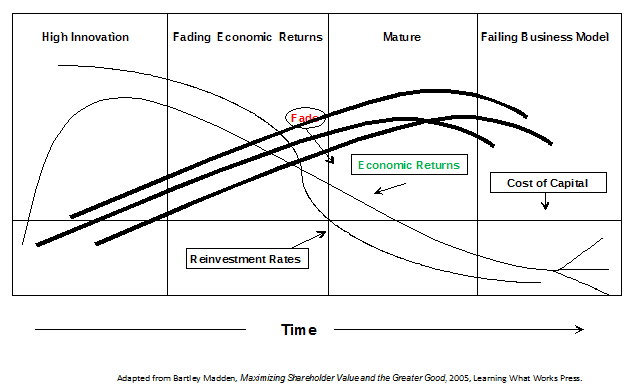

Figure 3 depicts that innovation is the only way to offset fade:

Figure 3: Counteract “Fade” With New Value Creating Innovative Initiatives and Businesses

To sum up this section, for-profit firms increase their valuation when they earn more in Free Cash Flow Return on Investment than their Weighted Average Cost of Capital (WACC). So what you might be thinking? Valuation is the proper superordinate goal in my view because, among other things, it provides the basis for having your people share in the gains they help to achieve in the most inclusive way. No other approach to sharing gains does this in my view.

2. An Approach to Share Created Valuation With Your Firm’s People

Part of the recent criticisms of shareholder value is that it is mercenary and is only for top-management and shareholders. Nothing can be further from the truth when valuation is viewed properly in my view. I learned this when I was fortunate to be hired into the strategy subsidiary of the Hay Group in the late 1980s and early 1990s. The Hay Group was and still is one of the leading compensation and human resources consulting firms. We worked with the compensation side of Hay creating incentive compensation plans that would help align key decision makers throughout the firm with the firm’s competitive strategy.

Our approach was done under the concept of “shared destiny”. Those who helped with gains could share in those gains. The easiest way to see this is through a brief example. Let’s say the firms Weighted Average Cost of Capital (WACC) is 9%. This is the Required Return measured in Free Cash Flow Return on Investment; to compensate owners for the risk they bear investing their capital. Anything the people of the firm earn in Free Cash Flow over this threshold is put in a pool to be distributed. So let’s say we have these data about your firm:

$1,000,000 in capital

9% of this capital would = $90,000.

This money is invested back in the business and/or paid out to the owners and shareholders of the business in the form of dividends. The money invested back in the business is used for anything to generate new rounds of profitable revenue. This can include increasing base pay of the firm’s people.

Any money earned over the $90,000 is put in a pool to be distributed to your people. So say $110,000 is earned. The pool would be $110,000 – $90,000 = $20,000.

The key to this approach is first to determine who will be in the pool for eventual distributions. Approaches have included:

- To those who are part of an extended team who have direct accountability for strategy and results. This is the top management team (TMT) plus contributing executives and managers who are not part of the TMT. Note the cadre of contributing executives and managers can change year over year so many can end up participating.

- To everyone in the firm. This is usually reserved for firms who are not that large in the total number of employees.

Once the people included in the pool are determined, the percentage of the pool that goes to each is critical. Some firms have prior goals set for each participating person. A percentage payout would be set for the degree of goal achievement. But believe it or not the fairest way many times is to allocate the pool based on seniority. Yes, seniority. In this approach though, some of the pool is set aside to award additional “spot bonuses” to people who have been key contributors but who have not been at the firm for long.

This article set out to show why firm valuation is the proper superordinate goal of the firm and how increases in valuation can be distributed to your firm’s people. I ask the question: can agile strategies, any of the functional strategies (marketing, supply chain, manufacturing, etc.) and even the firm’s competitive strategy provide the crow’s nest view to effectively subsume all that is required to grow the valuation of the firm? I think not. And is any other method of distributing monetary gains more inclusive? Again, I think not.

Now if you agree with me that increasing valuation is the proper superordinate goal of the for-profit firm, how will you approach your work differently in your firm or with your clients?

This article is part of a series on what causes a firm’s value to increase.

Dr. William Bigler is the founder and CEO of Bill Bigler Associates. He is a former Associate Professor of Strategy and the former MBA Program Director at Louisiana State University at Shreveport. He was the President of the Board of the Association for Strategic Planning in 2012 and served on the Board of Advisors for Nitro Security Inc. from 2003-2005. He is the author of the 2004 book “The New Science of Strategy Execution: How Established Firms Become Fast, Sleek Wealth Creators”. He has worked in the strategy departments of PricewaterhouseCoopers, the Hay Group, Ernst & Young and the Thomas Group. He can be reached at bill@billbigler.com or www.billbigler.com.