This short article is excerpted from a much longer article applying my 22 Element Causal Model of firm valuation and Full Potential to the Rolex watch company. This excerpted article follows from a first excerpted article on What Is Causation in Business that was published two weeks ago (today is October 29, 2020). For background on the full causal model please see Valuation and Stock Prices in These Crazy Times: Notes on Growing Wealth in the For-profit Firm.

Note that the assessment below and my analysis in the full article are based only on publicly available information and data. But this should not be an issue as the purpose here, as with the longer article, is to apply my model to a very well known company to serve as an example of how you can do the same for your firm.

- Assessing Rolex’s Potential to Grow Its Valuation From 2020 Onwards

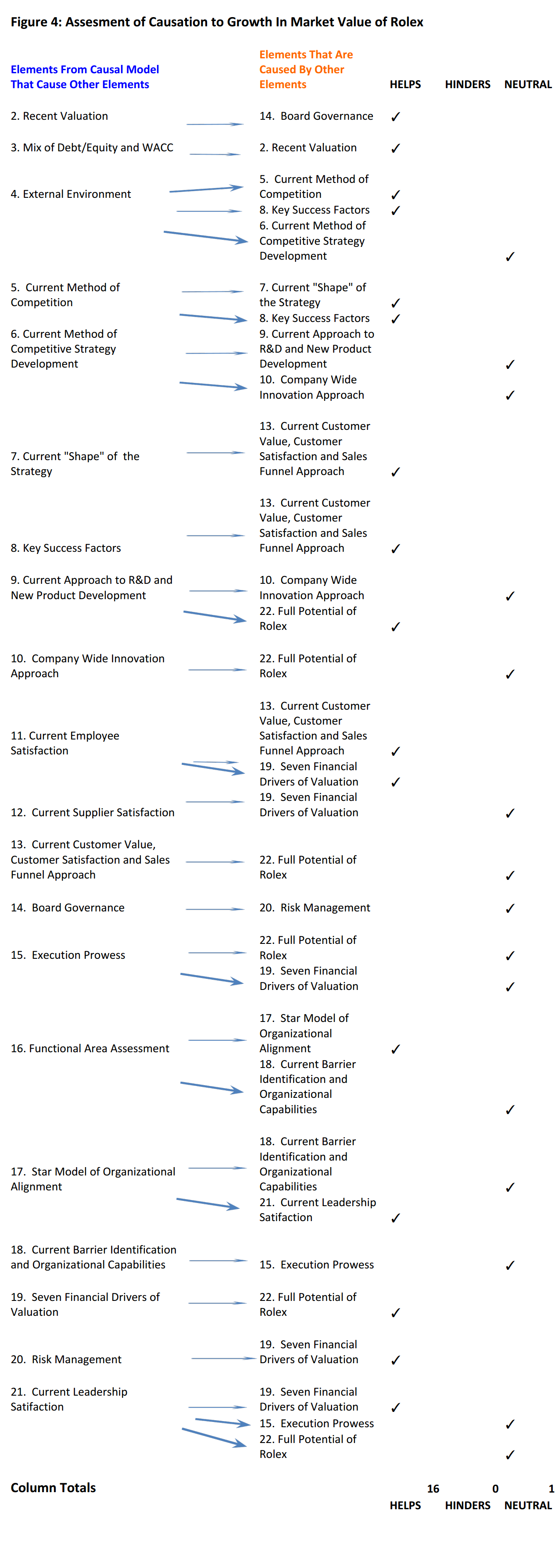

In this section, I will provide a summary of my above observations as to the strength of the causation among pairs of the 22 Elements to affect increases of the valuation of Rolex as it moves to its Full Potential. Note this is a “useful fiction”. By this I mean the model shows that three to five Elements in fact make up a causal relationship but we will assess two Elements at a time. Why?

Because in all practicality this is what most of us, I included, can handle. Studies have shown that even Mensa level IQ people can only handle four or five things at once in their minds and be productive with them. And when a firm decides on the most beneficial new initiatives to invest in to grow market valuation in the movement to Full Potential, it should really focus its efforts. When those few initiatives (no more than four or five at one time) are completed or terminated early thus releasing resources, the next set of four to five new initiatives can be approved and funded.

Figure 4 is from an Excel spreadsheet showing “Causer” Elements and “Causee” Elements and my assessment as to whether the current causal relationship at Rolex Helps, Hinders, or is Neutral to the growth in its valuation as it moves to its Full Potential. At the bottom of each Column, there is simply a count of the status of the causal relationships – that is the number of Helps, Hinders, or Neutrals. As we will see, Rolex in my estimation has all Helps and Neutrals and no Hinders.

A vital question is how do I know two Elements are causally related? Every one of the causal relationships shown in the model and in Figure 4 below has been measured and put through an experiment of sorts in at least one client measured with time-series data. As I mentioned, I started this work more than twenty years ago so for some of the client analysis I have very good proof from assessing that client over years in some cases. For Elements with nominal (numbers like 103, 2007, 50.5, et.) data like #4. Your External Environment or #19. Seven Financial Drivers of Valuation, those nominal data were used as-is. For the softer kinds of Elements like #11. Current Employee Satisfaction and many others, a Five-point Behaviorally Anchored Rating Scale was used. The two Elements were then measured over time at a particular period of time for each client. A simple Regression equation was used and assessed and in all cases, a statistically significant R2 was shown.

The experiment aspect comes in this way: for each causal relation, we estimated the time lag between a change in the “causer” Element and the hypothesized change in the “causee” Element. In almost every case the predicted time lag was confirmed within an acceptable variance of several weeks – either earlier or later than predicted. We did have a few occasions where our predictions were off by a large degree. This caused us to revisit our thinking and make a new prediction.

Thus I hypothesize these causal relations could/will hold true for our case study here at Rolex. But again this is a “useful fiction”, as the relationships would need to be tested at Rolex to confirm.

As I state above assessing the Elements of this system of causation one by one (that is only two Elements at a time) is simplistic. The system of these 22 Elements is actually very complex. And from systems theory, we know that focusing on only parts of a system can lead to sub-optimization of the whole system. As I mentioned above, in practice it helps to isolate Elements. Indeed if Rolex or any firm were to launch improvement initiatives, they would want to focus on only four or five Elements at a time anyway.

If my assumptions and assessments based on public information throughout this article are true and valid, Rolex should enjoy another three to five years of growing its Valuation as it moves to its Full Potential.

Conclusion:

If this excerpt interests you, please consider reading the full article to be published shortly. I think you will find the insights from this causal model and its application to Rolex useful for your firm. If your firm would like to use a very robust Diagnostic Survey in Survey Monkey of the 22 Elements please contact me at one of the addresses below.

This article is part of a series on what causes a firm’s value to increase.

Dr. William Bigler is the founder and CEO of Bill Bigler Associates. He is a former Associate Professor of Strategy and the former MBA Program Director at Louisiana State University at Shreveport. He was the President of the Board of the Association for Strategic Planning in 2012 and served on the Board of Advisors for Nitro Security Inc. from 2003-2005. He is the author of the 2004 book “The New Science of Strategy Execution: How Established Firms Become Fast, Sleek Wealth Creators”. He has worked in the strategy departments of PricewaterhouseCoopers, the Hay Group, Ernst & Young and the Thomas Group among several others. He can be reached at bill@billbigler.com or www.billbigler.com.