This article was in development before the week of August 19, 2019, when the Business Roundtable (BRT) announced their new statement of purpose of the corporation. Thus I think this article and others like it are even more important. The new statement by the BRT, in brief, is that shareholders are no longer the sole recipients of financial value created by publicly traded firms. Other stakeholders will be participating in that value as well.

Looking at the way shareholder value should have been practiced and I believe for the most part is being practiced, there is nothing new in the BRT statement. Henry Wolfe has expertly written on this topic on Linked In. Also, Paul Barnett and Andrew Swan, and others have nicely written about their current approaches to value-based management (VBM). VBM has been around since the 1980s hence I will not summarize their or those views here. Needless to say, this is a very important topic and will continue to be for years to come.

Why add my views to this mix? First I think the BRT statement will open a Pandora’s box of different interpretations of that statement. Indeed multiple and incompatible viewpoints are already emerging. Secondly, I think a more practical treatment of this topic is needed. Thus, this article is an overview of the framework I have used to guide some of my consulting work for years. Readers can use it if they see fit. And hopefully it will serve as one practical alternative to the multitude of different viewpoints, some way too theoretical in my view, that are emerging after the BRT statement.

This article will depict an Overview of the framework and then explode it in a series of Panels that will describe the key Elements within each Panel. Still, this entire discussion is a “crow’s nest view” kind of article. To the senior strategy professional there will be little that is totally new in terms of content. However, I have developed some nuances over the years that I think are unique and valuable and this is what I will discuss in each Panel. The real learning for strategy professionals is the dynamic interplay of the Panels and Elements over time as every firm tries to create a desired future.

Overview

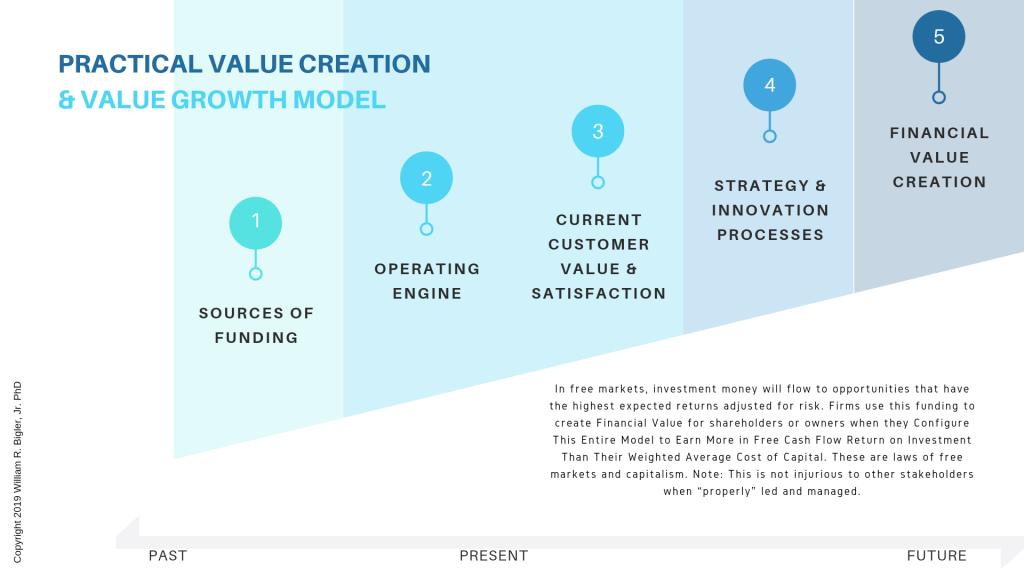

Figure 1a provides an overview of the framework:

The five Panels exist in time – Past, Present and Future time. Successful firms have learned from the Past to configure the five Panels in the Present so some measure of performance and success are being enjoyed. The Present configuration sets the firm on an innovation and growth path so that it can “intercept” its future on favorable terms. The unsuccessful firm will need to perhaps unlearn certain elements from its Past to fix problems in the Present. It may become stuck there until the problems are solved to then be able to move to a desired, more favorable future. At the end of this article, I will outline a program to fix the Present with the focus on creating increases in valuation as the firm moves to its desired future.

The verbiage under the figure above in Figure 1a is crucial in my view: “In free markets, investment money will flow to opportunities that have the highest expected returns adjusted for risk”. This is why creating and growing valuation for the profit firm is so important.

The Elements are pretty self- explanatory but I want to make some key points about each from my experience:

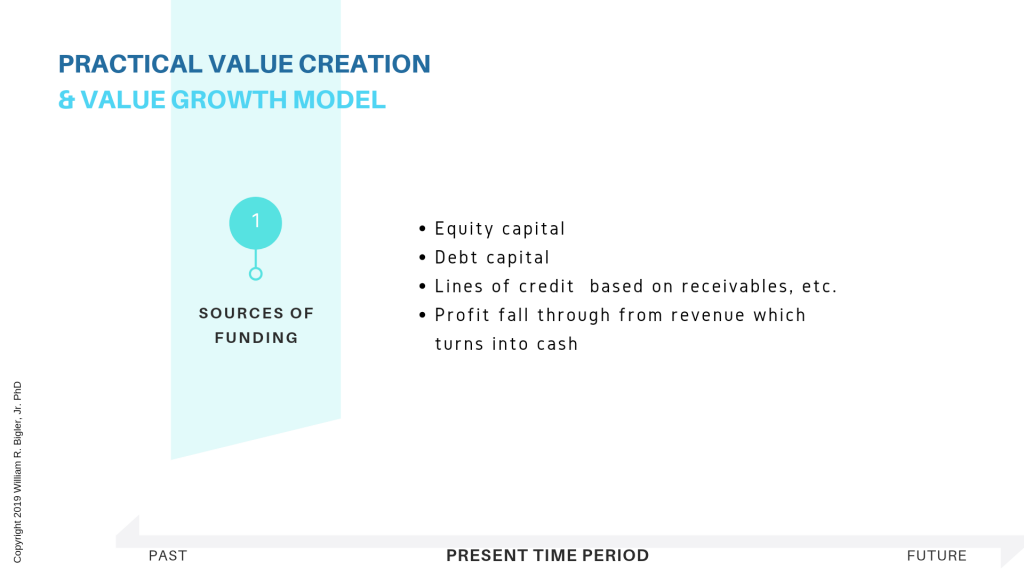

Adequate funding is the fuel for any kind of organization – for-profits, not-for-profits, government, education, etc. But firms, especially for-profit firms, receive adequate funding from a Past that has configured Panel #s 2-5 well. Obviously this is a chicken or egg problem and why new ventures are not discussed here. Successful established firms will have a favorable Past that invites new funding. New ventures do not have a favorable Past yet. Without adequate funding any firm is headed for extinction.

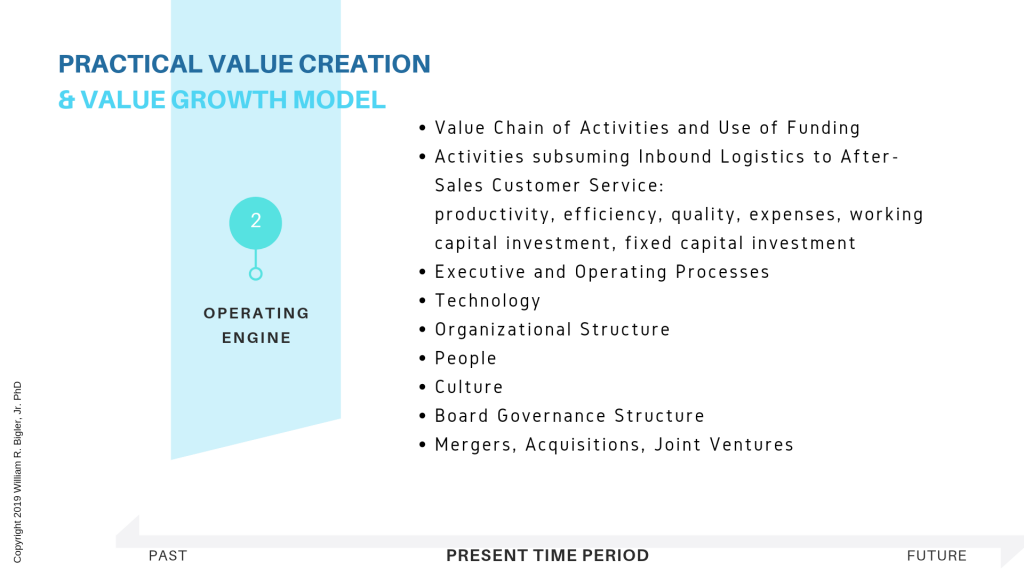

Panel 1 – Funding is the fuel for Panel 2 – Operating Engine, and Panel 4 – Strategy and innovation Processes and Panel 5 – Financial Value Creation. The Operating Engine is the workhorse of the firm. Its speed, productivity, efficiency and quality are paramount in today’s world. Board governance is not usually listed as part of the Operating Engine., but as Henry Wolfe and others have written, new board governance models should move from purely fiduciary oversight to a much more proactive operating role. I agree. Also notice I include Mergers, Acquisitions and Joint Ventures (and other forms of alliances) in the Operating Engine. The track record of these kinds of actions has not been favorable to contributing to increasing valuation. Since any of these external growth actions need to be integrated into the Operating Engine and Strategy and Innovation Processes, I like to include them here and not have these be a separate Panel. I know this may seem like I am being too nit-picky and obsessive. But sets of ideas that contain properly related elements must be intertwined to provide optimal meaning and effectiveness. For example, adding culture elements to a group that is purely tactical finance in orientation would produce some confusion.

Panel #3: Current Customer Value and Satisfaction

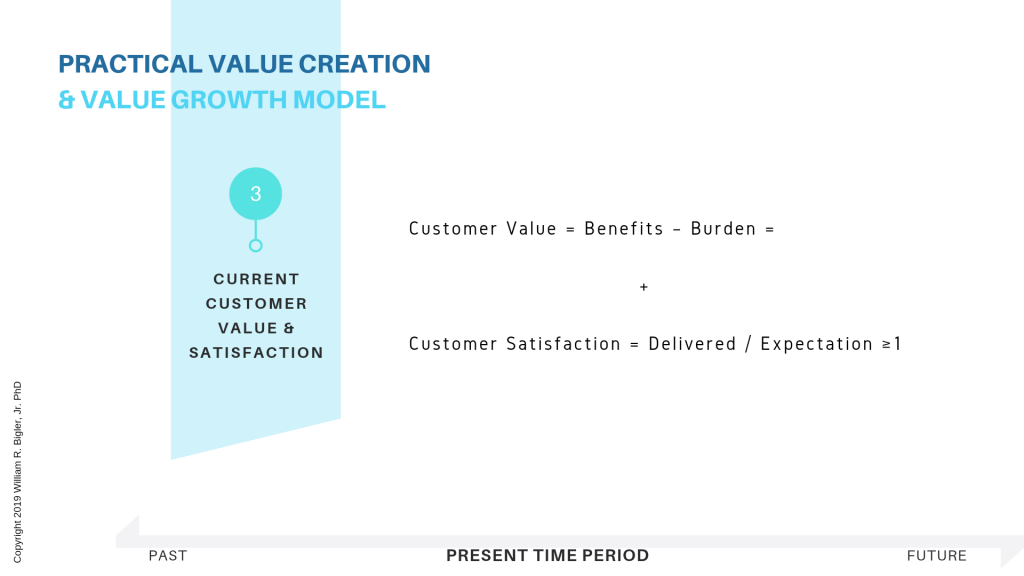

As Peter Drucker wrote years ago the purpose of the for-profit firm is to create a customer. And a customer who receives superior value that produces delighted customer satisfaction.

The two little formulas are touchstones for a firm. Customers receive Value when the Benefits we offer them are greater than the Burden we ask of them to get those Benefits. We satisfy customers when what we have Delivered for them is greater than or equal to what they Expected we would deliver. Violate these two touchstones and any business is headed for trouble and headaches. For example if Burden ever gets greater than Benefits received, a customer will go to a competitor for value. If we do not Deliver at least what customers Expected we would deliver, or if we inflate expectations in any way, I can guarantee you we have created a dissatisfied customer.

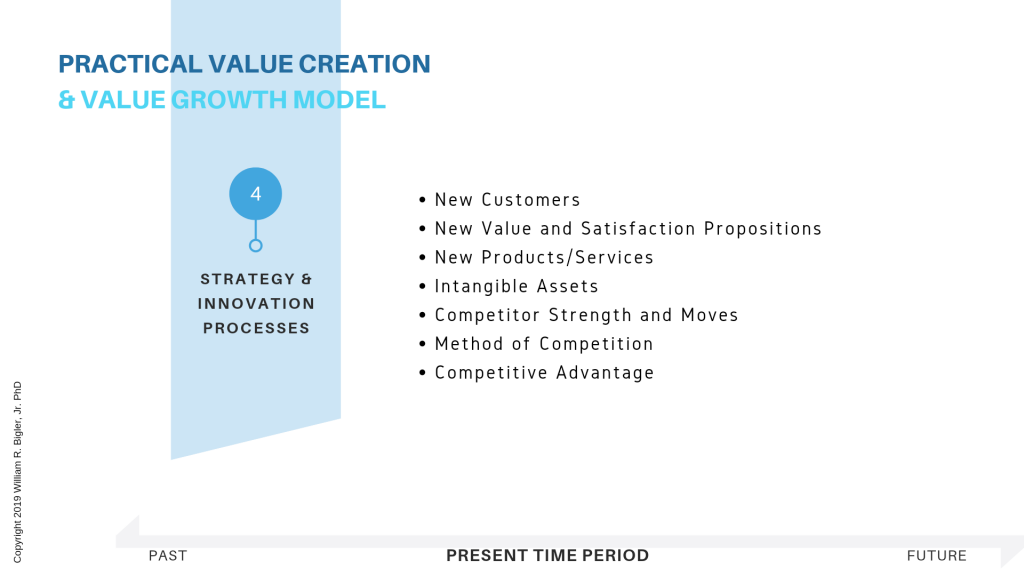

Panel #4: Strategy and Innovation Processes

Strategy and Innovation processes manage risk and position the firm for some kind of competitive advantage over competitors. They also provide newness to the firm that may to some degree upset the “core” of a firm found in Panel #2: The Operating Engine. The “creative destruction” of the core is a dynamic must for firms as newness replaces the old. The old saying “Grow or Die” has much truth to it.

Also, notice I include Intangible Assets in this Panel. This may be strange to some and ask why not include it in #2 The Operating Engine where physical assets turn inputs into outputs. Intangible Assets are things like brand, a strong culture, and proprietary R&D and innovation processes and routines and procedures that are unique to the firm. All of these are very difficult for any competitor to copy, not true of many of the assets found in Panel #2: The Operating Engine. Indeed, a powerful brand, if the firm can realistically brand itself, is many times a large contributor to the overall valuation of the firm. “Brand Equity” or “Brand Value” is the science and art of measuring the contribution of the brand to the overall valuation of the firm.

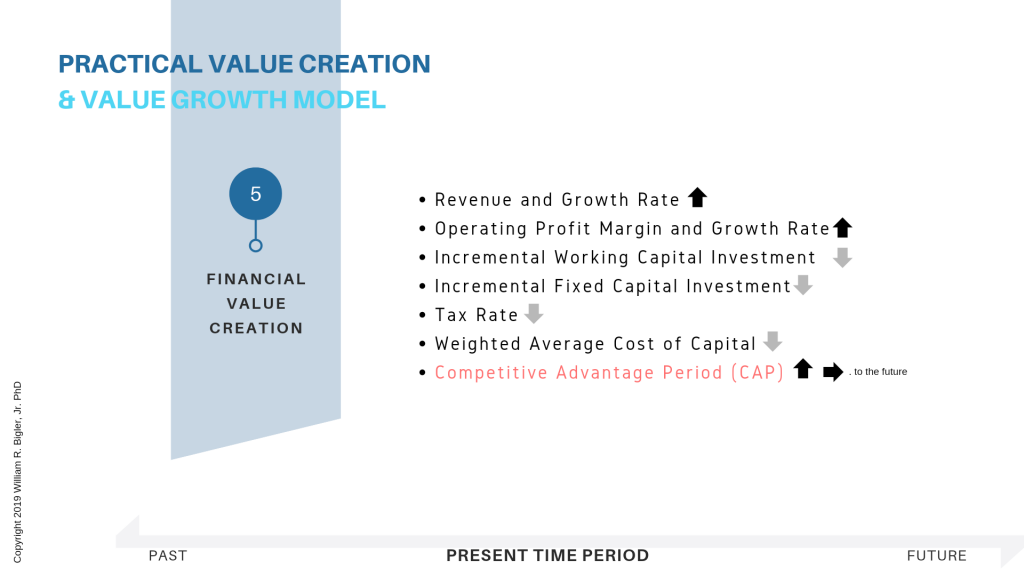

Panel #5: Financial Value Creation

Producing financial value for owners is the end result of configuring Panel #s 2-4 well and that has secured adequate funding (Panel #1).

Panel 5 depicts the classic Value Drivers as presented by Professor Al Rappaport (1986, 1998). The up and down arrows depict the direction required for each Driver to contribute to financial value creation. Recall firms create financial value when they earn more in Free Cash Flow Return on Investment than their Weighted Average Cost of Capital.

These Drivers are straightforward except for maybe the Competitive Advantage Period (CAP). Dr. Rappaport labeled this Duration, but I think CAP is more practically explanatory. It means the length of time into the future that favorable solutions in Panel #s 1-4 will remain favorable. A CAP of three years is much better than six months or no length of time into the future. A favorable CAP gives the firm time and freedom to secure successive advantaged periods into the future and to create a desired future.

Part 2 of this article will be published soon.

This article is part of a series on what causes a firm’s value to increase.

Dr. William Bigler is the founder and CEO of Bill Bigler Associates. He is a former Associate Professor of Strategy and the former MBA Program Director at Louisiana State University at Shreveport. He was the President of the Board of the Association for Strategic Planning in 2012 and served on the Board of Advisors for Nitro Security Inc. from 2003-2005. He is the author of the 2004 book “The New Science of Strategy Execution: How Established Firms Become Fast, Sleek Wealth Creators”. He has worked in the strategy departments of PricewaterhouseCoopers, the Hay Group, Ernst & Young and the Thomas Group among several others. He can be reached at bill@billbigler.com or www.billbigler.com.