This is Part 2 of this article (Part 1 is here if you missed it).

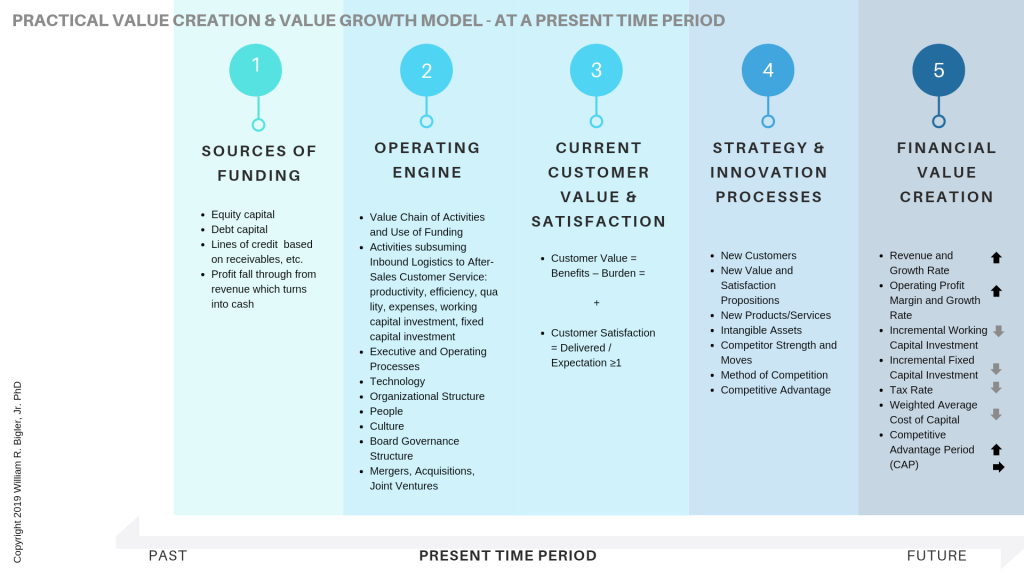

Figure 1g presents the entire Practical Valuation model at a Present time period:

Figure 1g: Practical Value Creation and Value Growth Model – Full Model At Present Time Period

Before we tackle what I think are the new insights and learning in this article, let me make an observation. You will notice things like Vision and Mission statements and Goals and Objectives are not directly depicted in the framework. Blasphemy? Based on my experience, Vision and Mission statements succinctly communicate the essence of key decisions throughout the model, with a forward look to the future. Goals and Objectives are very important to guide and prioritize work and measure interim performance and progress. However it would be non-useful in my view to articulate these first before the key decisions in the framework have been made, executed upon and learning gained of what works and what does not work. Indeed when Lou Gerstner was hired to turn IBM around in the 1980s, he stated to security analysts he “did not have time for the vision thing”. IBMs valuation model (whatever that was) needed fixing before moving to communicate the essence of what was fixed in a Vision statement.

You also notice the classic functional areas like marketing, R&D, manufacturing, HR, sales and after-sales service, etc. are not directly included. In the functional areas, we want “birds of a feather” grouped together so they can become experts. But we all know of the “functional silos” syndrome that can strike many firms. This is when the functions take on a life of their own, can practice the “not invented here” problem and become barriers in and among themselves. It is much better to view the skills and deliverables in these functions as contributions to cross-functional Processes. Here barriers can be knocked down as each Process Owner strives to make each process’s cycle time be as fast as possible and where wasteful “re-work” can be identified and removed.

Indeed, now we can focus on critical “cross-process” interactions that can really leverage valuation increases. Did you notice the complexity added here? For instance, did you know that 30% of the variability in the manufacturing process is caused by a long cycle time, high re-work R&D process? And did you know that 20% of the variability in a manufacturing process is caused by long cycle time and high re-work sales process? Thirty percent of the variability in an R&D process is caused by the executive processes of strategic planning and resource allocation. I could go on but you get the point. And as aside this is one of the reasons speedy strategy execution can be so difficult. To give credit, I learned of the science of cross-functional processes and cross-process interactions while in the Thomas Group in the late 1990s, then one of two leading Operations Excellence consulting firm. This was the best two and one-half years in my career.

The New Learning In This Article

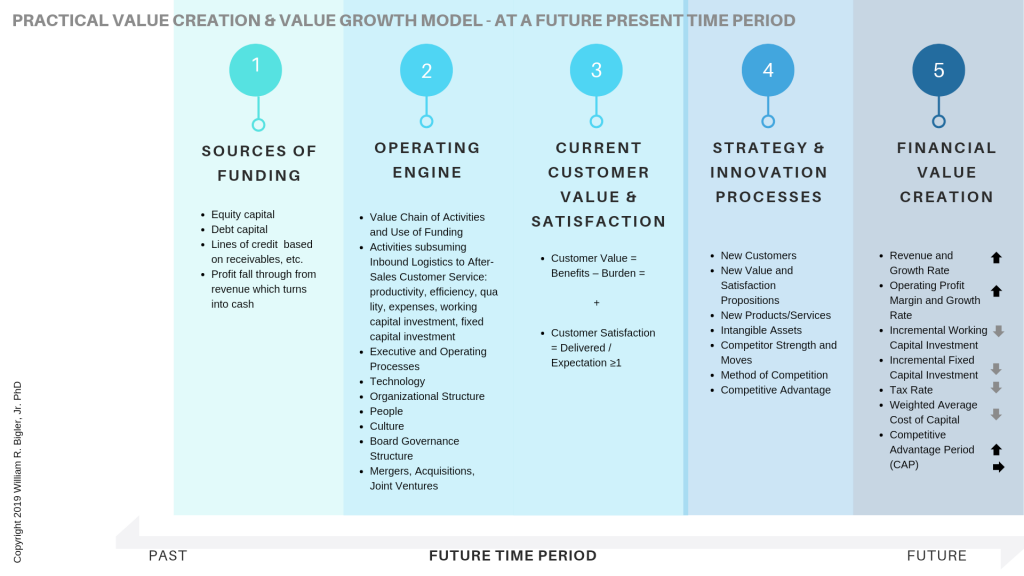

Figure 1h depicts our same full model but at a Future Time Period:

Figure 1h: Full Model At Future Present Time Period

Let’s say we are viewing this model as if we are five years from the date of this article’s publishing – September 6, 2024. What about ten years hence on September 6, 2029? What would this model look like then, in your firm? In today’s business world five years hence is difficult and ten years hence is almost impossible to articulate. Tools like forecasting, scenario planning and simulation try to put clarity on the future. Still, this is difficult work with varying degrees of uncertainty and risk.

There are at least three major ways of thinking about the future. One is to not worry too much about the future and develop a fast and agile firm that reacts to the now as the future is approaching your firm. A second way is to create a desired future scenario, analyze that it is the most likely scenario that will happen, is executable, and move the firm to that desired future with speed (notice speed is almost always a good thing). An Initiative Management Process can time-phase key initiatives for speed and also not cause “initiative overload”. A third way is to create an advantaged future that is only accessible by your firm. This way is reserved for firms who are already the “Defining Entity” in their space and can lock out most competitors from that created future. These firms move to their future with such force and speed (and have mastered execution and thus little initiative overload) that competitors are locked out. Think Amazon here, although I realize Amazon is beginning to show some cracks in its “godlike” competitive leadership status. Needless to say, this approach is reserved for only a handful of firms at any given time period.

From a valuation standpoint, dealing appropriately with an oncoming future is paramount. Recall the notion of Competitive Advantage Period (CAP) discussed earlier in Part 1 of this article. If your firm has secured a CAP of at least three to five years, it will have the time and momentum to secure its future better than rivals who have shorter CAPs.

Here is a key observation: all of this is a massive dynamic problem or dynamic opportunity depending on how you view the work before you. We move to an advantaged future when we have solved the Panels of the model well in the Present by continuing to learn from the Past. But there is a future waiting to happen regardless of how your firm is performing now in the Present. And we cannot hit the Pause button in any of these dynamics. For publicly traded firms, security analysts hear sweet music when during the quarterly CEO/CFO call these executives can paint a picture of an advantaged CAP that has facts, evidence but also energy and enthusiasm behind it. This is sort of like the major startup in Silicon Valley that wows venture capitalists. But they do this using prototypes that have limited real testing in the market. The established firm in our example does this but has real concrete current success evidence baked into the CAP.

The next section hopefully will provide some new or confirm current learning about the best way to deal with your firm constantly being in a process of moving from a Present favorable CAP, in part helped by the Past, to the Future.

A Practical Program For Enhancing Increases in Valuation

The following are the key initiatives to fix a Present time period’s model to be able to better intercept that firm’s future. The initiatives should be followed in the order presented in most cases. This builds what I call a “success and confidence platform”. Initiatives can, of course, be skipped if they are sufficient for the firm at the present time period. And please note I know of the complexity in these short sentences. But a good roadmap of major highways is better than no roadmap at all:

- Improve the supply chain – sets the foundation and platform for growth.

- Fix other problematic Executive and Operating Processes – drastically lower cycle times and rework by identifying and removing barriers using Process Maps. This makes the firm fast and sleek and helps to take out wasteful costs.

- Co-create With Loyal Customers – loyal customers can help tremendously fix problems with current products and services and help create new products and services that will likely be demanded. Note the new venture does not enjoy being able to co-create with loyal customers yet.

- Perform a Workout to Get Rid of Unneeded Costs – firms usually find some to much low hanging fruit to reduce. General Electric was the first to my knowledge to use a Work-out. Other firms followed suit quickly.

- Right-size and Re-allocate Your Workforce – this does not necessarily mean workforce reductions. If the situation is dire enough, do this humanely with fair out packages. I realize I may seem flippant here. This is serious and heart wrenching work to let real people go from full-time employment. So wherever possible retrain and re-allocate your people to revenue and customer-facing roles for #6..

- Gain New Revenue Fast – initiatives #s 1-3 and #5 set the firm up to secure more and quicker new revenue. Fix the Sales Process if need be. Please remember Revenue is Price X Quantity Sold. Optimize prices or quantity sold depending on your dominant Method of Competition – Low-Cost Provider or Differentiator. The profit fall-through from new revenue will turn to cash eventually, more or less quickly depending on the firm’s dominant business model(s). Firms like Dell and Amazon get new cash upfront. Industrial firms will turn profit fall-through into cash in thirty to forty-five days. This must be planned for.

- Fix Problematic Debt – restructure debt if need be and service the debt down with some of the new cash. Remember shareholder or owner value is Enterprise Value minus Debt. Get to the most effective levels of debt quickly.

- Use the Newly Generated Cash Wisely – allocate newly found cash (and supplement it with new favorable debt, lines of credit and/or more equity if prudent to add to the capital structure) to value-creating initiatives only, especially to #9 next. But back-office initiatives can be assessed via contribution to valuation increases as well.

- Pour the Coals to the Innovation Process – on the back of co-creating with customers (#3), install one if one is non-existent or pour the coals to your current Innovation Process. The goal is to create torrents of new product and service ideas that will win with customers.

These practical time-phased initiatives respect all of the Financial Drivers listed in Panel #5 and most of the Elements in Panel #s 1-4. It is easy to list them but they require hard work with true leadership. You can think of other key initiatives depending on your firm’s uniqueness. This Practical Playbook works.

This article is part of a series on what causes a firm’s value to increase.

Dr. William Bigler is the founder and CEO of Bill Bigler Associates. He is a former Associate Professor of Strategy and the former MBA Program Director at Louisiana State University at Shreveport. He was the President of the Board of the Association for Strategic Planning in 2012 and served on the Board of Advisors for Nitro Security Inc. from 2003-2005. He is the author of the 2004 book “The New Science of Strategy Execution: How Established Firms Become Fast, Sleek Wealth Creators”. He has worked in the strategy departments of PricewaterhouseCoopers, the Hay Group, Ernst & Young and the Thomas Group among several others. He can be reached at bill@billbigler.com or www.billbigler.com.