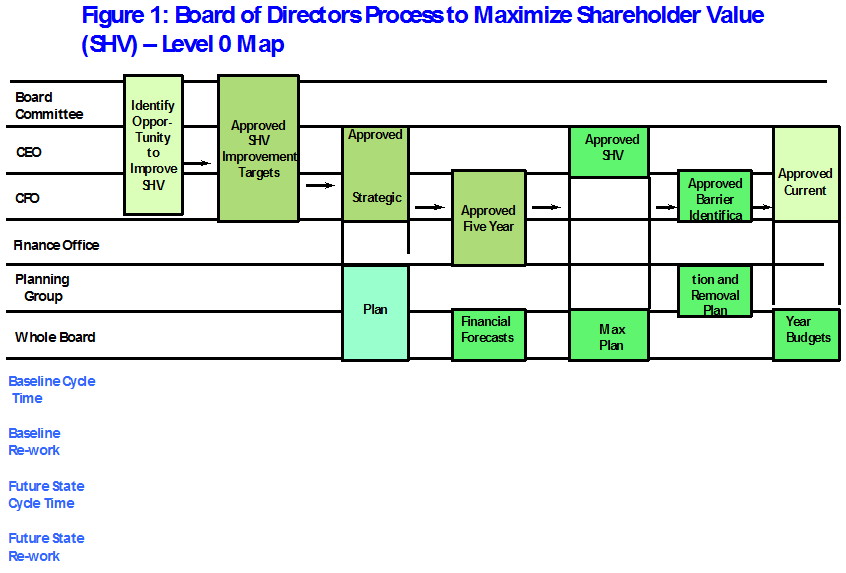

Welcome to Part II of this article. For reference you can find the main process chart from Part I included below. I invite you to read part one of the article: A Board of Directors’ Process for Maximizing Shareholder Value if you’re just joining us.

5. Approved Shareholder Value Maximization Plan

Prime Movers: CEO, Whole Board

This plan will be similar to the Private Equity (PE) approach to improve the value of the companies that form its portfolios as each firm moves to its respective “full potential’ (Read more about Full Potential for Firm Valuation). Here three to five of the new strategic initiatives presented in Activity 3 – Approved Strategic Plan, will be launched with laser like focus. The new initiatives are the ones that are felt will have the biggest impact on improving SHV. Also prior approved initiatives that may have stalled for one reason or another will come under scrutiny.

The method to choose the right three to five initiatives is one of the “holy grails” of business strategy and operations excellence. Every PE firm has their own “secret sauce” to do this and is one of the supposed reasons for “outsized PE returns” or alpha as it is called. I have my approach but every firm needs to develop their own. Here is where the board of directors has a chance to really shine. They do not determine the initiatives but will approve the initiatives. The board’s networks of individuals, firms, and resources should be accessed for this crucial activity in the process.

6. Approved Barrier Identification and Removal Plan

Prime Movers: CFO, Planning Group

This is a unique aspect of this process and is also the most revolutionary Activity in this board process. I have written in Four Kinds of Barriers for the Established Firm that there is a science to barrier identification and removal. All for-profit firms have a mix of four kinds of barriers. Subject matter, process, structure and culture barriers can plaque a firm’s processes, activities and initiatives. The best run companies only have subject matter barriers. That is any firm that is innovating will have new stuff to learn and thus face subject matter barriers. While these can be thorny, they are the easiest to identify and remove. Process, structure and culture barriers are a different matter and can be very troublesome.

Identifying barriers can be career limiting for the people who raise them. The only way to provide a safety net to those individuals is not simply to say “Don’t shoot the messenger”. The solution is developing, if one does not exist, a corporate culture of “transparent meritocracy”. As we all know, it takes time to change a corporate culture. But in a transparent meritocracy results over effort are valued and the key way to do this is the speedy identification and removal of the mix of barriers. In a culture of transparent meritocracy there is no place for people or effort to hide. So people might as well be honest and objective and call barriers as they seem them. A formal sub-process of Barrier Identification and Removal provides legitimacy and visibility to get this most important work accomplished.

The reader might be asking why a separate Activity to Identify and Remove Barriers and why not include this work in the SHV Maximization Plan? After all the SHV Maximization Plan covers only the key new initiatives expected to have the greatest leverage to increase SHV. But while most firms have issues with all of the four kinds of barriers in the ongoing work of the firm as well, it is best to focus on the barriers that will affect the key new initiatives only. As this board process cycles over time, yet newer initiatives will be launched and the Barrier Removal Team will get to work on other parts of the organization anyway. So larger coverage will ensue naturally.

Notice that this Activity is placed before the Activity of Approved Current Year Budgets. This placement makes sure the budgets are done and approved to accommodate any expenditure to identify and remove the four kinds of barriers, as well as investment in the new initiatives themselves.

7. Approved Current Year Budgets

Prime Movers: CEO, CFO. Finance Office, Planning Group

This Activity of the process is very familiar. The only comment here is that annual or current year budgets should be fluid and allowed to morph and change during the current year to accommodate other Activities in this board process that could change during the year.

II. Process Metrics

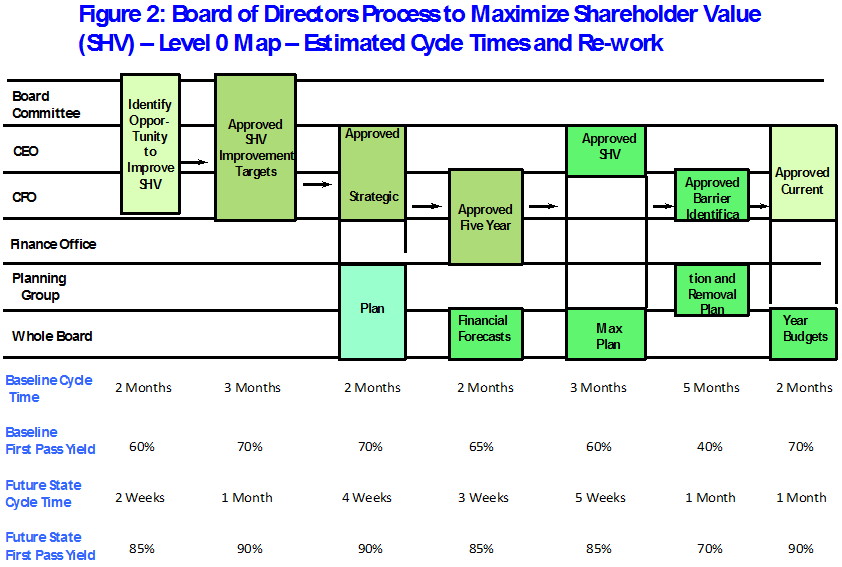

Figure 2 fills in the rest of the information that is required for this kind of a board process to be effective:

Two key process metrics are important: process cycle times and the amount of re-work in the process and its sub-processes and Activities.

- Process cycle time – is the elapsed calendar time for start to finish of one cycling of the process or sub-process.

- Re-work – Thomas Group, the firm where I learned my process disciplines mentioned in Part 1 of this article, referred to re-work in a process or parts of the overall process as “first-pass-yield” (FPY). This is the percentage of the number of cycles a process runs where inputs pass through it with no re-work. A FPY of 100% means there is no re-work. A FPY of 70% means that in 30% of the cycles of the process re-work happens. Re-work is very frustrating and vigilance and good process design must minimize this as much as possible.

There is a relationship between re-work and cycle time. The higher the re-work the longer the cycle time. The root cause of too long of a cycle time in a process or sub-process and too much re-work is always found in the four kinds of barriers.

Figure 2 displays hypothetical Baseline (Current State) cycle times and FPYs and desired Future State cycles times and FPYs. Every firm is unique and needs to measure its situation. While the numbers are fictitious the level of Baseline measures and the improvement potential at Future State are consistent with my experience.

There is almost always this kind of improvement potential in a management-oriented process when it is worked for the first time. In nearly every case of our diagnostics, management teams were surprised at how long things really took and the amount of frustrating re-work that was going on. For example, our diagnostics at a leading lighting manufacturer showed the baseline cycle time to bring any new lighting initiative to market was a whopping seven years with an overall FPY of 40%. We benchmarked against Philips Lighting and GE Lighting and two agile small manufacturers and found the Future State cycle time needed to be fourteen months with a FPY of 80%.

In our hypothetical case in Figure 2, the elapsed Baseline total cycle time through the seven activities is 19 months with an average FPY of 62%. The elapsed Future State total cycle time is 20 weeks or 5 months with an average FPY of (85%). This is the kind of improvement potential boards should be seeking. This is a 73% reduction in cycle time and a 27% increase in FPY.

III. Implications for the Board of Directors Using This Process

Every executive, operating and support process should be designed and managed for speed and little re-work. So should this board level process. But as we saw from our discussion in Activity 1, there are currently no current board committee that can reasonably take on this work.

This is why I think there needs to be a new board level committee formed, tentatively titled the SHV Maximization Committee. Its chair needs to have solid process disciplines knowledge and experience. He or she needs to measure baseline cycle time and FPY, set out future state metrics and identify and remove barriers to get to the future state metrics.

Notice again the Activities in this process are described as having things Approved. Each of those activities will have to interface with Level 1 processes of strategic planning, making five- year financial forecasts, and the process of identifying and removing barriers. Note most firms do not have a formal barrier identification and removal process. This should be added as well in my view and is in Activity 6.

If the ideal cycle time of this process gets to five months, which I think is reasonable, a firm will have a little over two “cycles of learning” in a fiscal or calendar year – (12 divided by 5 = 2.1). Over a course of five years, ten plus Cycles of Learning will give the firm a nice reservoir of knowledge on how to most efficiently and effectively increase SHV. This reservoir of knowledge only gets larger as time goes on. This board process in and of itself will increase the value of the firm should it ever be sold.

In our times of 2020, boards of publicly traded firms and private for-profit firms now have a tool and supporting culture to make a big difference. No process can ensure SHV increases as good people are required to make this happen. But a good process with its drumbeat of the timing of key Approved Activities is a good start.

This article is part of a series on what causes a firm’s value to increase.

Dr. William Bigler is the founder and CEO of Bill Bigler Associates. He is a former Associate Professor of Strategy and the former MBA Program Director at Louisiana State University at Shreveport. He was the President of the Board of the Association for Strategic Planning in 2012 and served on the Board of Advisors for Nitro Security Inc. from 2003-2005. He is the author of the 2004 book “The New Science of Strategy Execution: How Established Firms Become Fast, Sleek Wealth Creators”. He has worked in the strategy departments of PricewaterhouseCoopers, the Hay Group, Ernst & Young and the Thomas Group among several others. He can be reached at bill@billbigler.com or www.billbigler.com.