The concept of the “full potential” of your firm comes from Private Equity (PE) and its host of disciplines. I think it is a very important concept for firm performance and longevity as it tries to increase its valuation.

The first time I heard of this concept was when I read about it in the very good little book “Lessons From Private Equity Any Company Can Use” by Orit Gadiesh and Hugh MacArthur, Harvard Business Press, 2006. I was very intrigued by this phrase and concept and have thought about it ever since, but I found there has not been much written on this for public consumption. There are a few articles out there but none of them discuss the Full Potential of Your Business in terms that will increase its Valuation. So I have spent the last eighteen months researching and testing ideas on how the concept of the Full Potential of Your Business (FPOYB) can be useful to growing your firm’s Valuation. For those readers who would like more on the classic drivers of firm valuation, please read my prior article here. The FPOYB is at the center of a major new development at my firm: a Valuation Diagnostic Survey. Our Causal Model behind describing a firm’s Full Potential has twenty-two carefully thought through Elements, but the purpose of this article is not to discuss our approach. It will discuss this concept so you can develop your own framework and approach if you do not already have one and if you find this article useful.

First a few definitions:

FPOYB – what could/can be added to your base business over the next three to five years.

Performance – your favorite end result or lagged measure of results. As readers of my articles know my favorite is Free Cash Flow Return on Investment (FCFROI) being greater than your firm’s Weighted Average Cost of Capital (WACC). That is FCROI > WACC. But please substitute your favorite measure.

Valuation – what your company is worth to a buyer who wants to purchase your business. Other things held equal, you want your Valuation to be as high as possible.

The full potential of a business is the “north star” for valuing any for-profit business in my view. As of January 2020, the PE industry is flush with cash to acquire businesses. Valuations are up for many firms, especially family firms that never thought they would be targets of PE. If valuations are up anyway, you might be asking why my focus is on Full potential and Valuation. I hope to make this clear in this article.

Building Our Argument for the Full Potential of Your Business

Before we get to valuation, let’s discuss the concept of the full potential of your firm or any business and why I think this is a better frame of reference for performance than focusing on “normal” results themselves.

We normally think of your favorite measure of performance as that of which we are trying to improve. As I state above I like FCROI > WACC but your favorite distinct measure might be Return On Assets, Revenue Growth, Return on Equity, Operating Profit Margin, etc.

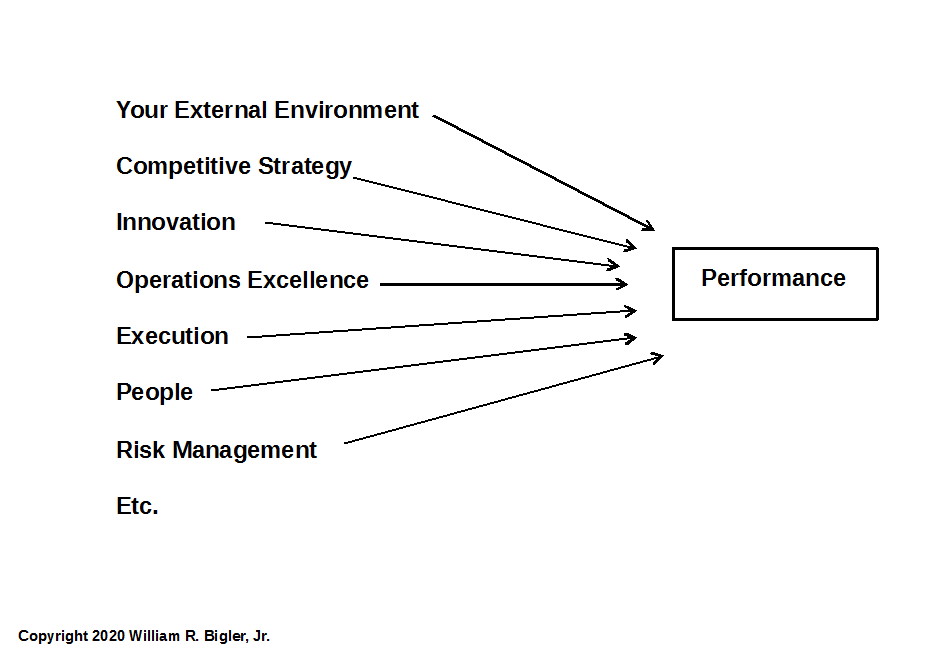

Many things drive to increase my favorite measure(s) of firm performance along with yours. Competitive strategy, innovation, execution, people, risk management, your external environment, etc. to name just a few. You can add to or subtract from my example or substitute your unique model for “driving” performance. If we think in statistical terms (don’t worry we will not get into any depth here), we normally think that our preferred measure of performance is “caused” by the host of things we think are important. Figure 1 depicts that normal causation view using the items discussed above:

Figure 1: Normal Causation of Driving Your Firm’s Performance

This depiction, while multi-faceted, is rather linear and pretty cut and dry. But an obvious issue with only one measure of performance in today’s VUCA (volatile, uncertain, complex and ambiguous) world is that it might not adequately describe performance in all of its facets. One could use a tool like the Balanced Scorecard (BSC). Indeed some of the elements in Figure 1 are included in the BSC. But in my view even the BSC misses the frame of reference of the FPOYB. Practitioners of the BSC will probably disagree with me. The tool is currently being presented as the holistic solution for strategic management of for-profit firms. And by the way I like the BSC as I was trained on it in 1996 so I am not being critical of the tool as it is used. But I think the FPOYB is a very value-added addition to our thinking. Let’s consider Figure 2:

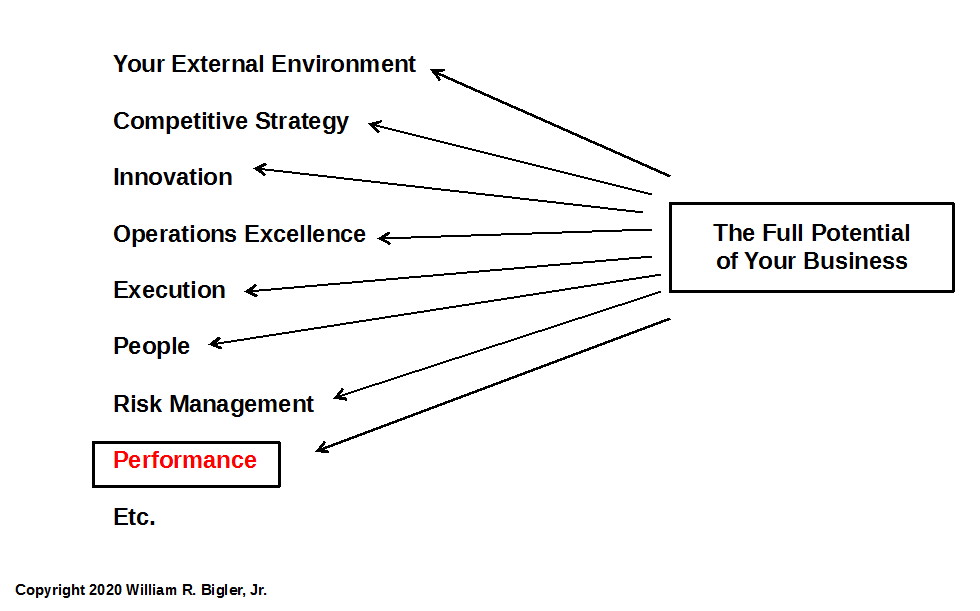

Figure 2: The Full Potential of Your Business Pulls Required Elements When Needed

In this depiction, the FPOYB “beckons” and pulls required elements when needed and in useful amounts. Notice a key difference here. The FPOYB sets the context and potential for any current period’s Performance. Firms that have by design or default limited their full potential have set a lower limit on Performance. Why would a firm do this? My next observation from the field may seem unkind. I have witnessed many times complacency on the part of senior management and its board of directors to stretch the organization from its base business. I have heard discussions like this: “Our base business is giving us all of the profits and cash we need right now. Why should we risk the base business with more stretch?” In one firm there was a fairly easy addition by replicating the base business in other geographies. But no one wanted to do extensive travel to secure those geographies. This firm was ripe for a takeover by a PE firm and two years later it was. Was this laziness or a lack of a sense of urgency by the management team and board? Regardless this firm’s new or revised full potential was beckoning. The PE firm saw this and seized the opportunity. The firm could have done this itself to continue to grow its valuation. Instead it was taken out early at a lower valuation.

And as if these dynamics are not enough, your current period’s Performance illumines what your new FPOYB looks like as it dynamically changes over time. If we are deficient in any current period’s Performance, this will set a limit on new changes to the FPOYB. This is a classic messy and dynamic problem and challenge.

So What Is The Full Potential of Your Business and How Can You Can Make This Concept Work for Your Firm?

The Full Potential of your business (FPOYB) is the practical best your firm can become at any point in time. This is not some abstract concept but a practical view of what can be reasonably added to your business over the next three to five years.

Here is how we have made the concept of the FPOYB operational –

- Describe your business today in practical strategic, operating and tactical terms. We call this your firm’s Base Business Situation (BBS). Example descriptors could be: current products and services offered, current geographic coverage, current production methods, current process configurations, etc. Your BBS is an objective statement of what is. Recall we have twenty-two tested aspects of your Base Business Situation that also describe your firm’s possible next Full Potential. You can use or make your own depiction.

- Describe what could be practically and realistically added to this base over the next three to five years. Examples include new geographies served, new products and services, new materials used in your manufacturing process, re-purposing assets, using more of idle assets, becoming more entrepreneurial in your culture, etc. Decide also what must or could be taken away from this Base Business Situation.

Let me make two crucial points. Firstly, we are not suggesting adding willy-nilly things to your BBS. We need to add things onto a robust and healthy BBS. If your BBS is deficient and/or faulty, you do not want to throw good money after bad at it. You should work to fix the BBS before deciding what could be practically and realistically added. In fact this approach of throwing good money after bad usually destroys your firm’s Valuation and thus should be avoided at all cost.

Secondly, the descriptors for your BBS and the FPOYB should be able to be associated with one or more particular financial Drivers of Valuation. This is the whole point of this exercise – to be able to grow your firm’s Valuation while moving to its Full Potential. For a reminder of the financial Drivers of Valuation, please see here for a previous article on this topic.

- Decide on the most important three to six initiatives required to realize the Full Potential over the next three to five years. Time phase in a Roadmap of those initiatives that should start within six months, those within nine months and then those within the year.

Conclusion

Experienced strategy professionals might say all I have done is put different language around the familiar Current State, Future State, Transformation Gap concepts. Or say that I have just given new language to the ways a firm can grow. These observations would be true. But the concept of the Full Potential of Your Business is a dynamic view of what your business can and should become within any next three to five year period to increase its valuation. I think the way the world is changing to quickly that enhanced future Full Potentials will become the norm. Thus FPOYB is not growth for growth’s sake. The Current State, Future State, Transformation Gap approach typically only paints a better Future than the Current State, not a concept of the FPOYB. And growth for growth’s sake is usually foolhardy as profits and eventual cash can be sacrificed in the push for growth for growth’s sake.

If your firm would like to use our free Valuation Diagnostic Survey to help make useful the concept of the FPOYB, please contact Bill at bill@billbigler.com. This diagnostic survey measures relatively quickly and unobtrusively via Survey Monkey the current potential of your firm to grow its valuation as it moves to its desired full potential.

This article is part of a series on what causes a firm’s value to increase.

Dr. William Bigler is the founder and CEO of Bill Bigler Associates. He is a former Associate Professor of Strategy and the former MBA Program Director at Louisiana State University at Shreveport. He was the President of the Board of the Association for Strategic Planning in 2012 and served on the Board of Advisors for Nitro Security Inc. from 2003-2005. He is the author of the 2004 book “The New Science of Strategy Execution: How Established Firms Become Fast, Sleek Wealth Creators”. He has worked in the strategy departments of PricewaterhouseCoopers, the Hay Group, Ernst & Young and the Thomas Group among several others. He can be reached at bill@billbigler.com or www.billbigler.com.