I think this is an important article. I will let the reader decide. It will discuss a topic that has become very emotional over the last three or so years. I have written other articles here that have touched on the themes presented here. But this one is different.

Don’t let the word Theory scare you. A good theory is worth a thousand piecemeal efforts. It guides thinking and action. A theory is defined thusly:

- a supposition or a system of ideas intended to explain something, especially one based on general principles independent of the thing to be explained

- a set of principles on which the practice of an activity is based

For me a good theory includes causal laws, which allow prediction to be made. If the theory is used in practice it can be strengthened by making predictions, assessing efficacy and improving the theory. But I will forgo this discussion for now as it will add length to this article and I do not need it for my purposes here.

In my view, we need good theory more than ever in the field and practice of valuation, especially when wedded to firm’s competitive strategy. This article will present my theory of valuation and why shareholders are the most important constituents in the total system of firms trying to grow their valuation. I will leave competitive strategy’s role in this to another conversation.

As usual for my articles recently, I will use as little verbiage as I can and build my argument in the form of figures and tables. This article will also try to frame my argument with as little technical detail as possible. See the end of the article for the most important books for me over the last thirty-five years if you desire more technical detail.

An Introductory Sojourn

What follows is based on legal rights in a democratic, free capitalist society. Shareholders thus are not the most important constituents in my view based on some “divinely” ordinated decree. I believe they are the most important constituents in part because of the fact that common equity shareholders are the last to get paid relative to the main players in the valuation gameboard. I will discuss this a little more at the end of this article.

Investors have the right and opportunity to employ capital towards its highest expected return adjusted for risk. The higher risk the higher expected return. This is a crucial point. If any inappropriate barrier is introduced that cuts at an investment’s chance to earn its expected return, investment money will not flow to those investments. And research by McKinsey and others shows that firms who grow their valuation by earning free cash flow return on investment greater than their weighted average cost of capital contribute to society. They generate more employment and generate more R&D expenditure to fund further rounds of innovation of demanded products and services. These grow revenue, cash flow and return on capital invested. This is a virtuous cycle.

But recent arguments inappropriately cast doubt on this proposition. Some decry the fact that some people in our society do not yet have extra funds for them to invest. Thus they are excluded from wealth generation and there should be the means to right this perceived inequity. There is no easy solution for this. A way to think about this is my personal situation. I come from a typical middle-class family where there was never any extra money. It took over thirty years of hard work for me to generate extra cash from which to invest. I am sympathetic to those families and people who just cannot earn enough extra yet to invest. But we should not in my view penalize those who do have funds by virtue of prior family money or who earn it like me through hard work over many years. Many successful investors have set up philanthropic funds to return some of their largesse to society. And this is a good in my view.

Another argument against the primacy of shareholders is that they only bought shares in the open market and were not part of the original founding and funding of a firm. This is a ridiculous argument. Someone wanted to sell his or her claim even if an original investor. Someone thought it was a good price and thus bought the claim. But the claim on dividends and share price appreciation remains constant. And firms will from time to time raise new funds via debt and equity. Any current shareholder has the option to buy more stock in this fundraising exercise, so in effect they become new owners. If they decide not to invest, their percentage of ownership drops.

Finally some argue that since most shareholders buy only a small number of shares they are really not owners. They can exercise no control and indeed are shown not to vote for anything when they have the chance either. While it is true that shareholders who own more than 3 percent of the shares outstanding can exert some power, again this is a ridiculous argument. It is the group of shareholders together who are the collective owners and who can exert some pressure on boards of directors (see concluding section also).

And it goes without saying that investors can lose a good portion of their money or all of it in their investments. There is no guarantee at all things will always be on the up. Employees can lose their jobs, suppliers can lose their contracts to supply and so on for the other constituents on the gameboard. So there is no guarantee here either. Without sounding naive, employees can find other jobs and suppliers can supply other customers. But if an investor loses a part or all of their money in an investment it is gone for good except for the tax write off feature.

Thus, this article will try to emphasize why we should “value Value” as a societal good and why shareholders are the most important constituents in the valuation gameboard.

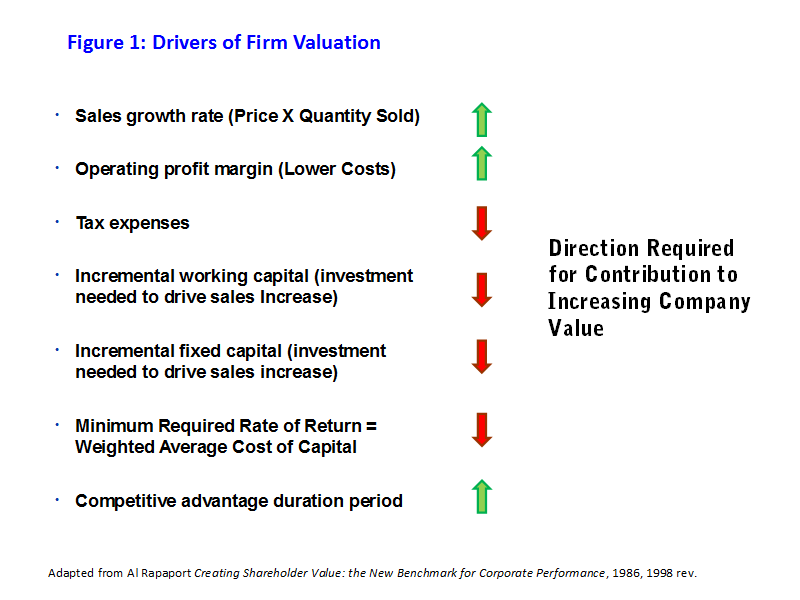

Figure 1: Drivers of Firm Valuation

I have used this figure in previous articles I have written here and also published on my website, www.billbigler.com. The numbers except for Competitive Advantage Period are the numbers that generate Free Cash Flow for a firm. Free Cash Flow figures prominently in Figure 2.

Competitive Advantage Period (CAP) is the length of time into the future that favorable levels and rates of the first six numbers are expected to be maintained. A CAP of three years is better than a CAP of six months or none at all in the case of some commodities.

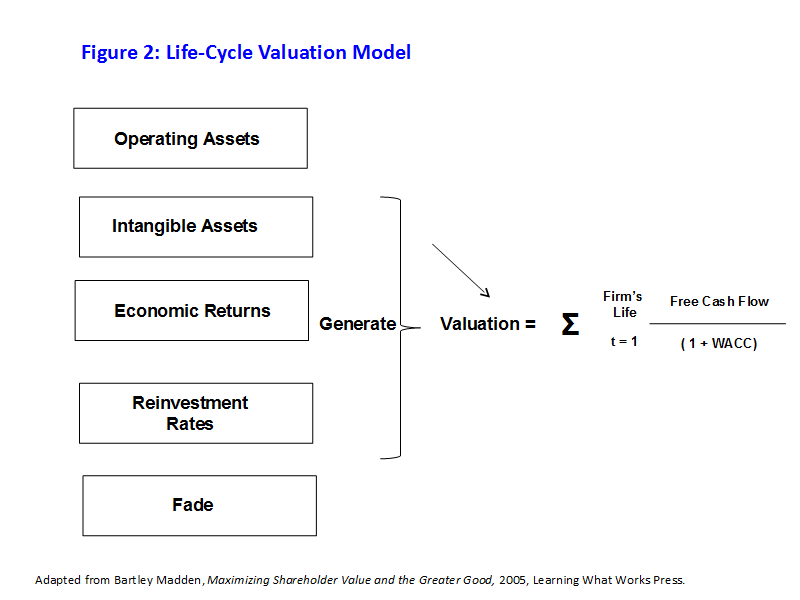

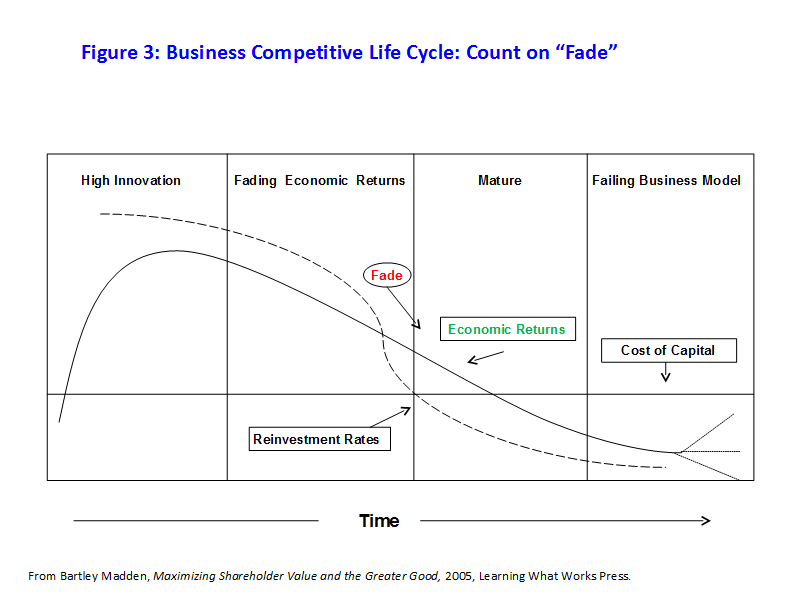

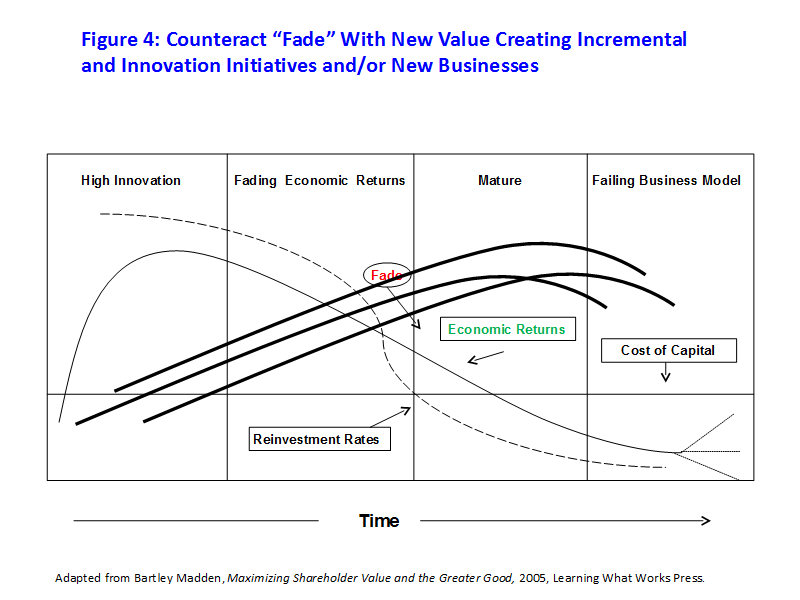

Figures 2, 3, and 4: Bart Madden’s General Diagram of Valuation and Associated Issues

Figures 2-4 come from the great work of Bart Madden. This high level model is pretty straightforward except for maybe Intangible Assets and the WACC. Intangible assets are things like a good brand, proprietary R&D processes, a strong corporate culture, proprietary routines and procedures that go to form organizational capabilities. The common feature to these aspects is they are very difficult for competitors to copy.

The numbers to the right of the Σ sign depict that firms create and grow value when Free Cash Flow Return on Investment is greater than the Weighted Average Cost of Capital (WACC), now and forecasted over the life of a firm. Note the phrase “forecasted over the life of the firm”. This really should read the expected life of the firm and this should dispel once and forever the favorite criticism of opponents to shareholder value that firms focus only on quarterly earnings. True firms issue quarterly “guidance” for expected quarterly earnings but these are intermediate signposts on the way to forecasted cash flow over the expected life of a firm.

The WACC is basically the minimum required rate of return for investors to entice them to invest their money in a firm.

You might be asking where are such things as competitive strategy formulation, strategic planning processes and Vision, Mission, Values statements and the like? From this model’s standpoint, these aspects are the means to configure and execute the five elements on the left side of the model – Operating Assets, Intangible Assets, Economic Returns, Reinvestment Rates and Fade. Since there are so many variations in definitions of competitive strategy, different kinds of strategic planning processes and so many approaches to derive Vision, Mission and Values statements and the diversity in the statements themselves, these are excluded directly from the model so as to unclutter it.

Bart Madden’s research of 7000 firms over a twenty year period clearly showed that absent innovation, firms will experience downward fading Free Cash Flow Return on Investment that goes below the WACC. This is due to the “crush of competition”. This is a formula for value destruction and is a crucial issue affecting value creation and growth for senior management and the board of directors.

Figure 4 depicts that the only way to counteract Fade is to develop and execute effective and winning new innovation in the form of new products and services. It also includes innovation in new business models to bring the innovation initiatives to market. Note: you cannot cut costs enough to counteract downward fade in free cash flow return on investment. You could drastically reduce new investment, but this would be self-defeating. The only way is to innovate.

With Figures 1-4 as the foundation for value creation and growth, we can turn to who the players are in the typical Valuation Gameboard.

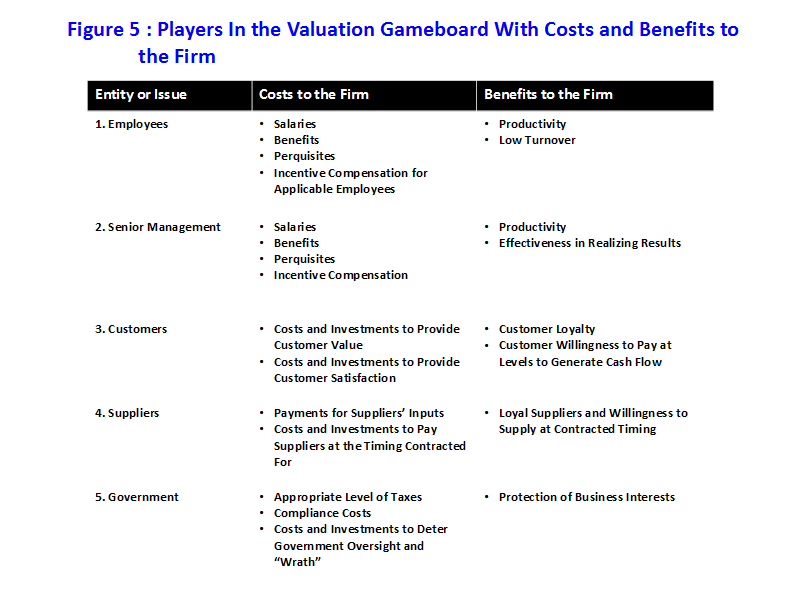

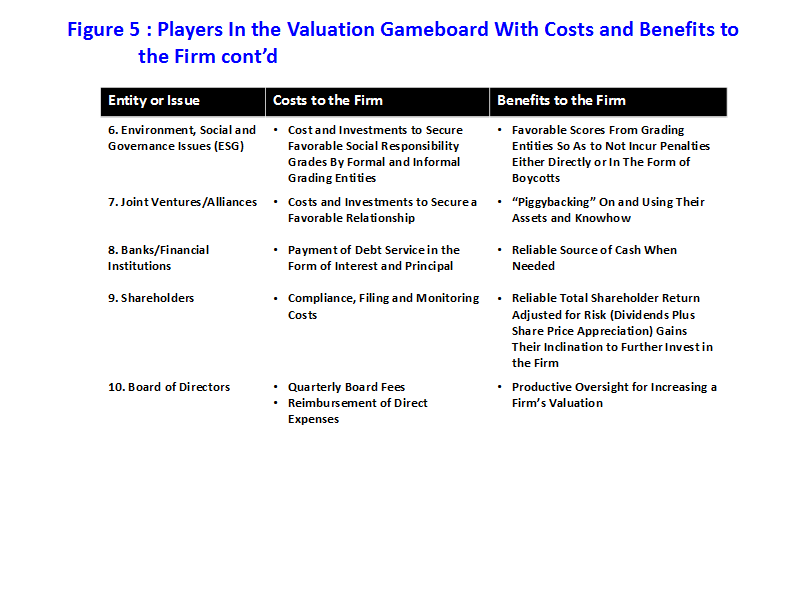

Figure 5: Players In the Valuation Gameboard With Costs and Benefits to the Firm

Figure 5 lists the typical players in the Valuation Gameboard. You can add or subtract based on your firm’s situation. The chart portrays the Cost to the Firm as well as the Benefits to the Firm typically.

The reader can sense how complex this gameboard is. In a well functioning democratic, capitalist system, society gains by having products and services that meet real needs that are competitively priced and for which there is outstanding after-sales customer service.

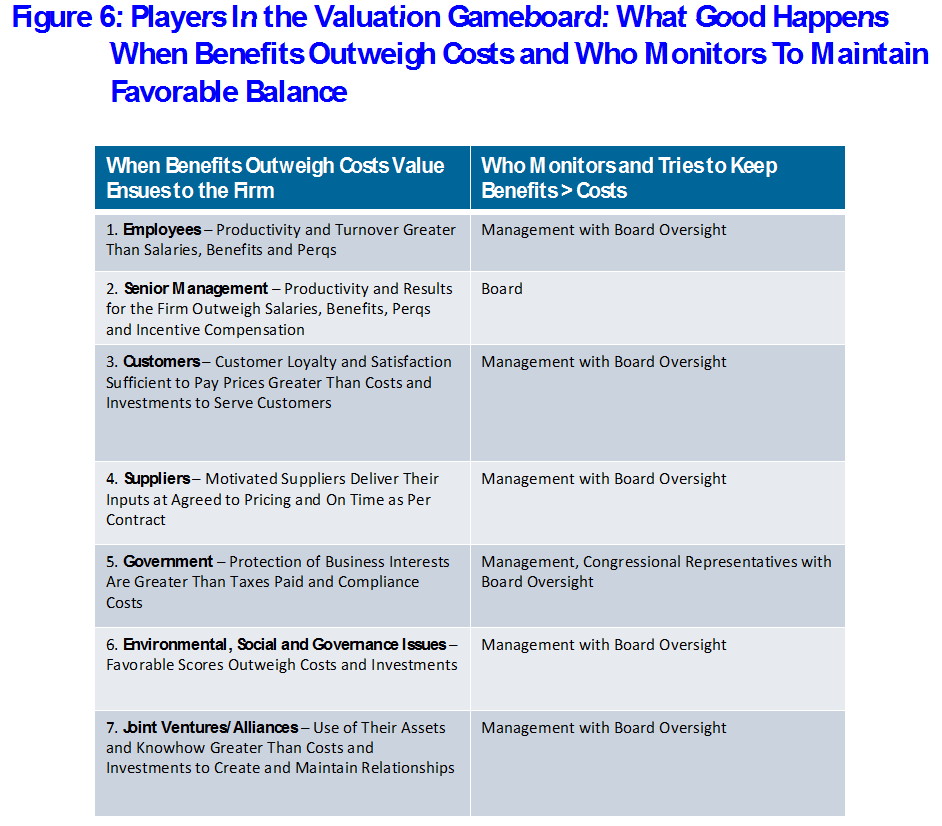

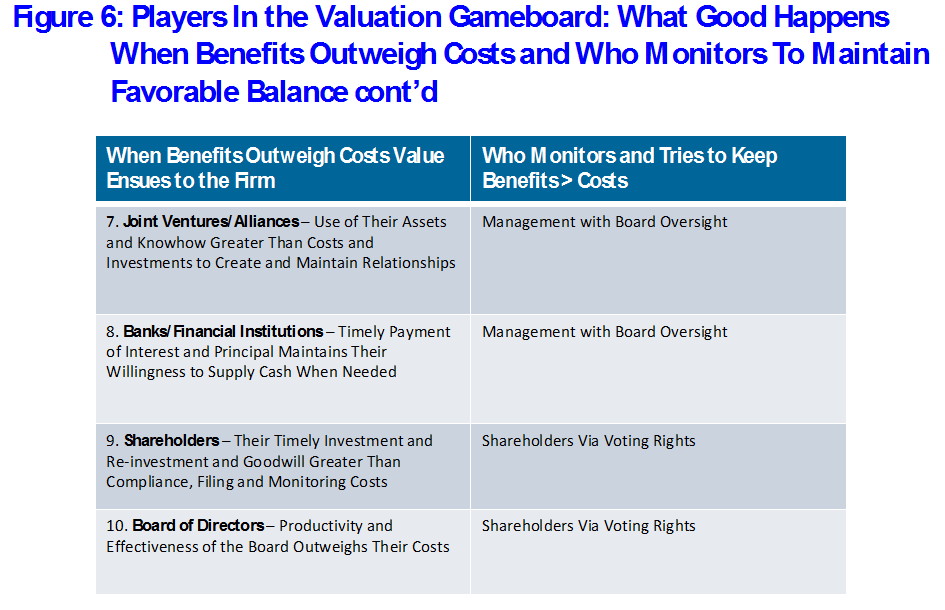

Figure 6. Players In the Valuation Gameboard: What Good Happens When Benefits Outweigh Costs and Who Monitors To Maintain Favorable Balance

Figure 6 depicts the scenarios for each of the players in the Gameboard for when Benefits Outweigh Costs and who monitors the situation for each to try keep the Benefits outweighing the Costs over time. If these relationships turn to where the Costs outweigh the Benefits, value creation and growth in valuation usually slow down or come to a stop.

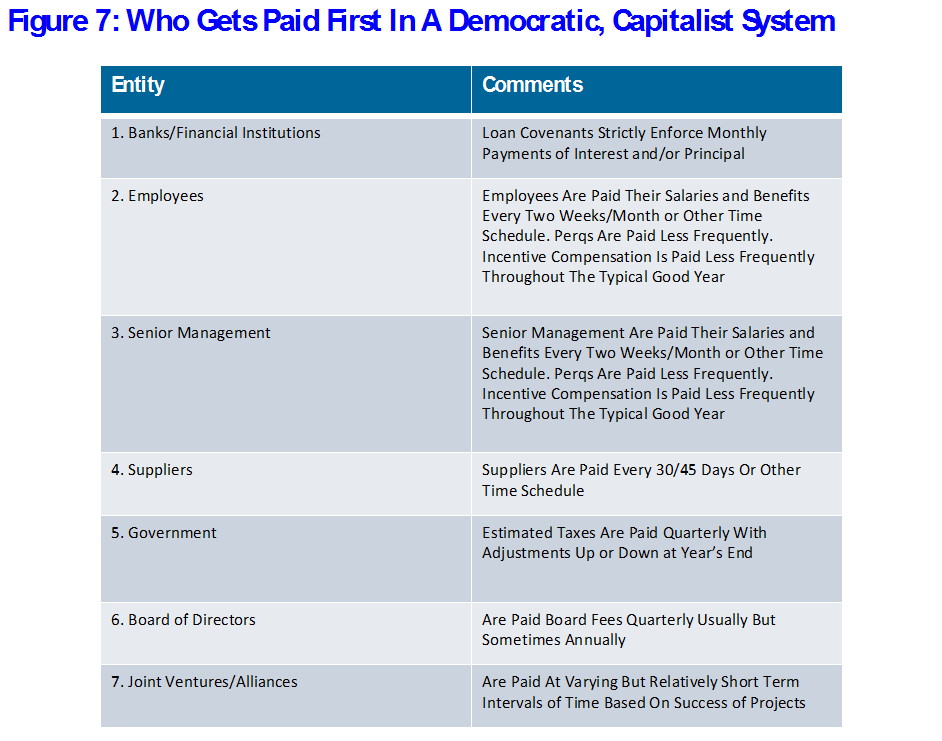

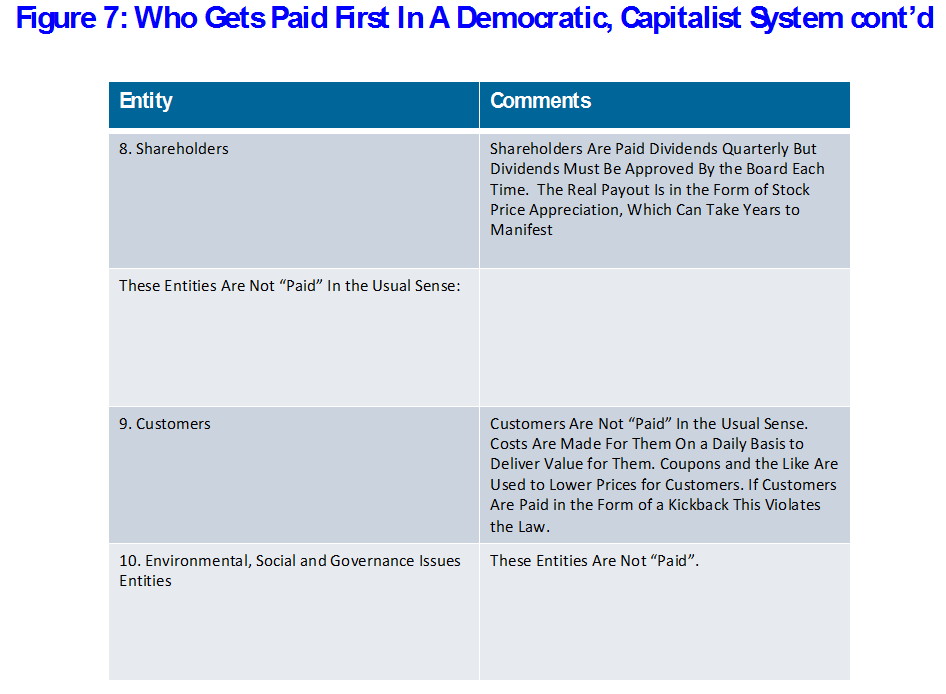

Figure 7: Who Gets Paid First In A Democratic, Capitalist System

Figure 7 is the crescendo of my argument that shareholders are the most important constituents in the Valuation Gameboard. Figure 7 is self-explanatory. Please read that Shareholders are the last to be paid in democratic, capitalist systems as the laws are stated today.

Shareholders get paid in the form of dividends and share price appreciation. Share buy backs are another form of getting paid although as the chart says shareholders relinquish future claims on dividends and forgo future share price appreciation when they sell their shares back to the firm. Share buy backs are a favorite attack point for those critical of shareholder value maximization. But firms do this, and even take on debt to pay for it, when there are no or few initiatives on the horizon that are expected to earn the WACC. So this is not a sly way to enrich shareholders, most of the time. Indeed some schemes have been noted to do this. But share buybacks are a questionable part of a good theory of growing valuation.

Here is my concluding argument. If we aim at maximizing or optimizing shareholder value, we have the opportunity to serve all of the other constituents in the gameboard first. Shareholders have a residual and contingent claim on cash flow and are paid after everyone else on the gameboard is paid. If we do as the recent Business Roundtable statement suggests – try to serve everyone equally at the same time, we end up diffusing our focus. Is it not better to set our sights on shareholders who get paid only if money is left over after paying all the other gameboard participants first? This is the difference between a shotgun shot or a focused rifle or arrow shot. Henry Wolfe and others who write here take similar positions.

Add to this the fact that shareholders are the only constituents on the gameboard who can add or remove a board of directors’ member. The board is an important entity on the gameboard, even if in practice a few are considered weak for a variety of reasons. This is not the norm from my experience for most boards though. Most try to perform effective oversight and guidance and some focus on shareholder value maximization. So shareholders are the only entity on the gameboard who can affect the board’s performance.

These are the main reasons why I think shareholders are the most important constituents on the Valuation Gameboard. I suspect some to many will disagree with me.

List of the Most Important Books for Me Over the Last Thirty-five Years (as the reader will notice, the latest book cited is from 2013. The field is well established in terms of frameworks and has not changed much in its essence since 2013):

- Alfred Rappaport, Creating Shareholder Value: The New Standard for Business Performance, Free Press, 1986.

- Alfred Rappaport, Creating Shareholder Value: A Guide for Managers and Investors, Free Press, 1998. (this is the revised 1986 book).

- Tim Koller, Richard Dobbs, and Bill Huyett, Value: The Four Cornerstones of Corporate Finance, John Wiley and Sons, 2011.

- Tim Koller, Marc Godehart, and David Wessels, Valuation: Measuring and Managing the Value of Companies, John Wiley and Sons, Fifth Edition, University Edition, 2010.

- Tim Koller, Marc Goedhart, David Wessels and Erik Benrud, Valuation Workbook: Step-by-Step Exercises and Tests to Help You Master Valuation, John Wiley and Sons, Fifth Edition, 2011.

- Bartley Madden, Maximizing Shareholder Value and the Greater Good, LearningWhatWorks, 2005. (this is a jewel of a little book and could serve as a first introduction to the multi-faceted aspects of valuation. It is free on Bart’s website).

- Bartley Madden, CFROI Valuation: A Total System Approach to Valuing the Firm, Butterworth-Heinemann, 1999. (CFROI stands for Cash Flow Return on Investment).

- G. Bennett Stewart, The Quest for Value, Harper Business, 1991.

- G. Bennett Stewart, Best-Practice EVA: The Definitive Guide to Measuring and Maximizing Shareholder Value, John Wiley and Sons, 2013.

- Joel Stern and John Shiely, The EVA Challenge: Implementing Value-Added Change In An Organization, John Wiley and Sons, 2001.

- James McTaggart, Peter Kontes and Michael Mankins, The Value Imperative: Managing for Superior Shareholder Returns, Free Press, 1994.

- Bernard Reimann, Managing for Value: A Guide to Value-Based Strategic Management, The Planning Forum, 1987.

This article is part of a series on what causes a firm’s value to increase.

Dr. William Bigler is the founder and CEO of Bill Bigler Associates. He is a former Associate Professor of Strategy and the former MBA Program Director at Louisiana State University at Shreveport. He was the President of the Board of the Association for Strategic Planning in 2012 and served on the Board of Advisors for Nitro Security Inc. from 2003-2005. He is the author of the 2004 book “The New Science of Strategy Execution: How Established Firms Become Fast, Sleek Wealth Creators”. He has worked in the strategy departments of PricewaterhouseCoopers, the Hay Group, Ernst & Young and the Thomas Group among several others. He can be reached at bill@billbigler.com or www.billbigler.com.