This will be a framework and guide oriented article, but I think it is a useful piece. It is somewhat of an advanced article written primarily for senior strategy professionals – CEOs, CFOs, heads of strategic planning and senior consultants. But anyone with a good basic understanding of competitive strategy, operations and finance will gain from it. This article is the first draft (really a first sketch) of what will become a Playbook for for-profit firms to use coming out of any “impairment episode” (COVID-19 now) to grow declines in firm valuation, but more importantly for the future from new impairment episodes to grow lost valuation caused by the episode. This article portrays my approach. But you can plug-and-play with your frameworks and tools.

I will share an approach that has taken years to build and heretofore has been proprietary to me. Why would I want to share it? The value of my personal stock portfolio is down 25% as of May 16, 2020 from just the COVID-19 impairment episode. I am sure many of you are in the same boat. If I can share what has worked for me and others can use it, we all can help firms grow their valuation and we all benefit. I hope this is a small contribution to that cause.

The main topic of this article is the notion of “impairment” to your firm’s ability to grow, much less maintain, its valuation after an “impairment episode”. I do not mean classic turnaround situations where the firm has had a tough go of things: its industry may have been in slow decline or the firm may have made blunders, etc. Impairment episodes as I define them are different.

COVID-19 is the most recent such impairment episode and it has affected negatively most firms in the United States. But pundits are writing this probably won’t be the last virus to cause impairment. Also in today’s world there are many things that can cause future impairment episodes of all kinds, not just from viruses. So this article is like a survivalist’s preparation for a future bad event. I truly hope we can file this away and never have to use it. But without crying wolf, my sense is it might be useful down the road.

Impairment to valuation of for-profit firms is a different way to view the valuation challenge. Executives in publicly traded firms want their stock prices to rise and executives in private for-profit firms want to see their valuations and wealth increase. Hereafter we will refer to growing your firm’s valuation to mean both stock price improvement and total shareholder return for publicly traded firms and increases in valuation and wealth for the private for-profit firm.

This article will discuss the following topics:

- Key dilemmas surrounding your efforts to grow your firm’s valuation after experiencing an “impairment episode”. Thousands of people have written about their versions of how firms can move from around May 1, 2020, to back to normal or a “new normal” period after the COVID-19 pandemic. But many forms of impairment have happened before this current episode and I think will continue to happen to firms in the future.

- Key trade-off decisions you will need to make given the problems stemming from an impairment episode.

- Depicting the complexity of your firm’s competitive strategy simply and why this is important.

- My point-of-view on how to view solutions to growing your firm’s valuation after the key trade-off decisions in #2 have been made.

- The Acid Test of the effects of current and new initiatives on expected increases in the value of your firm.

Being a beginning Playbook, this article has turned out to be a little longer than usual and I want to thank my colleagues Sarah Von Helfenstein and Warren Miller for suggestions on earlier versions of this article.

First a couple of key definitions:

Impairment Episode – is firstly a black swan event happening in and around the for-profit firm causing large declines in valuation. Such an event is further defined as “an unpredictable event that is beyond what is normally expected of a situation and has potentially severe consequences (in our case here for firm valuation). They are characterized by their extreme rarity, their severe impact, and the widespread insistence they were obvious in hindsight”. Historical examples include the financial crash of 2008, Zimbabwe’s hyperinflation in 2008, the 2001 dot.com bubble and World War I. Secondly for us an Impairment Episode need not have all of the attributes of a black swan event for severe consequences for firm valuation. An example would be the known non-legal and unethical behavior of the sub-prime mortgage industry in around 2008. This series of activities was known by industry insiders and then by industry regulators. Thus it was somewhat predictable even though it was beyond the norm. It still caused severe consequences for firm valuation.

Area of Impairment – an area of your firm that has been negatively impacted by virtue of a changed relationship with a key stakeholder(s) from an impairment episode. For our purposes an Area of Impairment was just fine before the Impairment Episode but comes to be seen as faulty or “impaired” as the episode is beginning to be understood and steps are taken to lessen its effect. So areas of your firm that were impaired before the episode are not included in our Area of Impairment definition.

Things That Cause An Area of Impairment After An Impairment Episode – adversely changed relationships, inadvertent or by choice, with your key stakeholders – customers, suppliers, employees and JV/Alliance partners, as a result of the uncertainty caused by the episode. In other words your firm just blew it with respect to some or all of your key stakeholders.

- Key Dilemmas From An Impairment Episode Causing Uncertainty in Growing Your Firm’s Valuation

The COVID-19 pandemic is the most recent impairment episode to affect many firms. As of May 1, 2020, the overall stock market was down 20% (a near all time low) from its all time high just three months earlier on about February 1, 2020. Pardon me if you are not familiar with valuation principles, but this general decline in stock prices was due to an increased market risk premium, increases in individual firm’s betas and forecasted declines in free cash flow from operations for publicly traded firms. Private for-profit firms have shown similar declines in valuation.

What is interesting is that not much had changed inside of most firms since the February all time highs of stock prices to around now May 16, 2020. Their current competitive strategies, business models, their valuable resources, capabilities and activities had not changed. But what changed precipitously were many firms’ relationships with their customers, suppliers, and joint venture/alliance partners and with their competitors. More on this below.

As far as overall firm valuations are concerned, as of May 16, 2020, things have started to improve in stock prices as security analysts are baking into their valuations forecasted improved free cash flow and reductions in risk. This is driven by a sense of a pending development of a therapeutic and a vaccine. The old saying “a rising tide lifts all boats” has some truth here. But will valuations come back to the high levels of February 1, 2020? We do not know for sure as of this writing on May 16, 2020. Say two-thirds of a firm’s valuation will return just from the “rising tide” cause. This leaves one-third of most firms’ valuation increase at potential risk. Some firms will not have been impaired greatly and will be able to re-capture that remaining third of valuation fairly easily.

But many firms will find that some degree of impairment will remain that will need timely and good decisions to regain the remaining lost valuation.

Figure 1 depicts possible areas of impairment:

One key point of distinction mentioned above is necessary again before we move forward. Possible areas of impairment are two kinds. First, areas that were already a problem before any impairment episode are not “areas of impairment” as I define them. These are or should be known to the firm. But true areas of impairment are vexing as those areas were “ok” before the impairment episode and coming out of the episode are or will be seen as impaired. What happened in the intervening period of time?

My view is that a firm’s changed or terminated relationships, either planned or inadvertent, with its suppliers, customers, employees and JV/Alliance partners has:

- Caused harm.

- Caused a situation where repairing that impairment will take much longer than first anticipated.

Suppliers may have looked or be looking elsewhere to sell their inputs and the credit terms they extended to you may become tighter. Customers may be seeking your competitors as you have gone “missing in action”. Employees might be looking for other employment if they have mobility, and joint venture and/or alliance partners may be looking for a partner on which they can rely better.

This is why your firm’s Competitive Strategy is primal. It needs to serve as a “touchstone” which is defined as “a standard or criterion by which something is judged or recognized”. Inadvertent changes to those stakeholder relationships and ad hoc ways to solve the impairment area problems could alter your competitive strategy and not on your terms. True low-cost providers may find they are adding things consistent with the differentiator form of competitive strategy. They might pour the coals to customer service, thus increasing costs. And differentiators could find they are helter-skelter adding things more consistent with that of the low-cost provider. They could be decreasing some of the prized benefits for customers like after-sales customer service trying to momentarily lower costs to increase cash flow. You want to avoid this and that is why section 3 of this article will depict a way to simply portray your firm’s competitive strategy relative to your key competitors or rivals so that your competitive strategy will remain a touchstone through all of the possible calamity.

- Key Trade-off Decisions That Need to be Made in Growing Your Firm’s Valuation

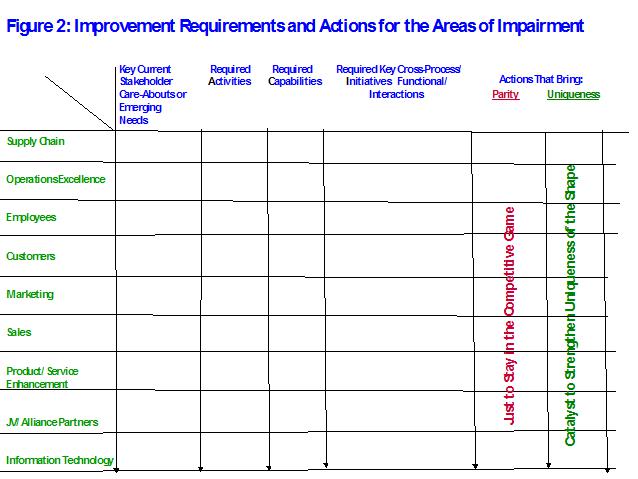

If your firm is not impaired or is only marginally impaired after an episode, you can continue with your prior growth plans. But say your firm is impaired. For example let’s say you know your Supply Chain has been impaired somewhat. You would then focus on that area and assess it against the Requirements for Improvement shown in Figure 2:

I realize there is a lot going on in this chart, but if you study it for a few minutes I think it is at least fairly clear. From the left, assess each key impaired area for what the key stakeholders care about and what has gotten them upset. The cause for impairment might have in turn caused emerging new needs or wants from those stakeholders. The next three columns come from the resource-based view of competitive advantage and the process innovation view from operations excellence. You might need to alter valuable resources and capabilities consistent with your competitive strategy. And you might need to strengthen key processes and key cross-process interactions. On the far right is room for recording whether those improvement requirements and resulting actions will only bring the firm back to parity or ideally give the firm some measure of new uniqueness.

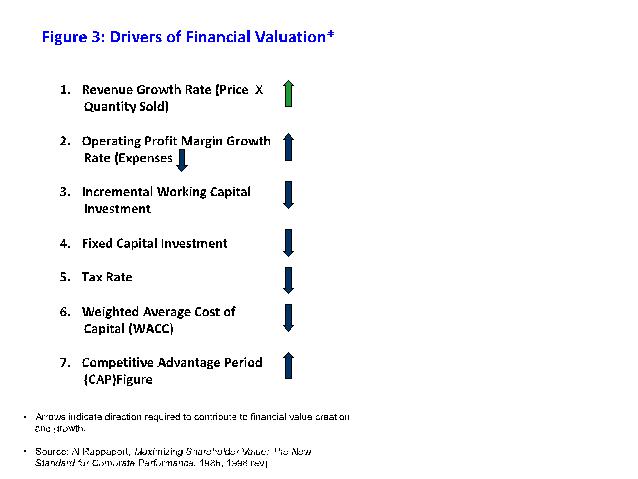

The last step in this section titled Key Trade-off Decisions That Need to be Made in Growing Your Firm’s Valuation is to make a high level assessment (more on this in Section 5 below) of the Improvement Requirements and Actions for positive or negative impacts on the Drivers of Financial Valuation as shown in Figure 3. This begins the acid test for expected improvement in the valuation of your firm taken up in Section 5:

The numbers in Figure 3, except for Competitive Advantage Period, are the numbers deriving discounted free cash flow from operations. Competitive Advantage Period (CAP) is the length of time into the future that the other six numbers are expected to stay favorable. A CAP of two years is better than a CAP of six months, or certainly no CAP at all found in industries that are pure commodities.

Every industry has the situation where a few of the drivers in Figure 3 are more important than others in increasing valuation. It could be that Revenue Growth Rate and Operating Profit Margin growth rate provide the greatest leverage in increasing valuation. Or you might find that reducing risk (in part causing a decline in the WACC) has the greatest leverage. You will need to prioritize and focus as you make these key trade-off decisions.

If your firm is impaired and certainly if it is severely impaired, you will need to work on all of the areas of impairment at once, while still focusing on the biggest drivers of financial value. This will take the outmost in strategic leadership to make the trade-offs work. One or two areas of impairment can take precedence, but there will need to be concurrent effort working on all of the impaired areas nearly at once. A way to do this is provided Section 4. Before we get to that topic we need to discuss your firm’s competitive strategy and how to simply portray it and why this is important.

3. Depicting the complexity of your firm’s competitive strategy simply.

Some people have argued over the last three or so years that strategic planning and competitive strategy are old hat and non-useful topics. I disagree strongly. This is not the place for a full discussion of this debate. What is important for our topics here is how we can simply portray the complexity of your firm’s competitive strategy so that it can remain your touchstone and be correlated with actions to grow your firm’s valuation. This is what is missing in most of the writings on how to move to a new normal from the COVID-19 pandemic and impairment episode.

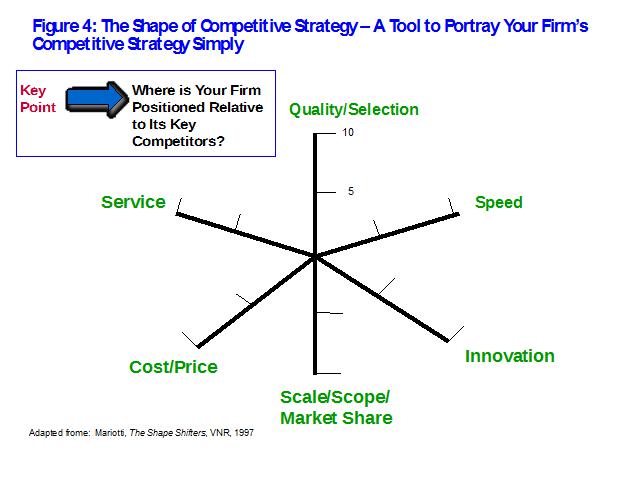

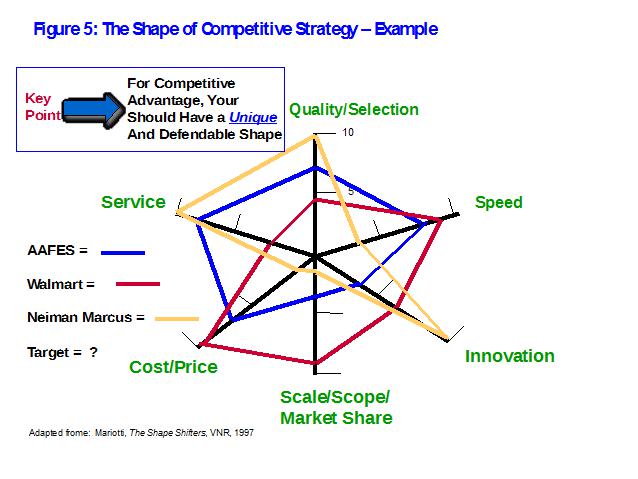

Figure 4 is adapted from a very good 1997 book by John Mariotti titled The Shape Shifters. I have used this approach since then when I have needed to portray the complexity of a firm’s competitive strategy simply:

Notice simplicity of the description is gained when we compare the shape of your firm’s competitive strategy to those of your key competitors. Notice that each dimension of Figure 4 can be scored from 1 to 10, with 1 being a low score on that dimension and 10 a high score or where your firm has put its emphasis. Figure 5 excerpts from a real example from 2005 when I worked with the Army and Air Force Exchange Service (AAFES).

This is the command headquartered in Dallas, Texas, and serves all of the post and base exchanges for the Army and Air Force worldwide. These exchanges are the retail stores on each post or base.

AAFES had enjoyed a protected advantage for over one hundred years. But around 2000, Target and Wal-Mart had started opening stores close to the posts and bases. They offered a larger assortment of merchandise and even lower prices than AAFES. Service men and women had enjoyed much lower prices than those found at “civilian” retailers for over one hundred years. This began to change and impair AAFES around the year 2000. We used something like Figures 4 and 5 in part of our work together. Note our actual shape diagram was more complex than the example as we included more factors. I think you get the picture though. Notice the unique shapes for Nieman-Marcus and Wal-Mart. AAFES had evolved to a bland and non-unique shape. At the time of that work we were just beginning to understand Target’s shape so that is left un-portrayed here. The key takeaway from this tool is your firm’s competitive strategy must have a unique and defendable shape for competitive advantage and the basis for valuation increases.

To be a little technical, we correlate the Shape scores of firm’s who have a unique and defendable shapes with those who are lackluster in their Shape with the financial drivers in Figure 3. This is a second glimpse at your firm’s valuation increasing potential.

4. Solutions for Growing Your Firm’s Valuation

For us the nature of the solution for growing the valuation of your firm after an impairment episode is somewhere in between crisis management and strategic planning. Crisis management is typically an all hands on deck 24-7 project that begins and ends. Strategic planning is a process that cycles at its designed drumbeat or rhythm of time but has more time for analytics and reflection. Our approach to Impairment Improvement has a lot of the sense of urgency from crisis management but also some of the process-like features of strategic planning.

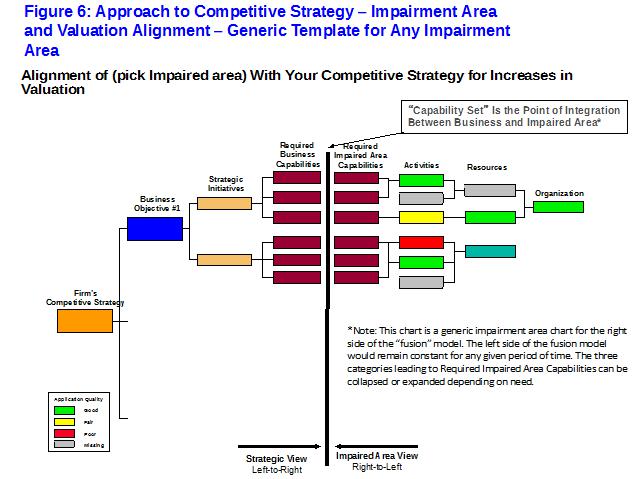

Figure 6 provides a template of how you can align your competitive strategy to the work of fixing possible areas of impairment to grow the value of your firm, which is the whole purpose of this article.

To remind you of an important point: our approach to fixing areas of impairment must continuously align with your firm’s competitive strategy to drive increases in your firm’s valuation. If you are not careful, focusing mostly on fire fighting by fixing the impairment areas can alter your competitive strategy. And this alteration may not be to your liking. As I have said above, I think it is best to have the constant check against your competitive strategy as your touchstone. And we hold the possibility your competitive strategy might change in this dynamic process. But this way it is on your terms and under your decision making, not left to random happenstance. However, we know it can take up to ten years for a firm to change its competitive strategy. So your competitive strategy will likely remain the same in this process of assessing any areas of impairment and forging improvement.

This approach is adapted from a methodology I used in the 2005 time frame while employed in a consulting unit of Computer Sciences Corporation. As the reader can see, from the left is the impetus from the competitive strategy. In this case we have simplified the figure to just one Business Objective, two Strategic Initiatives and six Required Business Capabilities. Strategic initiatives are those currently in play plus those that will be launched due to improvements in the Areas of Impairment (again more in Section 5). But this can be used as a Worksheet/Template to include more objectives, initiatives and capabilities. This series of topics gives the firm a snapshot view of its competitive strategy, current in-play strategic initiatives and most importantly new ones that need to be launched due to the Areas of Impairment improvement. It also catalogues the crucial business capabilities required to really implement the initiatives and the competitive strategy.

From the right side of Figure 6 comes the impetus from the improvement of the areas of impairment. Notice that Capabilities are where the two sides intersect. We define Capabilities as:

Highly complex and cross-functional combinations of processes, tools, knowledge, skills and organization – all put into place to deliver on the Value to Customers you seek to provide and to make your Competitive Strategy actionable. They also help to pinpoint and execute needed new initiatives. This tight integration makes these very difficult for a competitor to copy.

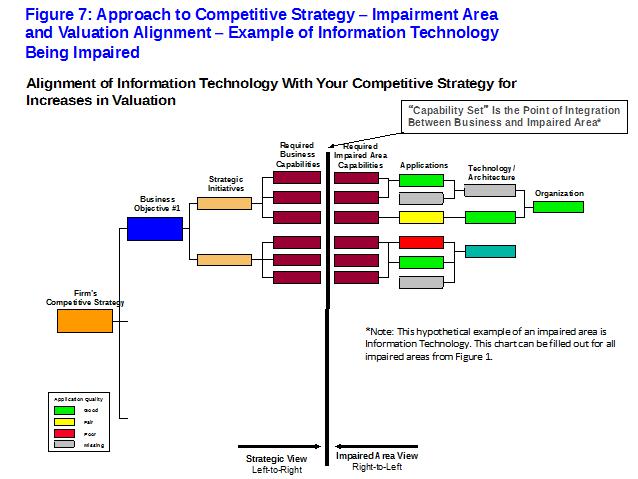

In Figure 7 we use an example that the firm’s Information Technology has become an area of impairment. But here you would endeavor to do this analysis for each of the areas of impairment listed in Figure 1.

Note this “fusion” joins at the required Capabilities from the Competitive Strategy with those required from the Impairment Area.

Section 5: The Acid Test of the effects of current and new initiatives on expected increases in the value of your firm.

We use discounted five year forecasted free cash flow from operations as the basis for our acid test. The numbers from Figure 3, except for the notion of Competitive Advantage Period, form the calculation of free cash flow from operations. We use a spreadsheet to:

- Forecast the likely growth or lack thereof in the “base business” of your firm. This is the five year forecast of revenue and operating profit margin from your current products and services. The spreadsheet also includes new incremental working and new incremental fixed capital investment required to generate those forecasted numbers from your current products and services.

- Forecast the likely increase in revenue and operating profit margin (and their trade-offs) from the new initiatives from work on the Areas of Impairment suggested and approved from Section 4. We use a robust Business Case format to assess each new proposed initiative. Notice in-play initiatives will have already gone through this screen.

- Combine the five-year forecasted improvements in the base business with that of the improvements from the new initiatives.

- Discount all of these numbers using your firm’s Weighted Average Cost of Capital to the present time period. This produces the Enterprise Value of your firm.

- In the case of the publicly traded firm, subtract the amount of debt from Enterprise Value. This equals Shareholder Value. Divide this number by the total equity shares outstanding.

- This number is the Implied Share Price. Compare this number to your current stock price. If the Implied Share Price is greater than your current stock price, this indicates all of your work is expected to increase your firm’s valuation. This can be adapted for the private for-profit firm that does not have outstanding shares traded on the market. If a new valuation is greater than the previous valuation, again you have an indication that your work is expected to bear fruit with a net increase in that private for-profit firm’s valuation. This is the holy grail from your hard work.

We would be glad to send our spreadsheets to anyone who is interested pro-bono. Just contact Bill Bigler below.

Conclusion

The Obama administration delivered to the Trump administration in 2016 a 60 page document titled Playbook for Early Response to High Consequence Emerging Infectious Disease Threats and Biological Incidents. This is a Playbook to handle this one kind of impairment episode for a nation. Hopefully this article is the start of a Playbook for any kind of impairment episode for for-profit firms. I hope you can use it in your firm now. I will be adding to this over the next weeks and months to make it more robust in case more impairment episodes happen. I hope they don’t but I am not holding my breath.

I would be glad and honored to discuss my approach with any senior strategy professional pro-bono without expectation of any paid work on my behalf.

This article is part of a series on what causes a firm’s value to increase.

Dr. William Bigler is the founder and CEO of Bill Bigler Associates. He is a former Associate Professor of Strategy and the former MBA Program Director at Louisiana State University at Shreveport. He was the President of the Board of the Association for Strategic Planning in 2012 and served on the Board of Advisors for Nitro Security Inc. from 2003-2005. He is the author of the 2004 book “The New Science of Strategy Execution: How Established Firms Become Fast, Sleek Wealth Creators”. He has worked in the strategy departments of PricewaterhouseCoopers, the Hay Group, Ernst & Young and the Thomas Group among several others. He can be reached at bill@billbigler.com or www.billbigler.com.