Currently there is a huge debate going on after the Business Roundtable published its view that stakeholders should have primacy over shareholders. These debates are varied. Some use the legal definition of the corporation as their basis. Others use ideology as their basis. I myself have offered my views. However, I will suspend these debates for this article. Thus it is for those boards of directors and senior management teams who view maximizing shareholder value as their superordinate goal or at least one very important goal.

This article will present a simple and linear looking process to aid the board of directors in helping to drive increases in shareholder value (SHV) in the publicly traded firm. But the principles apply to private for-profit firms as well as they try to maximize owner wealth. If the reader would like a little more background, please see A General Theory of Valuation and One Causal Model of Increasing Firm Valuation.

Simple does not mean easy and behind the linear look of the process, there are a lot of dynamics going on. And as the reader will see, this board process has huge implications for corporate culture change in many firms. Thus in the article, I hope to lay out the process and culture required for boards of directors to really up their games.

Why We Need This Process

Research has shown that many members of publicly traded firms do not understand how SHV is created and grown. This surprises me with the hundreds of thousands of MBAs who have graduated over the last twenty or so years. But my experience bears this out. To date, I have served on only one board and it was an Advisory Board of a start-up and not a legal fiduciary board. Our board understood SHV principles and disciplines. Still, I have known many board members over the years. Some understood SHV principles and disciplines but most did not. Upon reflection this is understandable because many board members have not come up through the finance function. This article will make an appeal that boards must be trained in SHV if they lack this knowledge. The training and education should be at the level of principles and not financial detail. This article’s main message is that a board-level process might be a way to provide a roadmap for boards and light a fire underneath them. Let’s get on with the article.

I. A Board of Directors’ Process for Maximizing Shareholder Value

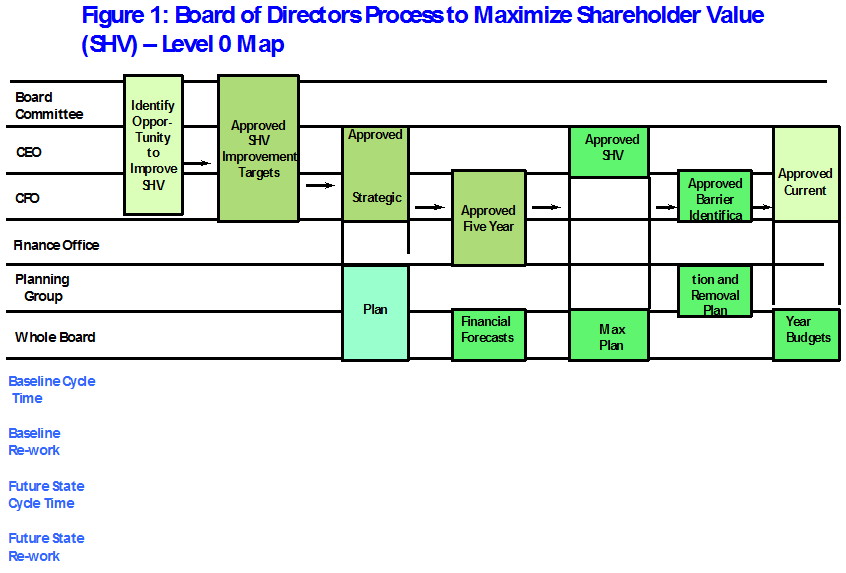

Figure 1 depicts a “Level 0” process for the board to use to help drive increases in SHV:

First a few brief comments on this kind of process map. There are at least several ways to depict executive, operating, and support processes for management use. Software development uses a whole other approach. I learned my process disciplines at Thomas Group twenty-four years ago and this is how they mapped processes. Then in the 1996 time frame, they were one of two leading operations excellence consulting firms. I was hired to co-lead a group that would try to develop a competitive strategy practice that would bolt onto their tremendous operations excellence knowledge. It was the best two and a half years of my career.

Level 0 means this is the highest generality of the process. Level 1 explodes to give more detail and Level 2 even more. For management purposes, you never need to go below Level 2 and I like stopping at Level 1 if you even need to go there. I will forgo Level 1 and 2 maps in this article.

You will notice at the left of the process map are the entities/positions that touch the process first, second, third, etc. in the order from top to bottom. Here is a key point: these entities/positions are the “Prime Movers” (PM) for the activities in the “swim lanes” from left to right in the map. This means they are held accountable to get the activity Approved. Always the prime movers seek and accept advice and help from others to get the activity approved but they are the ones held accountable to get it done. This is why at this Level 0 all of the activities, except for the first one, from the left are described as being Approved. If not, we could confuse effort with getting something approved on time. Let’s now discuss the Activities from left to right:

- Identify Opportunity to Improve Shareholder Value (SHV)

Prime Movers: Board Committee, CEO, CFO

The realization that there is an opportunity to improve SHV should be obvious in many firms. All the board and senior management needs to do is to assess the direction of their stock price over a rolling fifteen or so month period. If it is declining, obvious warning signs should be clear. But there is a more difficult opportunity to assess: what is the growth potential for SHV as a firm identifies and moves to its “full potential”. This is the opportunity to improve SHV that boards should be investing much more time and energy into.

The designation of the CEO and CFO Prime Movers (PM) is fairly obvious. But notice I list only the phrase Board Committee for that PM. This is because as of now there is no clear board committee that has or should have accountability for SHV maximization. Here is the list of the typical board committees in a publicly-traded firm:

- Audit Committee

- Shareholder Grievance Committee

- Remuneration Committee

- Risk Committee

- Nomination Committee

- Corporate Governance Committee

- Corporate Compliance Committee

- Ethics Committee

Of these, there is no clear choice to house SHV maximization accountabilities for the board. Maybe the Risk and Corporate Governance committees could be enhanced with SHV maximization accountabilities, but I do not think this is ideal based on my experience. In the concluding part of this article, I will make the case for the formation of an SHV Maximization Committee.

- Approved SHV Improvement Targets

Prime Movers: Board Committee, CEO, CFO

This activity sets out approved SHV improvement metrics and targets for those metrics. I have written here in other articles about the classic financial drivers of SHV:

- Revenue growth rate

- Operating profit margin growth rate

- Incremental working capital investment

- Incremental fixed capital investment

- Tax rates

- Weighted Average Cost of Capital (WACC)

- Competitive Advantage Period (CAP)

These financial metrics and ensuing targets and expected improvements to CAP would culminate in a stated and approved target of the desired stock price relative to the current stock price and in what time frame the improvement is expected. We could add other metrics such as:

- The desired position of Total Shareholder Return rank compared to other publicly traded competitors and over what time period for improvement.

- Targets for creating the largest spread possible between Cash Flow Return on Investment and the WACC. This is the acid test for firms to create and grow SHV.

- Cycle Time to Approved Strategic Plan

3. Approved Strategic Plan

Prime Movers: CEO, CFO, Planning Group, Whole Board of Directors

This should be an obvious activity. But here I will say this board process is agnostic to the method and process to create the strategic plan. Hundreds if not thousands of approaches exist and the only requirement is that the approach and strategic planning process works for the firm. Of particular interest to the board should be the suggested and approved new strategic initiatives. More on this in Activity 5.

- Approved Five Year Financial Forecasts

Prime Movers: CFO, Finance Office, Whole Board

This Activity builds from Activities 2 and 3. Included in the five-year financial forecasts should be:

- Revenue

- Expenses

- Net income

- Balance sheet items

- Normal Cash flow

- Free cash flow discounted to the present at the WACC and compared to current levels of free cash flow.

- Subtract debt and other items to arrive at the expected present value of shareholder value.

- Divide by the number of shares outstanding to get to Implied Stock Price and compare to Current Stock Price. If Implied is greater than Current, you are expecting to grow SHV. If Implied is less than Current, revisit assumptions, strategic plan, and new initiatives and re-plan. Note this introduces Re-work, which is not good, described below.

Part 2 will be published within the next day or two. Thanks for reading.

This article is part of a series on what causes a firm’s value to increase.

Dr. William Bigler is the founder and CEO of Bill Bigler Associates. He is a former Associate Professor of Strategy and the former MBA Program Director at Louisiana State University at Shreveport. He was the President of the Board of the Association for Strategic Planning in 2012 and served on the Board of Advisors for Nitro Security Inc. from 2003-2005. He is the author of the 2004 book “The New Science of Strategy Execution: How Established Firms Become Fast, Sleek Wealth Creators”. He has worked in the strategy departments of PricewaterhouseCoopers, the Hay Group, Ernst & Young and the Thomas Group among several others. He can be reached at bill@billbigler.com or www.billbigler.com.