In my view, we need good theory more than ever in the field and practice of valuation, especially when wedded to firm’s competitive strategy. Things have gotten very emotional around this topic in the last three or so years. This article will present my theory of valuation and why shareholders are the most important constituents in the total system of firms trying to grow their valuation. I will leave competitive strategy’s role in this to another conversation.

Author Archive for Adam Newdow

Growing Your Firm’s Valuation After This or Any “Impairment Episode”: Key Dilemmas, Decisions and Solutions

The main topic of this article is the notion of “impairment” to your firm’s ability to grow, much less maintain, its valuation after an “impairment episode”. COVID-19 is the most recent such episode and it has affected most firms in the United States and around the world. But pundits are writing this probably won’t be the last virus to cause impairment.

Valuation and Stock Prices in These Crazy Times: One Causal Model of Increasing Firm Valuation – The Ultimate Goal of the For-Profit Firm

I have re-written this article five times in the last five weeks (today is March 25, 2020). As we all know the COVDID-19 pandemic has caused huge losses in the stock market. It makes one wonder how stocks are really valued for publicly traded firms and how non-publicly traded firms (think of your favorite family-owned for-profit business) are valued.

The Full Potential of Your Business, Performance and Your Firm’s Valuation – Why This Is Such a Powerful Lens On Your Business

The concept of the “full potential” of your firm comes from Private Equity (PE) and its host of disciplines. I think it is a very important concept for firm performance and longevity as it tries to increase its valuation.

Strategic Management: Zooming From 30,000 Feet to In the Trees and Back Again

The strategic management of for-profit firms seeks, among other things, to secure the most advantaged future as is possible in today’s VUCA business world. VUCA, of course, stands for Volatile, Uncertain, Complex and Ambiguous.

Nagging and Unanswered Questions For Strategic Management: Why Can’t We Solve These? Part 2

Part 2 picks up from Part 1 with a discussion of Question #s 4-7. In case you missed Part 1 for a discussion of Questions 1-3 and would like to read it click here. And this is a little long but I think worth your time.

Nagging and Unanswered Questions for Strategic Management: Why Can’t We Solve These? – Part 1

This article will discuss seven of the most challenging questions that I have dealt with in firms over the last thirty years simply as examples that shed light on the purpose of this article. And that is why there are so many answers to the questions for the field of strategy conditioned with “it all depends on the context” or “it all depends on the nature of industry maturity”, etc. I thought we would have had clear guidance by now, so it is surprising to me that these remain perennial problems.

The Disappearing Art and Science of Real Process Management

This is a follow up on an article to I wrote earlier this year titled Time, Speed and the Process Revolution: Why Are These Disciplines Disappearing? If my observations are correct…that process disciplines from a management viewpoint are disappearing, I would like to try one more time to raise a clarion call that this is a problem.

In Response to the Business Roundtable New Statement: A Practical Model for Growing the Valuation of For-profit Firms – Part 1

This article was in development before the week of August 19, 2019, when the Business Roundtable (BRT) announced their new statement of purpose of the corporation. Thus I think this article and others like it are even more important. The new statement by the BRT, in brief, is that shareholders are no longer the sole recipients of financial value created by publicly traded firms. Other stakeholders will be participating in that value as well.

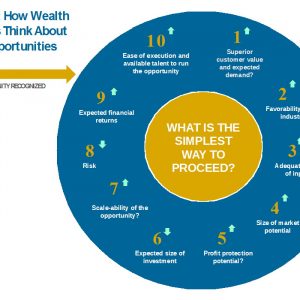

How Winning Wealth Creators Assess New Opportunities

We’ve seen recent renewed interest in how to think strategically. The offerings are good for the most part in my view. I think a focus on how ‘winning wealth creators’ think about and assess new opportunities before their investment could serve as a useful addition to any strategic plan.

A Crow’s Nest View Model for Growing the Valuation of Firms and an Approach for Sharing That Value With Your People

As I have written in this series, I think the most useful superordinate goal of the for-profit firm is growing its valuation. Superordinate is defined as “a thing that represents a superior order or category within a system of classification”.